Discover more from Weekly Tech Update - Julia

LatAm Tech Weekly

#160 - Powered by Nasdaq: Itau BBA MacroVision, Series C valuation jump, "powerful AI", deals of the week... and much more!

Happy Sunday!

This week was a bit of a rollercoaster for me—I came down with pneumonia for the first time ever (and, of course, just a couple of weeks before my marathon). Training had to come to a full stop, and I spent most of the week in bed. But as they say, the show must go on! I'm feeling better now and hoping it's all uphill from here so I can at least cross the marathon finish line.

On a brighter note, I’m thrilled to be feeling well enough for tomorrow, where I’ll have the honor of taking the stage at Itau BBA's MacroVision 2024! I’ll be moderating a panel with an incredible lineup: Ricardo Guerra (CIO of Itau Unibanco), Daniela Amodei (Co-Founder of Anthropic), and Vasi Philomin (VP of Gen AI at AWS). As you can probably guess, the theme will be AI & The Future of Business.

If you want to catch the panel—or any of the other amazing speakers like Raghuram Rajan, Fernando Haddad, Rogerio Xavier, and more—be sure to subscribe here!

Follow me on LinkedIn , Instagram for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

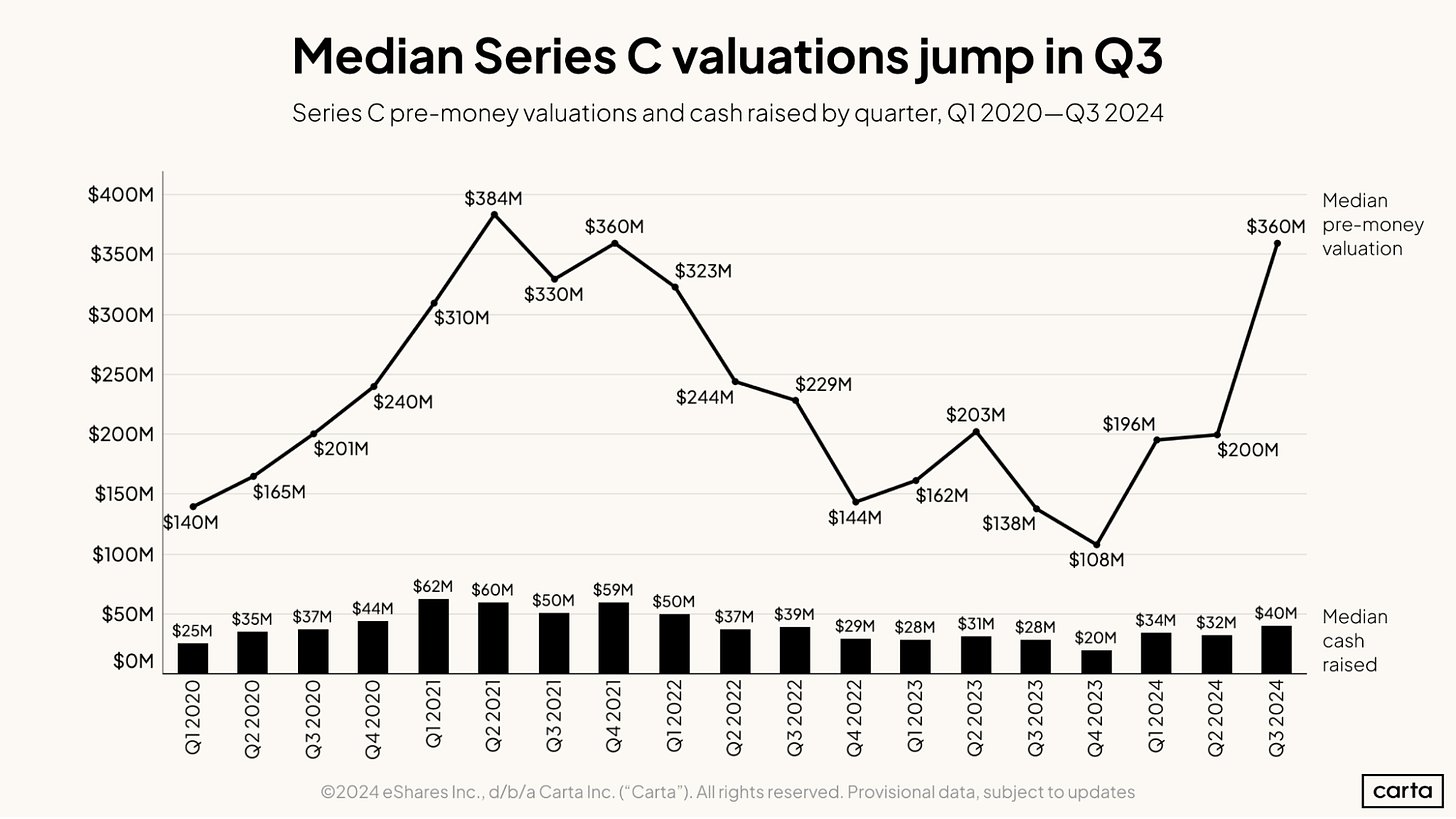

Moving on to our usual market update, a great read this week was Carta’s First Cut—State of Private Markets: Q3 2024. Despite the general slowdown in venture investments for the quarter mentioned last week both globally and in LatAm, initial data from Q3 2024 shows median pre-money valuations remained steady compared to previous quarters across the U.S. venture ecosystem.

A preliminary look at Q3 data for U.S. startups reveals cautious optimism in valuations. After modest gains in Q2, median pre-money valuations held steady compared to previous quarters. Even in rounds that saw slight quarter-over-quarter declines, the median remained above Q1 levels, with Series C showing particularly strong movement. It is very important to see such movements in the “later” stages, because it is a true sign that markets are slowly coming back. Remember that seed & pre-seed were almost unaffected by the recent market correction, while growth stages were hit hard. Therefore this movement in the Series C+ stage is important.

Meanwhile, consolidation in round sizes continues. The median cash raised last quarter stayed consistent with Q1 and Q2 figures, suggesting stable funding levels. Series E+ returned to Q1 levels after a notable spike in Q2. While final numbers on total rounds and capital raised aren’t available yet, early insights indicate that overall fundraising will align with trends from early 2024.

