Discover more from Weekly Tech Update - Julia

LatAm Tech Weekly

#166 - Powered by Nasdaq: the correlation between IPOs and M&As, CB Insights Top Ideas for 2025, deals of the week… and much more!

Happy Sunday!

I’ve been getting a lot of questions about which AI tools I use and how I use them—whether it’s for my investment banking work or content creation. The truth is, I’m completely obsessed with AI (if you’ve been following me for a while, you probably already know this). I’m always testing new tools to figure out which ones actually help me work smarter and get things done more efficiently. While my list of tools is constantly evolving, I decided to share the ones I currently use and what I use them for in this LinkedIn post. From the obvious ChatGPT to Notebook LLM for my podcast, you’ll find the full list in the link. The post is in Portuguese, but if you’d like an English version, just reach out—I’m happy to share!

Also: it’s that time of the year! Soon we will publish our The Next Big Thing LatAm 2025! We are on our third edition. For those who are new, it is basically a report with predictions from the top thought leaders in the region. If you want to see last year’s report, click here.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

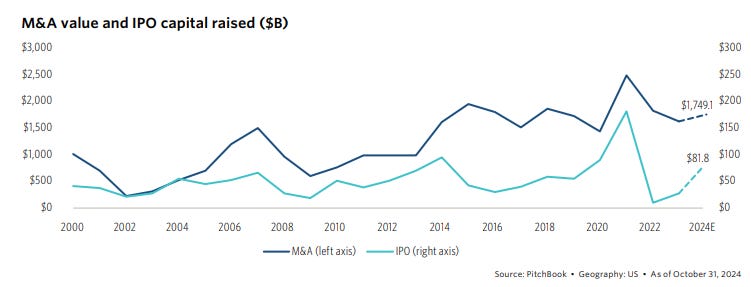

To start off, a great read this week was Pitchbook’s report on the outlook for IPOs & exits for PE and VC backed companies. The outlook for US PE-backed companies is at a pivotal moment, marked by signs of recovery after a challenging period. The private equity space, much like the broader tech and startup ecosystems, has been navigating a boom-and-bust cycle that began in 2022. For investors and operators, the big question is: where do we go from here? Encouragingly, 2024 is shaping up to be a year of renewed momentum in both M&A and IPOs. M&A activity has bounced back, with an estimated $1.7 trillion in deal value this year, representing up to 23% year-over-year growth when accounting for late-reported deals. On the IPO side, capital raised has already reached $67.9 billion through October, more than doubling last year’s $27.8 billion. If the pace holds, 2024 could close at $81.8 billion—a staggering 194% increase compared to 2023. These numbers suggest the start of a multiyear period of strength for IPOs, fueled by stabilizing interest rates, easing geopolitical tensions, and healthier public markets.

What’s particularly interesting is the historical connection between IPOs and M&A, which often move in tandem. IPOs, being more sensitive to market conditions, tend to lead the way, setting the tone for broader dealmaking. In many ways, this mirrors what we’ve seen in Latin America’s tech sector, where a surge in public listings a few years ago spurred more aggressive consolidation and deal activity. Just as in the US, IPOs in LatAm aren’t just a liquidity event—they are a signal of market confidence and a catalyst for further growth.

For PE investors, IPOs remain a crucial exit strategy, especially for companies with valuations exceeding $1 billion. While private M&A still accounts for most exits, going public offers unique advantages: enhanced access to capital, greater visibility, and the ability to use equity as currency for acquisitions or to incentivize employees. However, the landscape isn’t without challenges. Pre-IPO environments have shifted since 2021, with fewer “fear of missing out” deals and no recent preemptive M&A offers scooping up companies before their public debut. Even so, the pipeline looks promising, with PitchBook identifying the top 50 PE-backed IPO candidates expected to hit the market over the next 12 months.

For LatAm investors and founders, this recovery in US PE-backed IPOs offers lessons and opportunities. The resurgence in IPO activity could open the door for LatAm companies eyeing dual listings or inspiring a regional rebound in public market enthusiasm. It’s a reminder that even after a downturn, market cycles eventually realign, often creating fresh opportunities for growth and innovation. As we’ve seen in LatAm, especially in tech, the ability to pivot and seize these moments is what sets resilient companies apart….

