Discover more from Weekly Tech Update - Julia

LatAm Tech Weekly

#167 - Powered by Nasdaq: "AI eats the World", secondary prices rebound, deals of the week... and much more!

Happy Sunday!

It’s that time of the year - predictions or “educated guesses” of what will be the trends for 2025 start to appear… From “The World Ahead 2025” by The Economist to Deloitte’s Global 2025 predictions - all have one common topic, and yes (you guessed it) it’s artificial intelligence!

As many of you know, Lucas Abreu and I have been producing The Next Big Thing LatAm report since 2022. This initiative brings together insights and opinions from thought leaders across various industries, highlighting emerging trends and opportunities. We're now gearing up for the release of our third edition, and trust me, it's shaping up to be our best yet! Mark your calendars for December 18—this is one you won't want to miss. Stay tuned!

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

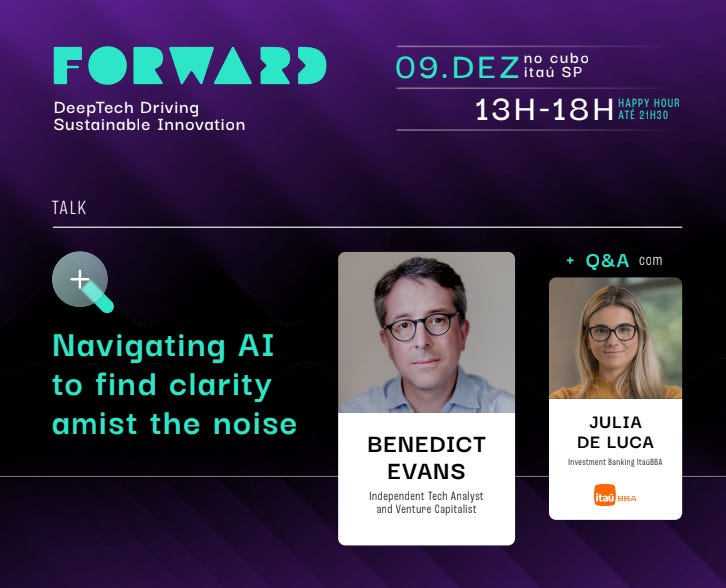

As I’ve mentioned over the past few weeks, tomorrow I have the honor of hosting a podcast and leading the Q&A session with Benedict Evans, the keynote speaker at FORWARD 2024. The event is already sold out, but don’t worry—I’ll be sharing highlights and key insights with you next week…

The session will revolve around Ben’s annual presentation, which you can check out in full here. To prepare for the talk I’ve done my homework and thoroughly reviewed it this week to craft thoughtful questions for him. Today, I want to share my key takeaways and what I think are the most compelling graphs from his presentation. So, without further ado, let’s dive in!

“AI eats the world”

Open AI is already valued at USD 157bn in its latest round. By means of comparison, Microsoft took 20 years to reach this same valuation.

Awareness of ChatGPT is reaching 60% in developed economies, but use is still lagging behind (around 10%)

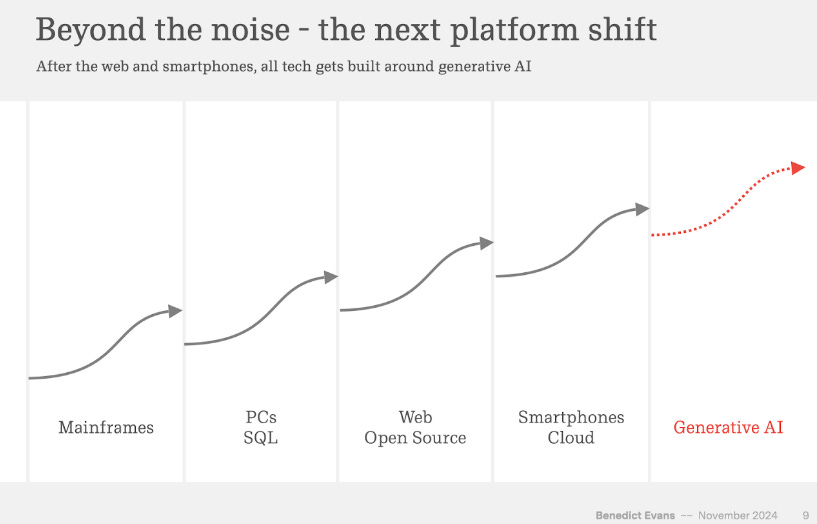

Beyond the noise and hype that comes together with AI, after the web and smartphones, all tech will be built around gen AI

But, scaling is hard – intense need of GPUs, time and money (current models in training now are at a USD 1bn cost, in 2025/2026 the cost will hike to USD 5bn- USD 10bn)

Given this cost, naturally capex from the big four tech companies (Meta, Alphabet, AWS and Microsoft) has hiked to ~USD 220bn in 2024 combined versus USD 90bn in 2023. And this figure is expected to increase even more in the coming years.