Shifting gears a bit, while researching for the presentation tomorrow, another great read was Dario Amodei’s (brother to Daniela, who I will be interviewing, and also Co-Founder at Anthropic) Machines of Loving Grace - How AI Could Transform the World for the Better.

In his essay, Dario Amodei, CEO of Anthropic, explores the concept of "powerful AI" and its transformative potential. While often focused on mitigating AI risks, Amodei emphasizes that powerful AI can unlock a fundamentally positive future if managed properly. He defines powerful AI as a highly intelligent system, far surpassing human capabilities in fields like biology, math, programming, and engineering. This AI would be able to autonomously solve complex problems, complete long-term tasks without supervision, and control virtual and physical tools, operating at speeds up to 100 times faster than humans. With millions of instances running simultaneously, Amodei describes this system as a "country of geniuses" capable of tackling vast challenges.

Key characteristics of powerful AI include:

Multimodal Interfaces: The AI can interact through text, audio, video, and control virtual tools or robots, simulating human work in a remote environment.

Autonomous Task Execution: It can handle long, complex tasks autonomously, without needing constant direction.

Physical Control: While not embodied, the AI could control physical equipment and even design new machines or robots.

High-Speed Processing and Collaboration: The AI operates at an accelerated pace, managing parallel tasks or collaborating with itself across millions of instances.

Amodei believes that powerful AI will have radical potential across several key fields, which he outlines as follows:

Biology and Physical Health: AI could dramatically accelerate the rate of medical and biological discoveries. By acting like a virtual biologist, it could design and run experiments, vastly speeding up research in gene editing, disease eradication, and drug development. This would lead to the prevention and treatment of diseases, extended human lifespans, and increased control over biological processes such as fertility or aging.

Neuroscience and Mental Health: In this field, AI could enhance understanding of the brain by measuring neural activity with unprecedented precision and uncovering the roots of mental illnesses like depression and schizophrenia. AI-enabled interventions, such as advanced neural measurements and behavioral therapy, could lead to cures for most mental health disorders. Additionally, AI could improve everyday cognitive function, helping people manage focus, stress, and mood.