As promised, now I will dig in a bit more on the 15 trends to watch for 2025 by CB Insights. Hope you like it!

Financial Services

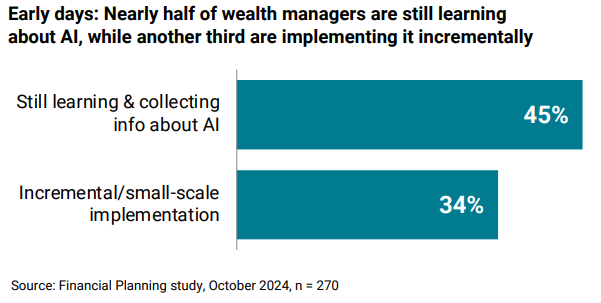

1. The Cyborg Wealth Advisor

Financial advisors spend 70% of their time on tasks like compliance and research, leaving little room for client interaction. AI is helping firms like Morgan Stanley automate these routine tasks, boosting client-facing time and productivity. This adoption has driven a 14% YoY revenue growth for their wealth management division. However, smaller firms remain hesitant due to regulatory and technical barriers.

2. AI Agents with Spending Power

AI agents, powered by tools like Coinbase’s crypto wallets and Skyfire’s blockchain integration, are taking transactional capabilities to the next level. They can make independent decisions, such as completing purchases or managing finances, though scaling this requires secure payment infrastructure and trust-building mechanisms.

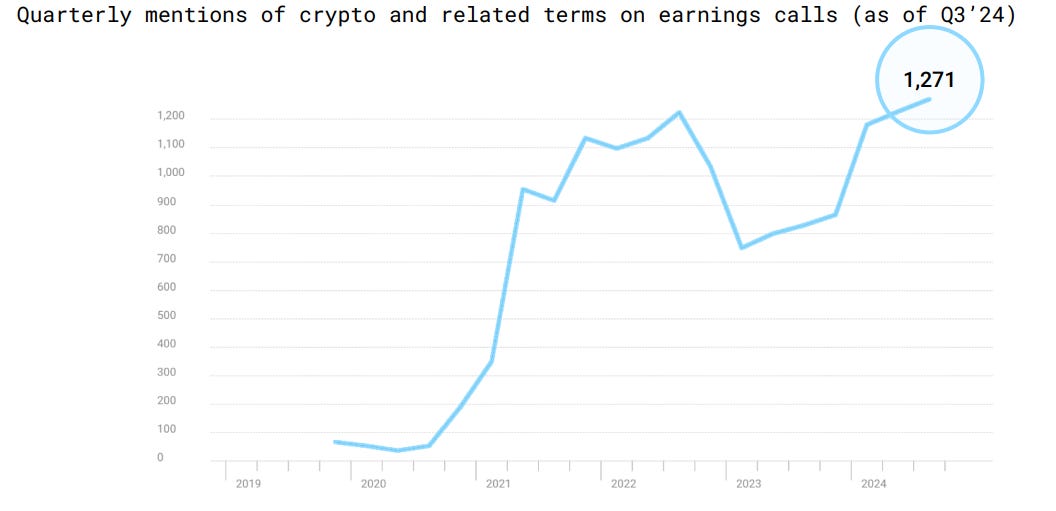

3. Crypto Inches Toward the Mainstream

Crypto is regaining traction, with major players like Visa, PayPal, and Stripe investing in blockchain and stablecoin technologies. Stripe’s acquisition of Bridge, the largest crypto deal to date, highlights the industry’s focus on using crypto as a payment rail, particularly for autonomous agents and international transactions.

4. Opportunities in Compressed Fintech Valuations

Fintech startups have seen exit valuations drop from $1.7M per employee in 2021 to $1.3M in 2024. This correction presents acquisition opportunities for solid fintech companies with strong products but growth headwinds. Stripe’s acquisition of Bridge and S&P Global’s purchase of Visible Alpha are prime examples of strategic consolidation in the space.