AI gives you infinite interns…

But the future can take a long time…

Cloud is only in 30% of workflows today globally (even being considered “old” and a “given”)

25% of CIOs globally launched a project using LLM, while 50% expect to launch in at least one year

The change in views across the different years:

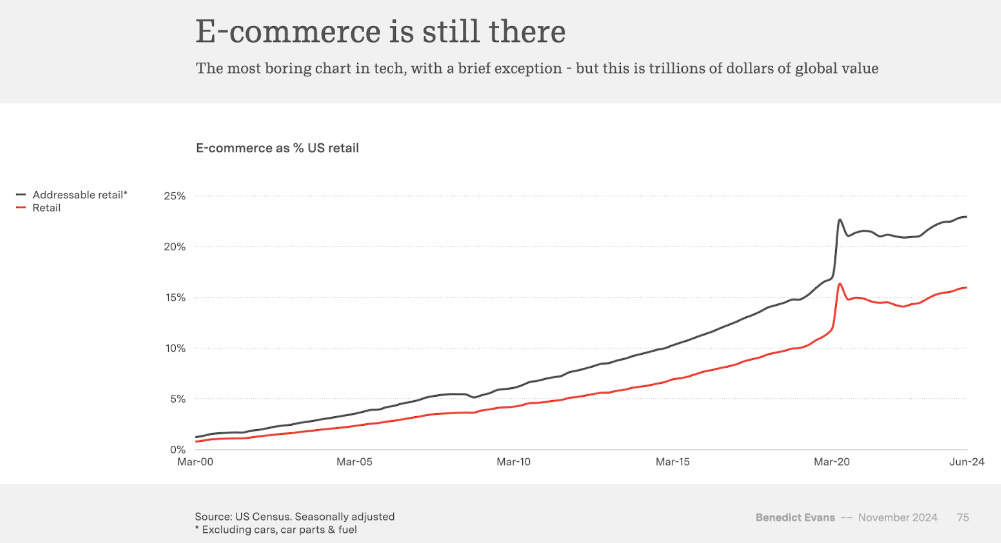

2000:Maybe people will buy things online…

e-commerce is still here and rising as a % of traditional retail

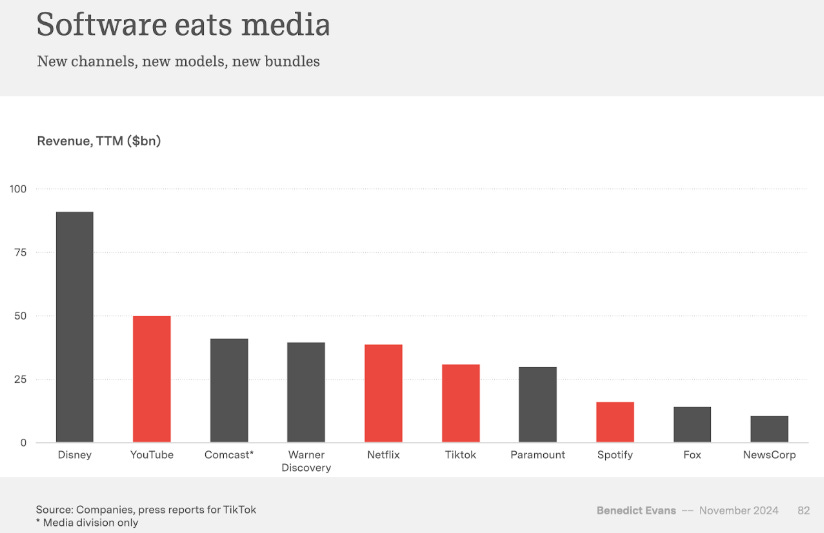

2010: SaaS, automation, workflow

Software is eating media

2030: Gen AI

“Intelligence is whatever machines have not done yet” Larry Tesler, 1970

Moving to our most common topics on the current VC landscape, a great read this week was a piece by PitchBook on secondaries. While this type of transaction is still in its early stages here in LatAm, it’s already a well-established practice in the U.S. One notable example from the region is Contabilizei’s recent round, where Kaszek sold its stake to Warburg Pincus. Transactions like this signal the growing potential for secondaries to become a more prominent feature of the LatAm venture ecosystem—following in the footsteps of the U.S. market.

