Discover more from Weekly Tech Update - Julia

LatAm Tech Weekly

#121- Powered by Nasdaq: IPO backlog, Private & Public markets, deals of the week, and much more!

Happy Sunday!

It's been a dynamic week filled with exciting developments and groundbreaking news in the tech world. The SEC has officially approved 11 Bitcoin exchange-traded funds, paving the way for a surge of new investors into the cryptocurrency market. This move signals a potentially huge year ahead for crypto. Meanwhile, in Latin America, there have been significant funding rounds announced. So, without further ado, let's dive into the details!

Follow me on LinkedIn , Instagram or Twitter for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

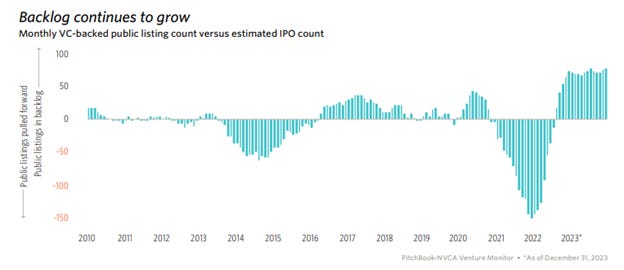

This week saw the release of Pitchbook's VC Exit Predictor, offering insightful perspectives on the venture capital landscape. Despite expectations of a challenging environment for venture capital in 2024, there's an undercurrent of optimism for a resurgence in IPOs this year. The report reveals a noteworthy contrast: public listings accounted for just USD 28.2 billion through Q3 2023, compared to USD 511 billion raised in the first three quarters of 2021. According to PitchBook’s VC Exit Predictor, as of Q3 2023, a significant number of startups have been identified as having over a 50% likelihood of achieving a successful exit. This includes 2,282 late-stage and venture-growth-stage SaaS startups, with predictions suggesting that 194 of these are more likely to exit via IPO rather than through mergers and acquisitions.

The IPO landscape in 2023 presented a less than compelling picture for the broader market. Only eight companies managed to go public in Q4, with the largest generating a modest $298.8 million in exit value. While this figure is respectable, it pales in comparison to the potential held by the 723 unicorns currently remaining private in the US.. These companies have been hesitant to list under the current market conditions, leading to an accumulating backlog of IPOs.

In light of the recent performance, a resurgence in fundraising seems unlikely. Nonetheless, the market is still flush with 'dry powder', and firms that demonstrate robust financial health are likely to continue receiving funding. Economic indicators suggest a gradual reduction in market uncertainty as the year progresses, potentially aiding the venture capital sector in establishing a new equilibrium in this evolving landscape.

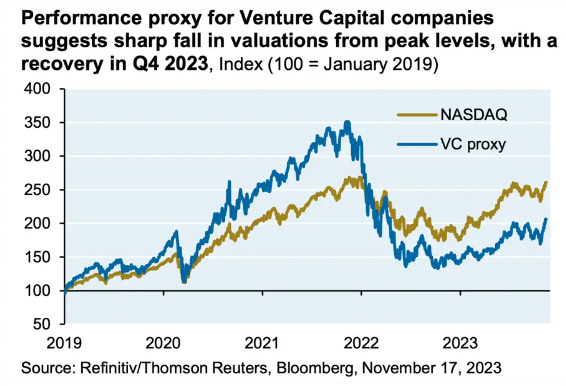

This week, I delved into Rohit Yadav's "The Big Book of Venture Capital – 2023," an insightful 200-page deck that's truly worth the read. The report spans a variety of topics, but one particularly relevant section echoes the theme discussed earlier: the notion that private markets serve as a delayed reflection of public markets. It's a well-known fact that private market trends generally trail behind public market performance by several quarters. In the venture capital sphere, this correlation is even more pronounced, with the effects amplified in both positive and negative scenarios.