Healthcare & Life Sciences

5. AI in Disease Management

AI tools are transforming how diseases are detected and managed. Startups like Lucem Health analyze vast datasets to predict patient risks without direct testing. Other companies are using AI to diagnose conditions earlier, such as Alzheimer’s and cancers, creating a shift toward preventive healthcare.

6. RNA Therapeutics Boom

RNA technologies like mRNA, RNA interference (RNAi), and antisense oligonucleotides (ASOs) are targeting previously untreatable diseases. The success of mRNA vaccines during COVID-19 has driven momentum, with companies like Alnylam Pharma expanding into CNS diseases such as Alzheimer’s and ALS.

7. Autonomous Robots in Caregiving

With projected shortages of 139,000 physicians and 63,000 nurses by 2030 in the US, healthcare providers are turning to robotics for caregiving and operational support. Companies are exploring robotic assistants for in-home care and advanced automation for hospital logistics, with leaders like Tesla entering the market.

AI

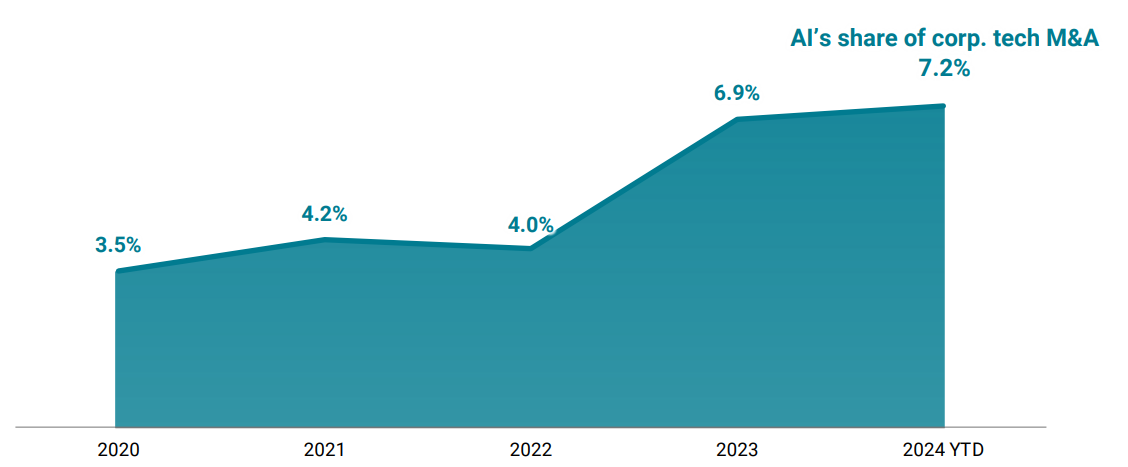

8. AI M&A Drives Strategy

AI acquisitions have surged as companies seek to integrate advanced technologies. Nvidia, for instance, is embedding AI across its product lines, while Salesforce and Thomson Reuters are expanding AI capabilities through strategic acquisitions. This trend highlights the race for competitive advantage through AI tech and talent.

9. LLMs’ Explainability Moment

The “black box” problem of large language models (LLMs) is being tackled through advances in explainability. Techniques like probing and feature attribution are helping developers understand how LLMs arrive at their decisions, a critical step for adoption in regulated sectors like finance and healthcare.

10. Open Source vs. Closed Models

While open-source AI dominates in cost-sensitive and niche applications, closed models from companies like OpenAI and Nvidia lead in performance and enterprise adoption. Open-source models are increasingly pivoting to hybrid approaches, combining free tiers with paid access to premium capabilities.

11. US Leads the AI Arms Race

The US accounts for 71% of global AI funding, driven by a strong ecosystem of startups and talent. However, China is closing the gap with investments in open-source models and regional dominance. Other nations, like Brazil and Australia, are emerging as specialized AI hubs.

Enterprise

12. Spatial Computing Revolution

Devices like Apple’s Vision Pro are redefining how enterprises interact with data and collaborate. Spatial computing allows for immersive training, real-time collaboration, and advanced data visualization. While high costs limit mass adoption, industries like healthcare and manufacturing are embracing these tools for precision and efficiency.