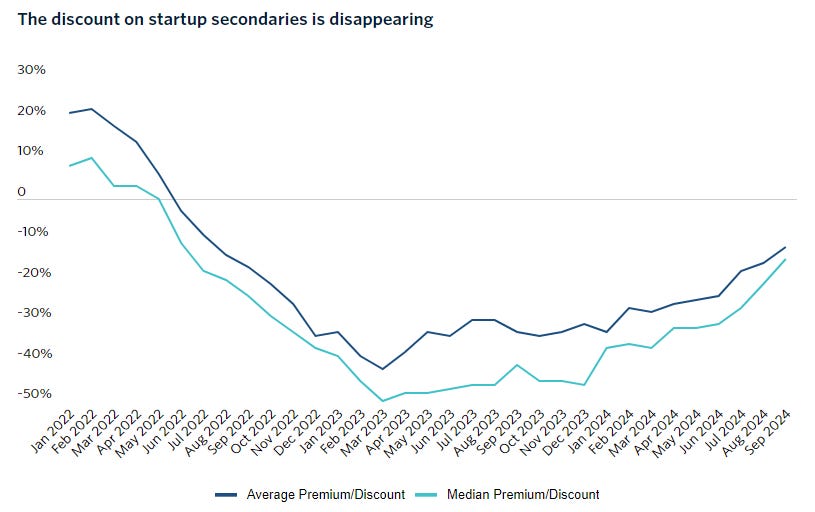

In the U.S., the sharp discounts on startup secondaries that defined the VC market downturn are rapidly fading, indicating a recovery in demand for minority stakes. According to data, secondary prices have rebounded from a 50% discount relative to their last funding round in early 2023 to just 12% by September 2024. Over the past two years, aging VC funds and employees sold their shares at steep discounts, creating opportunities for secondary investors like StepStone and Industry Ventures, who raised new funds to scoop up these undervalued shares.

Now, the market is nearing a new equilibrium, reminiscent of mid-2022, as buyer interest aligns with seller supply. High-growth, pre-IPO companies are even trading at premiums, driven by tender offers and expectations of an IPO market revival. SpaceX and DataBricks, for instance, are reportedly planning tender offers at valuations above their last rounds. Stripe’s story further illustrates this rebound: after its valuation plunged nearly 50% in early 2023, its secondary market valuation has climbed back to $99.8 billion—surpassing its $95 billion valuation from 2021 and far exceeding the $70 billion valuation tied to its ongoing employee tender offer. This resurgence underscores renewed confidence in high-performing startups and the strength of the public markets, setting the stage for what could be a broader shift in global venture capital markets, including LatAm.

