Discover more from Weekly Tech Update - Julia

LatAm Tech Weekly

#81 - Powered by Nasdaq: SVB facts & useful links, the investor-friendly tech enviornment, deals of the week, and much more!

Happy Sunday!

There is no way of writing a tech newsletter this week without mentioning the case of Silicon Valley Bank. SVB has long been the financial pillar for tech – and after a liquidity crisis that affected the entire institution, it was shut down by regulators on Friday, appointing the Federal Deposit Insurance Corporation (FDIC) as receiver. Silicon Valley Bank had about $209 billion in total assets and about $175.4 billion in total deposits, as of Dec. 31, 2022. Apart from identifying below what happened each day of the week, I will not summarize or give any opinion on what happened here as several news outlets and blogs already did. I will tell the facts. I read it all – you can go directly to the links on the “What am I reading” section. As always, I strongly suggest ZeroHedge’s analysis on the theme. Among everything I read, their coverage was the best. Just now the Fed board announced that “Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.” I am writing this on a Sunday night – so maybe when you actually read the newsletter, the story might have evolved…

On to a more positive note, next week I will be a speaker on the Identity Day, organized by Brazilian antifraud startup CAF. The event is free you can check out more details on the panels, speakers and also register at caf.io/identity-day.

Finally, SXSW is happening in Austin, Texas! If you follow me for more than one year, you know I went last year. Even though I did not have the opportunity to do so this time around, I am of course following everything that is happening. I will add a section on the bottom this week and the next with selected insights on the event. Content is being brought by my friend and work colleague Felipe Rama, who is there in person. As Itau Unibanco is a sponsor this year, you can also follow live the coverage of the event at the Instagram profiles of @Cubo.Network , @ItauBBA and @sigaIF. The Inteligencia Financeira portal is also publishing live on the web.

Follow me on LinkedIn , Instagram or Twitter for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

On to the usual market update: February numbers for the tech ecosystem are out- and things are continuing to slow down. Last month Latin America saw 53 funding rounds and USD 289mm volume of investments - a 60% decline when compared to January and a 76% decrease YoY. It is indeed a more investor friendly dealmaking enviornment. In fact, Pitchbook has a VC Dealmaking Indicator that is very interesting to follow.

The Indicator tracks deal-level data to quantify whether the negotiating environment is more friendly to startups or investors. It also incorporates the ratio of capital demand to supply, a measure of how much capital startups could require to sustain their businesses, tracked against how much they've raised already. To illustrate, a higher Indicator values reflect a more investor-friendly dealmaking environment, and lower values a more startup-friendly one. On the graph below, it is clear that since 2010, the scales have tipped decidedly in favor of startups. From 2010 to 2015, late stage deals were more investor friendly than early stage deals, but since 2015, terms and deal characteristics converged and startup friendliness was high at all stages after mid 2020. This trend reversed starting in 2022, largely driven by the expected demand for capital from startups seeking additional funding after having raised large rounds over the prior two years.

PitchBook also developed a suite of indexes designed to track the performance of companies that have either recently transitioned from the private to the public markets or are unicorns that may be entering the public markets soon. As the convergence of public and private markets continues to accelerate, this index becomes even more crucial. Note that I generated the figure below on Thursday, if you play around with the time horizons and also try it on another day, necessarily the percentages will be different as the index is dynamic.

Brazilian born Arquivei, a SaaS that provides better management of invoices thus reducing tax fraud while giving insights into consumer behavior for companies, acquired ConectaNF-e, a document upload automation tool, for an undisclosed amount.

Founders Fund cut the target size of its eighth flagship fund in half from $1.8 billion to $900 million.

A study showed that digital nomads contributed USD 523mm to Mexico City’s economy in 2021—and also 15% of tourism inflows.

Six months after its pre-seed, B2B payments platform Barte has raised a $3m seed round, bringing total funding to date to over $4m. The Brazilian fintech will use the money raised to establish itself as the premium B2B payments platform in Brazil, aiming to recreate the 10x growth it achieved in 2022. The round was led by NXTP and Force Over Mass, with participation from existing investor VentureFriends.