Retail & Consumer

13. The Personalization Imperative

AI-driven personalization is transforming retail. From dynamic product recommendations on Walmart.com to ChatGPT-powered search tools, retailers are creating tailored customer experiences. Companies see a 3x boost in conversion rates from personalized promotions compared to generic offers, making this a strategic priority.

Industrials

14. Next-Gen Data Centers

Traditional data centers are struggling to meet AI’s massive computational demands. Companies like Amazon and Microsoft are leading the charge in building advanced facilities, with $1 trillion in global AI infrastructure spending projected. This is critical for supporting AI workloads like training and inference.

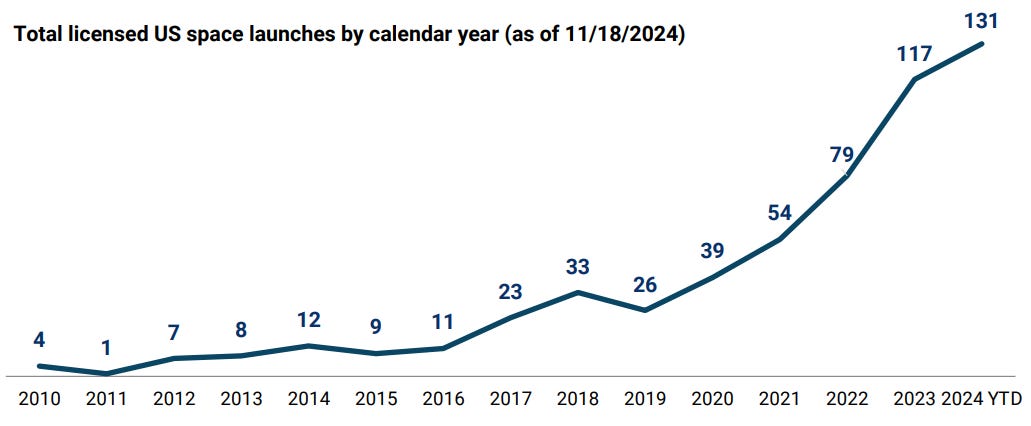

15. Cheaper Access to Space

The declining cost of space launches is driving investor interest in satellite and space tech. Innovations are unlocking opportunities in areas like global communications, Earth observation, and logistics, with startups entering previously inaccessible markets.

General news:

• Amazon invests $4B in Anthropic to integrate generative AI into AWS, intensifying competition with Microsoft and Google. This move aligns with Amazon’s aim to lead in AI innovation while navigating ethical and regulatory challenges.

• Nvidia unveils Fugatto, an AI model capable of generating music, modifying voices, and creating unique sounds. While revolutionary for music, film, and gaming, the model’s public release is not yet planned.

• Mandatory FIDC Registration under CVM Resolution 175 starts on November 29, promising greater transparency, fraud prevention, and legal security. Experts predict this reform could boost private credit funds’ popularity.

• Nvidia eyes Brazil for AI expansion with the government forecasting a R$ 23B investment (2024–2028). Nvidia aims to secure supercomputer projects, diversifying its revenue streams beyond hyperscalers.

Deals:

• Sinatra raised R$4M in a pre-seed round led by Quality Digital Group, with a16z Scout participation. Its AI Copilot, processing over 10M orders, targets profitability by 2025 and global growth.

• Fiagro Nagro Oikos raised R$75M to expand credit access for small and medium rural producers. The fund, utilizing AgRisk technology, aims to grow its portfolio to R$200M, reinforcing agribusiness financing.

• Zentynel invested in Axenya, a healthtech using AI to lower healthcare costs. Axenya plans to expand its network, targeting R$30M in revenue and 150K covered lives by year-end.

• Netspaces acquired Insignia Assets, accelerating its global expansion in real estate tokenization. With plans for operations in 100 cities by 2024, the proptech launched a Cashback Token program for property transactions.

• Zemo Bank secured R$2M from Bertha Capital to enhance its B2B fintech solutions. Managing over R$1B in Total Payment Volume (TPV), it aims to capture R$153M in revenue, leveraging AI-driven innovations.