Economic Development and Poverty: AI’s ability to make intelligent economic decisions could foster growth in developing nations by optimizing healthcare distribution, improving crop yields, and addressing systemic inefficiencies. While challenges like corruption and governance remain, AI could help uplift entire regions through targeted economic interventions, potentially spurring a second Green Revolution in agriculture and making healthcare accessible in even the poorest areas.

Peace and Governance: AI could either strengthen or undermine democracy, depending on how it is developed and deployed. Democracies could use AI to counter misinformation and foster transparency, potentially leading to stronger governance and more stable societies. However, if misused, AI could enhance authoritarian regimes through propaganda and surveillance. Amodei stresses that it will require collective effort to ensure AI is used for peace and democratic governance.

Work and Meaning: While AI is poised to automate many jobs, Amodei believes that meaning in human life will not be solely tied to economic productivity. AI can increase comparative advantage in the short term by enhancing human labor, but eventually, new societal models will be needed. AI may help humans focus on activities that bring fulfillment and foster deeper relationships, while universal income or new economic systems could emerge to ensure a fair distribution of resources.

Amodei concludes that while powerful AI presents extraordinary risks, it also offers an opportunity to radically improve life across various domains. By addressing these risks thoughtfully, we can harness AI to create a future where healthcare, mental health, economic growth, governance, and human fulfillment are all significantly advanced, leading to a more equitable and prosperous world.

General news:

Brazil is at the forefront of financial innovation with the adoption of OpenFi and the upcoming launch of Drex, the Central Bank’s official stablecoin. Unlike Open Finance, which focuses on data integration between institutions, OpenFi incorporates decentralized finance (DeFi) principles and smart contracts, providing more flexibility, transparency, and efficiency in transactions. With Drex, based on the ERC-20 standard, Brazil is positioning itself as a global leader in the digital financial revolution, though regulatory challenges remain to balance innovation and security.

Kamino, a Brazilian fintech focused on financial management for small and medium-sized businesses, is expanding into education with its new platform, Kamino Academy. The initiative offers free courses and certifications in financial planning, aimed at empowering entrepreneurs with better management skills.

A study by Appdome reveals that 84.5% of Brazilians prefer shopping through apps, far surpassing the global average. Despite this growth, security concerns remain high, with 90% of users worried about app safety and nearly half having experienced or known someone affected by cyberattacks. The report also highlights that many users are willing to abandon apps that don't protect their data, reflecting an increased demand for stronger cybersecurity in mobile applications.

Darwin Startups' Emma Project aims to reduce gender inequality in entrepreneurship by supporting 5,000 women by 2030. The initiative offers mentorships and resources to accelerate startups founded by women, with plans to expand into Latin America and Lusophone Africa. The program's goal includes training 2,000 women, pre-accelerating 600, accelerating 200, and securing investments for 50 startups. Named after Emma Darwin, the initiative addresses challenges women face in business, promoting inclusion in the entrepreneurial ecosystem.

Brazilian fintechs Scalable and Zaut have been selected for the latest cohort of the Bank of America's global acceleration program, which runs until March 2025. This fourth edition includes participants from Latin America, with Scalable and Zaut joining Melvinpay from Mexico and Olé.

Deals:

Chinese entrepreneurs Estrella Ouyang and Marta Cheng have raised R$3 million in pre-seed funding for their esoteric startup, AuraPura, in Brazil. The platform will serve as a marketplace connecting holistic therapists—such as astrologers, tarot readers, and coaches—with customers. Leveraging their experience in companies like Microsoft and TikTok, the founders aim to digitize the booming $2.4 billion Brazilian wellness market. AuraPura plans to expand across Latin America and eventually the U.S., combining traditional services with AI-driven mental health tools.

Brazilian proptech Morada.ai has raised R$6 million to expand its AI-powered real estate platform, which helps users find their ideal homes. The company’s AI agent, Mia, enhances customer interactions by offering natural, 24/7 conversational support, handling tasks like scheduling visits, answering questions, and processing paperwork. Mia serves nearly 100 developers across 17 states, including major companies like Cyrela and Direcional. Morada.ai reported over 400% growth this year, aiming to streamline home-buying with advanced AI tools.