Eletromidia announced that Rede Globo (Brazil’s largest TV and media group) is buying a 15% stake in the company, subject to approval by the antitrust agency CADE. The sellers will be Visuvius (controlling shareholder with 55% stake) and Alexandre Guerreiro (CEO of Eletromidia), who will jointly sell at first 12 million shares (8.6%) and another 9 million (6.4%) 30 days after signing the contract and CADE’s approval.

According to a survey carried out by Cubo Itaú, the startups that are part of the hub ended 2022 with a combined revenue of BRL 9.7 billion and over BRL 5 billion in equity raised.

Crowder, startup that operates an online platform for investing in debt and equity of startups and other growth companies in Latin America, under the regulation of the Central Bank of Uruguay, raised a pre-seed round of USD200k with Cryptotrust Fiduciara and Undisclosed Investors.

Itaú Unibanco is finishing setting up Carbonplace, a network for trading carbon credits. The financial institution received authorization from the Central Bank to invest in the new company. Announced in July 2021, the platform raised US$ 45 million in a round with the nine banks that founded the fintech: Itaú, BBVA, BNP Paribas, CIBC, National Australia Bank, NatWest, Standard Chartered, SMBC and UBS.

Pismo announced a new capability of its core banking and payments platform: digital lending functionality. The cloud-native API-based solution offers embedded experience for BNPL, reduces costs and time-to-market

Sinqia announced a new M&A. The company is acquiring a 60% stake in Compliasset, a reference in regulatory compliance software, which for the last 12-month period ended on February 28, 2023, reported gross revenue and EBITDA of BRL 6.7 million and BRL 3.1 million (50% margin), respectively. The acquisition is the fourth for the Sinqia Digital unit, which is focused on horizontal solutions with higher cross-selling potential.

The Brazilian Central Bank chose the hyperledger Besu platform, an open-source crypto asset blockchain, for the pilot of the “Real Digital” the “tokenized” version of the Brazilian currency that is expected to be launched at the end of 2024.

International Women’s Day!!! Did you know that the holiday was adopted by the UN 46 years ago?

Women’s presence in senior management roles In LatAm surpasses global average: 32,4% of senior management positions in medium-sized companies are held by women, but which is only a 0.5% increase since last year.

Startups with female founders continue to see declines in the number of deals completed and capital raised, according to data from PitchBook's US VC Female Founders Dashboard. Two months into 2023, such startups have completed 408 deals worth $3.2 billion, a decline of 51% and 66%, respectively, from the same timespan last year. However, companies with both male and female founders are doing better relative to the overall US VC market, as they have the highest share of capital on record at 18.5%. For comparison, startups with only female founders have raised 2.2% of all US VC capital so far this year.

Méliuz announced the sale of 100% of Bankly, its bank as a service platform, to Banco Votorantim for BRL 210 million plus inflation adjustments until the closing of the deal.

Itaú Unibanco announced that it will now offer to end customers the possibility of investing in startups.

Santander Brasil closed an agreement to sell its 40% stake in Webmotors, a platform that allows customers to buy, sell, finance and insure new as well as used cars and motorcycles to Carsales, for 1.24 billion reais.

Principia, a fintech focused on student loans, raised BRL 24mm led by Valor Capital with participation of GFC and Supera Capital. They also announced a merger with startup 4IES, a tuition payment platform aimed at colleges.

SVB announced the sale of securities at a loss, and also that it would sell $2.25 billion in new shares to improve its balance sheet. That triggered a panic among key venture capital firms, who reportedly advised companies to withdraw their money from the bank.

Transfeera, a fintech that provides payment infrastructure, announced today that it earned BRL 19 million in 2022, a figure that corresponds to a growth of 102% compared to the revenue recorded in the previous year.

Shares of SVB Financial plunged by more than 50% on Thursday. Trading in the stock was halted for volatility multiple times during the session, and the drop brought SVB’s market cap below $8 billion.