• Opea and Trademaster raised R$150M through a new receivables investment fund to boost B2B credit. The fund supports over 1M retailers, targeting ecosystem efficiency and growth.

• Alprestamo launched in Chile with a $1.5M investment, aiming to democratize financial access. Partnering with 100 banks, the fintech plans to attract 2.5M users within two years.

• Yágua prepares its first VC round for 2025. With over 70 clients, it aims to expand its IoT water monitoring solutions into agribusiness and public sectors, addressing sustainability demands.

General news:

• Founders Club has supported over 1,500 entrepreneurs with R$10M in investments and 197 strategic connections. Offering networking, mentorship, and resources like cloud credits and the Founders Academy, it promotes social impact through education. The club is expanding and running a Black Friday membership offer of R$549.

• Apple faces investigation by Brazil’s Cade after Mercado Livre accused it of anticompetitive practices. Allegations include restricting app developers’ payment systems. Cade has mandated compliance, with a daily fine of R$250,000 for violations.

• Zapping appoints Aline Cavalcante, former Disney & ESPN executive, as Head of Commercial. She aims to grow Zapping to 150K subscribers by 2025, leveraging her industry experience to establish the platform as a streaming leader in Brazil.

• Paymóvil launches an advanced API for digital payments, offering features like contactless transactions and real-time transfers. Targeting businesses in Colombia, it plans expansion to Ecuador in 2025 and across LatAm.

• Mercado Pago partners with Frontal Trust to launch a financing fund for SMEs in Chile. Addressing reduced bank credit, the initiative offers transparent loans and integrates public and private investments to support business growth.

• Intel secures $7.9B from the US government to build four new chip factories, countering China’s semiconductor dominance. Despite restructuring efforts, Intel faces challenges in AI and GPU markets, with its market value down to $101.4B.

• Giannis Antetokounmpo enters venture capital with Build Your Legacy Ventures. One of the fund’s first investments supports Unrivaled, a professional women’s basketball league, aligning him with athletes like Kevin Durant in impactful projects.

Deals:

• Equity Fund Group (EFQ) acquires a minority stake in LDX Capital, with R$200M under custody. EFQ aims to expand into insurance and consortia, targeting R$1B by 2026. Henrique Martines joins as a partner to explore further opportunities.

• iBUILD raised R$3.2M to scale its sustainable Steel Frame construction franchise network. Now valued at R$20M, it plans a Series A round targeting a R$100M valuation and aims for 200 franchises by 2027.

• Agilize secured R$60M in funding led by AXA IM Alts. Serving SMEs across 600+ cities, Agilize plans to double revenue within two years by enhancing scalability and partnerships.

• Koin expands to Colombia with a $5M investment, targeting 100 merchants in its first year. As e-commerce fraud prevention becomes critical, Koin leverages its expertise from analyzing 25M transactions annually in Latin America.

• Justo exits Brazil after three years, focusing entirely on Mexico, which generates over two-thirds of its revenue. Following a $50M Series C round led by General Atlantic, Justo targets 100% growth in its home market by 2024.

• Teachy raised R$40M in a Series A round led by Goodwater Capital. Supporting 1M educators, Teachy aims to expand globally, enhancing AI tools for teaching and benefiting 60K Brazilian schools.

General News:

• BNDES set a record in innovation financing with R$11.1B in 2023, a 385% increase from 2022. Micro, small, and medium businesses received R$3.5B. Key projects include a R$500M investment in Eve’s flying car factory and sustainable aviation fuels.

• Pony.ai went public on Nasdaq, raising $260M at a $4.55B valuation. Operating in China and the U.S., the robotaxi company has driven over 35M autonomous kilometers but faces a valuation drop from $8.5B in 2021.

• SST is revolutionizing video analytics by turning cameras into intelligent systems. With R$1.5M MRR in its first year and plans for a seed round in 2025, SST is rapidly growing with enterprise clients and international expansion.

• Innspatial expands into Peru with Pluz Energía, covering 3,500 km of Lima’s streets to inspect electrical network risks using AI. The Chilean startup plans to raise $2M by 2025 to fuel further regional growth.