Edtech startup Comiuniti has raised capital to enhance its communication software for schools. Selected by the Chile Mass acceleration program, Comiuniti aims to centralize and streamline internal communication within educational institutions. The funding will support the development of features that improve user engagement and overall efficiency. This move underscores the growing investor interest in solutions that address the needs of the education secto

General news:

The Brazilian Supreme Court (STF) has authorized the return of social network X (formerly Twitter) after it fulfilled legal obligations, including paying fines and appointing a local representative.

MercadoLibre founder Marcos Galperin celebrated a record-breaking August for the company in Argentina, citing a surge in consumption. The marketplace sold 20 million products, generating $916 million in sales. Categories such as tech items like laptops and tablets drove growth. Galperin also noted accelerating growth in September. MercadoLibre reported a 69% increase in its lending portfolio and an expanding base of buyers and sellers, reflecting a broader recovery in consumer behavior across various sectors.

Uruguayan fintech dLocal has received approval to operate as a Payment Transaction Initiator (ITP) via Pix in Brazil’s Open Finance system. This positions dLocal among 39 institutions authorized to act as ITPs, allowing it to facilitate non-bank transactions like e-commerce payments and loans.

Mattilda, a Mexican startup focused on school fee management, has partnered with Tapi, a paytech, to simplify tuition payments using neobanks like MercadoPago. This solution will benefit over 100,000 users across more than 200 private schools in Mexico, offering faster, more efficient payment processing.

Lumx has appointed Nathaly Diniz as Head of Tokens & Institutional Sales to strengthen its tokenization strategy and expand institutional partnerships in Latin America. Nathaly brings seven years of experience in digital assets, previously leading B2B projects at Foxbit and contributing to Brazil’s Real Digital initiative. She is also involved in several blockchain and fintech organizations, enhancing her expertise in the sector. With this leadership move, Lumx aims to consolidate its position as a blockchain infrastructure leader in the region.

Marcello Adrião, partner at private equity firm Axxon, has acquired a stake in Alicerce Educação, marking his first personal equity investment in a private company. Adrião also brought seven other investors, including Leonardo Letelier (Sitawi CEO) and Guilherme Martins (Insper President), to join the cap table. Alicerce, led by Paulo Batista, aims to expand access to fundamental education in underserved communities in Brazil. Adrião will serve as a board observer and consultant, alongside Pedro Vilela, who joined through Rise Ventures' investment last year.

Mexican unicorn Stori has launched *Stori Inversión+*, offering fixed returns of up to 15.5% annually, enhancing its savings solutions. Users can invest with as little as $5 USD through its app, competing with traditional options like CETES.

Deals:

Brazilian fintech Asaas has raised R$820 million in a Series C round led by BOND, with SoftBank, 23S Capital, and Endeavor Catalyst. This marks Asaas' first international funding, which will support acquisitions and expansion efforts. With plans to grow its portfolio and enter new markets, Asaas aims to reach R$400 million in revenue by 2024 and over R$1 billion by 2026. The funds will also boost R&D and global sales. Asaas is preparing for an IPO and expects its tech and M&A strategy to drive continued growth.

Brazilian fintech Tuna Pagamentos raised $2M in a Seed round led by ABSeed to prepare for a Series A. Founded in 2019, Tuna offers B2B payment solutions, focusing on customizable combinations of payment gateways and fraud prevention tools. With clients like Riachuelo, Zé Delivery, and Reebok, Tuna's software helps boost sales by up to 20%.

Brazilian legaltech Intelijus raised R$ 2.8M in a pre-seed round to enhance its AI-based legal assistant, LIVIA. LIVIA stands out as a fully autonomous legal agent, aiming to automate all lawyer tasks, beyond simple document drafting and chats. With major clients like Caixa Econômica and Natura, Intelijus targets R$ 3.3M in ARR by year-end, with over 4,000 lawyers on its waiting list.

General news:

Gabriel Galípolo, newly approved as Brazil’s Central Bank President starting in 2025, emphasized the need to maintain monetary stability while fostering innovation and entrepreneurship. In a Senate hearing, he discussed making Brazil an attractive destination for sustainable economic initiatives. Galípolo addressed challenges in reducing interest rates, calling for competitive credit solutions. His vision focuses on balancing productivity, transparency, and sustainability, with a strong commitment to combating inflation and ensuring long-term economic growth. Galípolo has a background in economics and previously served in Brazil’s Ministry of Finance.