Trading in SVB shares was halted and California regulators intervened, shutting the bank down and placing it in receivership under the Federal Deposit Insurance Corporation.

Ascenty, company that provides high bandwidth connectivity and data center solutions primarily to large corporate enterprise clients and wireless communication carriers in Brazil, raised a debt round of USD825mm with banks such as Itau Unibanco, Banco MUFG Brasil and Credit Agricole.

What did I learn from readers?

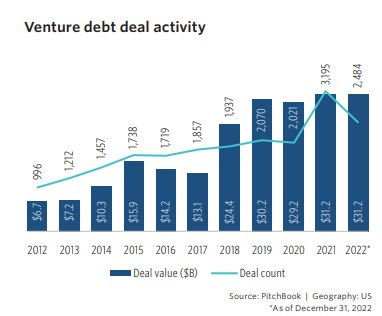

Amidst the SVB news, I received from a reader an analyst note from Pitchbook on Venture Debt. The bank is one of the largest participants in the venture debt space, providing loans to many startups within the tech and life sciences sectors.

Venture debt has grown significantly in recent years. Though the market shifted quickly in 2022, more than $30 billion in loans were provided to US-based VC-backed companies, which showed an appetite for debt despite rising interest rates.

Venture debt, similar to the broader VC market, benefited from the cheap capital of the past decade. The macro shifts of the past year, along with inflation, interest rate hikes, and geopolitical tension, have created a market where capital is no longer as cheap, and that includes venture debt. It has quickly become more expensive at a time when the venture market needs capital because of the quick retreats by investors exercising greater caution.

Just like other financing options, debt offers a unique set of advantages but also has downsides. Amid the ongoing market volatility and interest rate hikes, venture lending presents opportunities and challenges for both borrowing companies and lenders. Startups are often attracted to the nondilutive nature and flexible structure of venture debt but should be prudent when planning debt repayment or refinancing to avoid cash flow disruptions.

What am I reading?

What am I listening to?

The J Curve Podcast - hosted by Olga Maslikhova interview with Camila Junqueira.

SXSW Insights:

Featured Session: OpenAI Co-founder on ChatGPT, DALL·E, and the Impact of Generative AI

Why did GPT Chat become so viral and can it be considered the “app killer”?, in Greg Brockman's view, it's because it's simple, free and there was a difference in perception of what is possible to do with AI by the mass public.

With the rapid adoption, the model was even more trained and with the numerous human feedbacks, the tool is getting better exponentially;

Everything can be treated as a language and thus, it is possible to read and train the language model constantly;

Their focus is on developing what they called “knowledge work”: learning new languages, checking lines of programming code; suggesting improvements.

It is only the beginning for AI.

JOB POST // LAYOFFS:

If you want your jobs posted here, just follow the steps:

1. Create your Woke´s All in One Recruitment Platform Account - It is 100% free;

2. Sign-in and open a "new project";

3. Complete the "job Description" (Will help you be more effective);

And you are ready to go! All the new jobs created until every Thursday night will be posted!

NEW JOBS:

Analista de Benefícios Pleno - Castgroup

JOBS (Still open):

Gerente de Branding, Comms & Events - Empresa Confidencial

Executivo de Vendas SR - Ecomex NSI

Analista de Inside Sales - Ecomex NSI

Analista de Sistemas Oracle - Ecomex NSI

Gerente de Projetos - Ecomex NSI

Analista de Regimes Especiais - Ecomex NSI

LAYOFFS SOLUTIONS:

For more details, checkout the presentation or get in touch with Woke´s team!

But If your company is in a different momentum, expanding the team, do not miss the opportunity to have access to many layoff lists already in your ATS and candidates database. It will provide your Talent Acquisition team a more efficient candidate sourcing!

Create your free account and hire the best!

Quote of the week:

“Banks are to the economy what the heart is to the human body. They cycle necessary capital through the whole, and they are barely noticed until pressure, necessity, or crises.”

― Hendrith Smith, Essays on the Banking Industry