• Doctoralia launched Noa Notes, an AI-powered tool saving doctors up to 30% of time on administrative tasks. Used by 4K Brazilian doctors, it enhances data accuracy and complies with global privacy standards like LGPD and HIPAA.

• Healthtech Serena expands to the U.S. and Europe, offering AI-driven psychological support via WhatsApp. With 500 daily sessions in Brazil, it aims to reach 100K users by 2025.

• SoftBank plans to invest $1.5B in OpenAI employee-held shares following a $500M investment in October. This aligns with OpenAI’s $157B valuation and its partnerships, such as Microsoft’s $13B stake.

• 99Pay received Central Bank approval to operate as a Direct Credit Society, enabling direct loans to its 16M+ users. With over R$1.5B facilitated since 2022, the digital wallet is expanding its financial services.

• Gupy invested R$2.5M to integrate its ATS with LinkedIn Recruiter, automating hiring and reducing recruitment times by over 50%. It solidifies Gupy’s position in LatAm HR tech.

Deals:

• Hugo Barra’s /dev/agents raised $56M in seed funding, reaching a $500M valuation. Focused on developing an “OS for AI agents,” the startup aims to revolutionize collaboration across platforms.

• Bia Energy raised $8.5M in bridge funding to enhance its clean energy solutions and expand its $8M+ monthly revenue. It plans a Series B round and international growth by 2026.

• Novvo secured R$3.2M in funding led by BR Angels. Known for “Pré Drink” capsules, Novvo aims to expand to 10,000 stores by 2024, boost R&D, and prepare for international markets.

• Appmax & EBANX invested R$1M to support 100 businesses’ international launches. Combining AI tools and payment solutions, the partnership has already generated $2M+ in sales in LatAm markets.

• Makasí secured R$120M via CRI to finance real estate projects for small and medium developers. With 130+ operations approved, the fintech streamlines credit processes and targets underserved markets.

• Pony.ai raised $260M in its IPO on Nasdaq, expanding its autonomous mobility solutions in China and the U.S.

General news:

• Across Capital launched its first growth fund, raising $120M to invest in scalable startups in the U.S. and Latin America, with a focus on software-driven businesses. Early investments include QI Tech, Zig, and Akad Seguros in Brazil, and Slope in the U.S., with 60% of the fund allocated to LatAm startups.

• 49 Educação introduces Ítalo Sabo and Jady Ferreira Batista as partners to spearhead its global growth and the launch of 49 Ventures in 2025. The initiative will connect startups with experienced entrepreneurs for mentorship and strategic investments.

• C6 Bank launched “C6 Assistant,” a generative AI-powered tool enabling seamless financial transactions through texts, photos, or files. The assistant aligns with the bank’s projected R$2B profit in 2024 and upcoming investment-focused updates.

• Brazil’s Senate advances a bill to promote greentechs, offering tax reductions, sustainability grants, and R&D funds. A proposed green certification for environmental innovation aims to foster sustainable startup growth.

• Microsoft faces an FTC antitrust probe over alleged Azure market abuse. Despite the investigation, Microsoft’s cloud revenue surged 22% to $38.9B last quarter, bolstering its $3.1T valuation.

• Miguel Nicolelis and Flavio Pripas launched NeuroCapital Fund with $200M to revolutionize brain health and human performance. The fund targets the global neurotech market, projected to reach $680B, bridging science and venture innovation.

• Stefanini plans to double AI investments to R$2B by 2027, enhancing legal and banking solutions. With R$8B in projected 2024 global revenue, AI remains central to its strategy for tangible business results.

Deals:

• NoPing raised R$17.4M (US$3M) in funding led by EdgeUno to expand its gaming infrastructure platform globally. The investment will enhance latency-reduction tools and strengthen partnerships with game publishers.

General news:

• Transforme, a Chilean venture studio, plans to expand to Peru and Ecuador by 2025. With five startups in its portfolio, it aims to scale its regional presence and address market gaps through its venture studio model, fostering entrepreneurship and growth.