Meta has launched its AI assistant, Meta AI, in Brazil, aiming to compete with ChatGPT and expand its presence to 43 countries by the end of 2024. With around 500 million active users, the chatbot was introduced in the U.S. in 2023 and has since expanded globally.

Celcoin has appointed Sergio Meirelles as its new Director of Strategy and M&A. With over 15 years of experience, Meirelles will lead post-investment M&A efforts following Celcoin’s R$650M funding from Summit Partners.

A recent study found that 70.5% of Brazilian VCs don't consider startup acceleration a factor when investing, revealing a disconnect between VCs and accelerators. In contrast to the U.S., where accelerators like Y Combinator boost investor interest, Brazil's ecosystem doesn't show the same alignment. The study suggests this gap is due to low maturity and weak collaboration between accelerators and VCs, impacting startups' access to capital. Closing this gap could unlock new growth opportunities for the Brazilian startup scene.

Fintechs point out that Brazil's new private payroll loan project could increase risk, interest rates, and vulnerability for borrowers. The proposed law, set for November regulation, eliminates the HR department as an intermediary in loan contracts, automating the process via digital platforms like e-Social.

The U.S. Department of Justice (DOJ) is considering breaking up Google to reduce its monopoly in online search and other key areas like Chrome and Android. This antitrust move follows a recent ruling that Google violated U.S. law by dominating the search market. The DOJ's proposal could force Google to share data with competitors and limit its ability to use search results for AI. With Alphabet valued at $2 trillion, this could become one of the biggest antitrust cases since Microsoft's in 2000.

The Mapeo TIC 2024 report highlights the growth of Bolivia's startup ecosystem, which expanded from 147 to 167 startups in the past year. Fintech leads the way, representing 32% of startups. Key challenges include funding and talent retention, while international expansion into markets like Paraguay, Peru, and Mexico shows promising opportunities.

Peruvian startup Price Lab has expanded to Mexico, aiming to transform retail pricing strategies with AI. The platform offers dynamic pricing optimization, enabling retailers to adjust prices based on market changes and competitor data, with a 96% accuracy rate in real-time recommendations.

General news:

OpenAI could face operational losses of $44 billion by 2028, tripling to $14 billion in 2026 alone. Despite raising $6.6 billion at a $157 billion valuation, profitability is only expected by 2029, with a $100 billion revenue target. Although OpenAI's revenue could grow to $3.7 billion in 2024, analysts doubt its aggressive goals. The company plans to spend $200 billion by 2030 on model training. Investors like Microsoft and Nvidia are key backers, but the path to sustained profitability remains uncertain.

Brazil's Ministry of Finance has unveiled proposals to enhance competition in the digital sector. The report suggests revising antitrust laws and creating new pro-competition tools targeting major digital platforms.

Natura Ventures, launched in June with R$50M for startup investments, is set to make its first investment this year. Focused on pre-Seed and Seed-stage startups, the fund plans to back 3 companies annually with checks between R$2M to R$10M. Impact criteria, such as diversity and responsible practices, are key factors in selecting startups. Partnered with VOX Capital, the fund aims to drive innovation in areas like circularity, customer experience, and tech-enabled transformation, aligning with Natura's broader sustainability mission.

Unimed has merged its tech companies Zitrus and Unio to create the healthtech Nexdom, with an initial valuation of R$ 250M and R$ 70M in revenue. Nexdom aims to streamline data sharing across Unimed's network and expand to external clients. The company plans to serve 80% of Unimed's operators in three years and double its revenue to R$ 140M. Nexdom will focus on automation, machine learning, and AI to improve healthcare efficiency, targeting faster medical appointments and personalized health plans.

Low digital literacy poses a challenge for financial digitalization in Brazil. While 73% of Brazilians accessed the internet in 2023, disparities remain, especially in lower-income classes, where access is under 70%. Only 29.9% of the population has basic digital skills, limiting their ability to use complex financial services like crypto.

The Central Bank of Brazil has launched the second phase of the Drex digital currency pilot. With no initial limit on business cases, the pilot aims to test tokenization benefits for Brazil's financial system. Drex is designed to be secure and easy to use, ensuring offline payments and simplifying digital asset transactions.