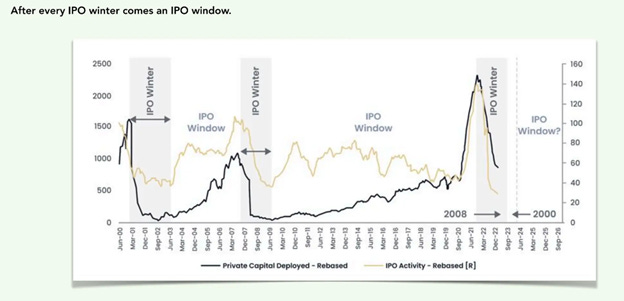

Also, after every IPO winter, comes an IPO window. Looking at the hard data, things look rather promising for this year as per the graph below:

Although VCs can sell their companies to strategic acquirers or PE firms, historically, the asset class’s most substantive form of liquidity has come from IPOs.

Signals for an IPO revival:

1. Gains in the stock prices of recent IPOs. Rising post-IPO stock prices could help revive the IPO market.

2. Declining interest rates: if the Fed sees inflation dropping below its 2% target, interest rates could drop and stocks could rise

3. Steadily rising tech stock prices

4. IPOs of fast-growing Generative AI companies.

Shifting gears to Latin America in specific, a big buzz this week was a public statement on Brazil Journal (local news outlet) by Spectra Investments, one of the largest fund-of-funds in Latin America, known for being a significant Limited Partner in several local funds. They claimed that multiples in the early-stage market are irrationally high and that venture capital has stopped making sense in Brazil.

This statement quickly became the most discussed topic among local VC investors. Two partners from SaaSholic, a local VC firm publicly responded, saying, 'Yes, valuations are high, but we disagree that VC has stopped making sense in Brazil.' (PT only)

General news:

Itaú Unibanco is offering over 220 job openings in the Technology sector. The recruitment process includes hiring black, brown, LGBTQIAP+, and disabled individuals, and covers areas such as Software Engineering, Data, and Design.

The vacancies span various specialties, including Back-end, Front-end, DevOps, Fullstack, Mobile, and Product Design analysts, as well as data scientists and engineers. The prerequisites vary depending on the area and position.

Stone has received authorization from the Central Bank of Brazil to operate as a financial institution. This new license aligns with the company's strategy to diversify its financing sources. Following this news, Stone's shares surged on the Nasdaq, closing at $17.10, a 2.9% increase.

Deco, a Brazilian startup founded by three former VTEX employees, aims to challenge WordPress, the dominant platform in the content management system (CMS) market, which holds over 60% of that market and over 40% of all internet sites. Guilherme Rodrigues, Luciano Júnior, and Rafael Crespo created Deco.cx over a year ago. Rodrigues and Luciano have been programmers since their teens, while Rafael has a background in design and talent acquisition at VTEX.

Deals:

Hiker Ventures, a fund created by the M&A boutique Araújo Fontes, has announced a new investment. Fluna, a startup specializing in automation and process integration, raised R$ 2.5 million in a seed round led by the fund manager.

General news:

According to recent data by Dealogic, despite a challenging 2023 for the investment banking industry in Brazil, with a general decrease of 17% in fees, Itau BBA has held its leadership position for the second consecutive year, followed by Bank of America and BTG. Itau BBA accounted for 13% of the total.

Deals:

Conta Simples, Brazilian developer of digital bank accounts intended to make financial transactions more agile and secure, raised $40,87M in a round led by Base 10 Partners, with the participation of existing investors such as Domo, Valor Capital Group and Big Bets.

General news:

Positive news for crypto: The recent approval of Bitcoin spot ETFs by the U.S. SEC is expected to significantly boost the crypto market by attracting large-scale institutional investors. This is important because ETFs provide these investors, who often face restrictions on investing outside public stock markets, with an accessible route into the cryptocurrency domain. Additionally, the upcoming Bitcoin halving event, scheduled for around April or May 2024, is anticipated to create scarcity by halving the rate of new Bitcoin production. This scarcity could increase Bitcoin's value and potentially lead to a substantial surge in buying activity within the market.

In this context, Hashdex, the Brazilian asset manager, received unprecedented approval from the United States Securities and Exchange Commission (SEC) for its Bitcoin ETF to trade on the spot market.