• ESOPs in LatAm: 75% of startups establish ESOPs before Series A, with 85% adopting them, surpassing Asia’s 78% rate. While ESOPs attract and retain talent, only 25% of startups in Brazil extend them to the entire workforce, highlighting the need for more inclusive strategies.

• Insider has appointed Guilherme Almeida, former Enjoei executive, as CFO. Almeida will drive the tech apparel brand’s financial strategy, targeting 165% revenue growth in 2024 and international expansion.

• Meta plans a $10B submarine cable project spanning 40,000 km to support its global internet and AI operations. This move reflects a shift in infrastructure ownership from telecoms to tech firms, with Meta joining Google in controlling undersea cables.

• Pix and Cash Trends: Cash usage in Brazil dropped from 76.6% in 2019 to 40.5% in 2023, with Pix now accounting for 24.9% of payments. Despite this shift, 17.3% of people still haven’t used Pix due to lack of knowledge or access.

• Brazil’s Crypto Flows: Cryptoasset imports contributed $14B to Brazil’s record $56.2B financial outflows between January and October 2024. Despite a $3.4B trade surplus in October, financial accounts remain negative due to capital market operations and crypto investments.

• Electronic Invoices: Brazil’s Central Bank approved rules to centralize the tracking of R$11 trillion in invoices starting in 2025, aiming to reduce fraud, enhance transparency, and boost credit access.

This theme is very important, and several funds are taking a look in this issue as it generates several business opportunities. Do you want to understand more? This startup called Antecipa wrote a great summary! PT ONLY

Deals:

Conexa acquires Lina Saúde, a data intelligence platform, after achieving R$250M ARR. Lina’s patient management capabilities will help scale Conexa’s base 3-4x in three years, complementing its existing telemedicine platform.

• Patagon AI, an AI-powered sales platform, raised $1.1M to expand into Colombia. The startup targets $2M in annual revenue by 2025, optimizing sales and marketing processes for sectors like retail and insurance.

• Cicatribio, a biotech startup from Bahia, raised R$2M to scale its animal wound-healing gel. Supporting 250 families, the startup integrates AI for treatment monitoring and plans a product for human use.

• Talabat raised $2B in its IPO, marking 2024’s largest tech listing globally. Valued at $10.1B, the Middle Eastern food delivery giant plans to expand across eight countries.

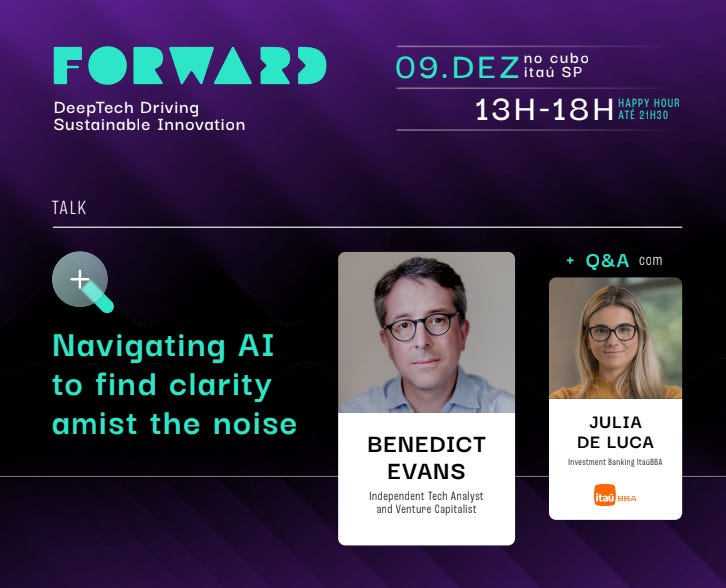

I’ll have the honor of conducting the Q&A session with Benedict Evans ( if you are an avid reader you know that I love citing his reports) live during FUTURE 2024! It will take place in Sao Paulo on December 9th. If you like tech, you cannot miss it. See you all there? Click here for tickets!

Itaú Views - Macro Update on what happened this week in Brazil related to fiscal spending cut plan by the government

“The first method for estimating the intelligence of a ruler is to look at the men he has around him.”

― Niccolò Machiavelli

This is awesome, Julia!