Colombian startup Autoparti, offering a subscription model for auto parts and services, has been selected for the Techstars Atlanta accelerator program. With monthly fees ranging from $5 to $20 and a 15% transaction fee, Autoparti aims to modernize the Latin American automotive sector through digital channels. The company is raising $300K to expand globally, targeting Mexico, Brazil, and the U.S. in 2025.

General news:

99Pay, the digital wallet linked to 99, saw 120% growth over the past year, now reaching 16 million active accounts. It aims to surpass 20 million by year-end. Celebrating its 4th anniversary, 99Pay has partnered with Me Poupe! to launch a financial education platform, offering free courses on budgeting, debt management, and investing.

Elon Musk unveiled Tesla's autonomous robotaxis, including the pedal-less Cybercab, aiming for production by 2027. Despite a 45% rise in Tesla’s stock since April, investors remain cautious due to Musk's history of unfulfilled promises and concerns about the robotaxi’s business model.

Brazil hosts 875 deep tech startups, with 40% focused on biotechnology, as highlighted in the **Deep Techs Brasil 2024** study. Half of these startups target human health or agribusiness solutions, primarily incubated in São Paulo's research centers.

WeWork has settled its debts with the Vinci Offices (VINO11) real estate fund, paying all overdue rents and penalties by October 10. Despite clearing the arrears after four months of non-payment, WeWork must vacate its location at Rua Augusta and Rua Oscar Freire in São Paulo. The fund plans to lease the property to a new tenant while maintaining its dividend guidance of R$ 0.045 to R$ 0.055 per share until December.

Deals:

Warburg Pincus has invested $125M for a minority stake in Contabilizei, becoming the fintech’s largest investor. This deal marks the exit of early investors like Kaszek, while SoftBank remains a shareholder. Contabilizei, which serves over 50,000 clients with automated accounting solutions, now focuses on growth backed by Warburg Pincus' expertise. The company is already operating at breakeven with annual revenue exceeding R$300M. Warburg Pincus sees significant potential in scaling technology adoption within the fragmented accounting sector.

Brazilian HRTech startup Mentora raised R$ 1.5M in a pre-seed round led by DOMO.VC, with participation from iFood co-founders. Launched in 2023, Mentora combines AI and human expertise to develop leadership skills and drive team performance.

CoreWeave, an Nvidia-backed AI startup, secured a $650 million credit line from major Wall Street banks to expand its business and data center operations. The company, which has raised $12.7 billion in the past 18 months, plans to operate 28 data centers by the end of 2024, including locations in major U.S. cities and London. CoreWeave's CEO noted that the credit facility will enhance their growth strategy amid a booming AI market, which is projected to exceed $1 trillion in revenue by 2032.

If you like tech events, I encourage you to access my LinkedIn post that has the entire list!!!!

REC ‘n’ Play

Date: November 6-9

Location: Recife

Description: Annual innovation and technology festival aimed at fostering creativity, technology, and entrepreneurship. It brings together professionals, students, and enthusiasts through workshops, lectures, and cultural activities, providing a platform for learning, networking, and collaboration. The event highlights Recife's role as a growing hub for innovation in Brazil, connecting participants with industry experts and new trends.

Stats Conf

Date: November 8-9

Location: São Paulo

Description: Bitcoin only technology event - crypto, finance, blockchain

#fswk24 - O Momento Atual dos VCs na Saúde

Date: November 6

Location: Rio de Janeiro

Description: This event focuses on the current landscape and opportunities for venture capital investments in the healthcare sector. Attendees will gain insights into the latest trends, challenges, and strategies for investing in health tech startups and innovative healthcare solutions.

The AI-Powered Renaissance: Amplifying Human Potential by Tulio Ribeiro from LANX Capital

Machines of Loving Grace - How AI Could Transform the World for the Better by Dario Amodei

Podcast by Atlantico: “Atrás do Retorno” interview with Luis Orenstein (Partner at Dynamo)

Menendez Brothers: watched both the Netflix Documentary & the Series based on the story.

“Progress in science depends on new techniques, new discoveries and new ideas, probably in that order.” - Sydney Brenner

Subscribe to Weekly Tech Update - Julia

Most relevant news on LatAm tech throughout the week with comments & opinions, reading recommendations and other curiosities about the ecosystem.