Roberto Campos Neto, president of Brazil's Central Bank, assured that Pix transactions for individuals will not be taxed, as per the existing rules. However, certain exceptions under Resolution BCB No. 19/2020 allow banks to charge fees for Pix transactions in specific cases. Individuals, including micro-entrepreneurs, might face charges if they use alternative channels for transactions, receive Pix for commercial purposes, exceed 30 Pix transactions monthly, or receive payments via dynamic QR Code or from corporate entities. For corporate entities, charges can apply when using Pix for transactions involving either individuals or other corporate entities, and when payments are made or received via QR Code or payment initiation services.

Deals:

Lina, an infratech company providing data sharing and services technology, raised R$ 8 million in its latest investment round. The funding was led by the MSW Capital management firm through the MSW MultiCorp2 fund, which includes BB Seguros, Baterias Moura, AgeRio, and Embraer among its investors.

Bullla, a fintech specializing in flexible credit and benefits, announces the completion of its second fundraising round, issuing senior and subordinate shares totaling R$ 75 million to strengthen its Credit Rights Investment Fund (FIDCs). In September of last year, the company had already raised R$ 106.5 million to boost the credit operations of the BulllaEne card.

Deals:

Gabriel, an anti-crime startup specializing in security cameras integrated with artificial intelligence software, has raised an additional R$ 35 million in an extension of its Series A funding round. This investment aims to accelerate the company's expansion in São Paulo. The funding round was led by Astella Investimentos and included participation from Qualcomm Ventures and Globo Ventures, the latter already being an investor in the startup. This extension comes two years after Gabriel initially raised R$ 66 million in its Series A round, which was led by Softbank.

Turbi has just raised an additional R$ 150 million to expand its fleet of owned vehicles. With this operation, ARC Capital joins the cap table as the round leader, along with Reag Investimentos and Clave Capital.

Neogrid, a software company based in Santa Catarina focused on industry and supply chain, has announced the acquisition of 100% of the startups Predify and Horus. These were companies in which Neogrid already had a stake, but they are now fully absorbed by the multinational.

General News:

With an addressable market of R$107 billion and the green light for its association with Itaú, Totvs' fintech will accelerate the expansion of its portfolio. The starting point is a partnership with PagBrasil.

Born digital, Oya Care expands into a more comprehensive journey of women's health. Since the opening of its physical clinic, the startup has seen a 400% increase in revenue and a 40% increase in the number of monthly appointments.

What did I learn from readers?

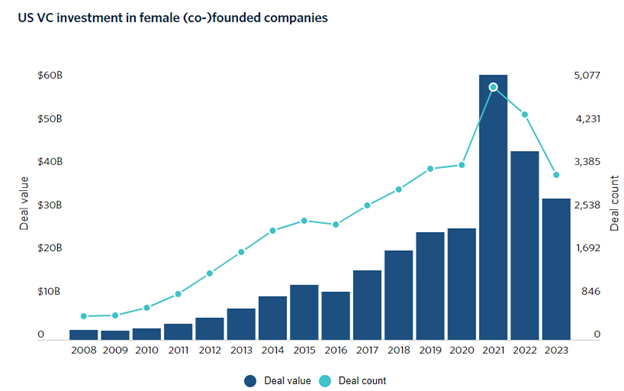

2023 ended on a positive note for female entrepreneurs, as it marked the third-highest year for venture capital raised by startups with female founders or co-founders, according to data from PitchBook's US VC Female Founders Dashboard. However, despite this achievement, the total capital raised by these companies has seen a decline for the second year in a row.

Here are three key observations from the 2023 US VC funding landscape for female founders:

Adaptation to a Post-Pandemic Normal: Venture capital investment in women-founded startups has decreased for two consecutive years. Yet, the overall funding amount remains significantly higher than pre-pandemic levels.

Capital Raised by Female-Founded Companies: In 2023, companies with at least one female founder raised approximately $32.7 billion across 3,230 deals.

Performance of Exclusively Female-Founded Startups: Startups with only female founders secured $2.8 billion in venture funding, spread over 867 deals.

These trends indicate an evolving venture capital environment for female founders, offering insights into what might be expected in the future.

What am I reading?

What am I listening to? What am I watching?

Naruto - there is a geeky child within me

Quote of the week:

"Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom."

Viktor Frankl