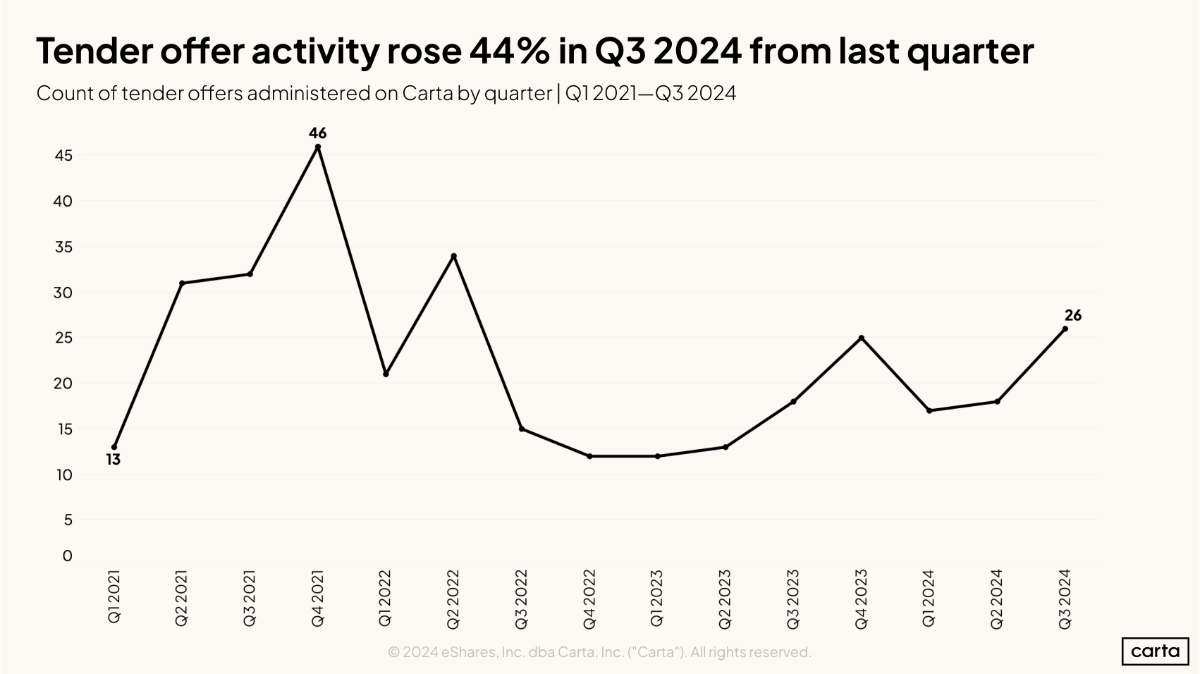

Speaking of which, tender offers indeed seem to be on the rise. In Q3 2024, Carta facilitated 26 tender offers—the highest number since Q2 2022—marking a rebound in liquidity events after a significant slowdown from mid-2022 through 2023. Tender offers, which allow early investors and employees to sell shares for liquidity, had previously dried up, especially among Series C+ companies, which saw their share of tender offers drop from over 80% in 2021 to just 50% in 2023.

This trend reversed in 2024, with Series C+ companies making up 63% of all tender offers on Carta by Q3. The median size of these offers has also risen to $23 million, up from $14 million in 2023, though still below the $40 million median seen in 2021. As later-stage companies delay IPOs and M&A exits, tender offers have become a critical tool for retaining talent, with data showing that these offers are now, on average, oversubscribed. As mentioned above, this is also an important component to boost secondary prices.

General news:

Open Finance in Brazil adopts a new governance structure aimed at enhancing professional oversight and transparency. The updated framework introduces a legal entity to manage operational responsibilities and accelerate the system’s evolution, attracting more participants and driving innovation in the financial ecosystem.

Meta invests $10B in a new underwater cable system connecting continents to support AI and next-gen internet infrastructure. Spanning over 40,000 kilometers, the project aims to bypass geopolitical tensions but will take years due to resource limitations.

PIX hits record high with 239.9M transactions in 24 hours last Friday, moving R$130B. Driven by early 13th salary payments, PIX now accounts for 39% of Brazil's 2023 transactions and continues to innovate with new features like ‘PIX Agenda Recorrente.’

PIX expands abroad as Brazilian institutions like PagBrasil and Fiserv enable payments in countries like Argentina, Uruguay, and the U.S., converting transactions to local currencies instantly. This bridges the gap as the Central Bank’s global integration plan (Nexus) remains pending.

Febraban and Google Brazil join forces to combat financial fraud. The partnership, signed by Isaac Sidney (Febraban) and Fabio Coelho (Google Brazil), focuses on enhancing Android security and developing tools to protect banking app users.

LG lugar de gente and iFood Benefícios partner to streamline corporate benefits for 2.3M professionals. The partnership targets 2,000 companies, integrating iFood’s meal voucher solutions into LG’s HR platform with no fees and broad acceptance.

Deals:

Nebius raises $700M to expand into the U.S. AI infrastructure market, challenging rivals like CoreWeave. Backed by Nvidia, Accel, and Orbis, Nebius aims for $750M-$1B ARR by 2025 with full-stack AI solutions and a new GPU cluster in Kansas City.

Chilean edtech Poliglota raises $1.5M via crowdfunding to boost its B2B model and expand in Mexico. Serving clients like Walmart, H&M, and Uber, Poliglota uses AI for personalized team training and has 42,000 active users.

Advent acquires Colombia's Siesa, a leading ERP provider with 7,000 clients, strengthening its Latin American tech portfolio. While also in talks with Linx in Brazil, Advent reinforces its commitment to digital transformation with $1B invested in nine Colombian companies.

Jeff Bezos invests $700M in Tenstorrent to challenge Nvidia in the AI chip market. The round, led by Bezos Expeditions, values Tenstorrent at $2.6B, with funds supporting engineering, supply chains, and production for AI server dominance.

General news:

Uinvex and B3 launch Brazil's first secondary market for crowdfunding, enabling tokenized trading of investments via blockchain and Pix. The debut operation supports Saveon Energia, offering investors liquidity and an estimated 25% annual return, expanding access to capital for SMEs and startups.

Visa's Working Capital Index highlights Latin America's financial efficiency, with 24% of growth companies among global top performers. The region saw a 300% boost in operational efficiency, with virtual card adoption rising 13%. Despite recession concerns, 85% of firms plan to expand digital tools in 2025.

Fabricio Bloisi of Prosus emphasizes Brazil's investment potential as the company sharpens its focus on innovation. Prosus reported $2.96B in revenue this semester, with AI and predictive tools like Toqan driving growth across delivery, fintech, and edtech sectors.

Rocketseat enters higher education with the launch of Rocketseat Technology College (FTR). Its online postgraduate course, starting in January 2025, integrates technical and strategic skills for developers, focusing on AI, infrastructure, and product strategies.

Nuvei appoints Juan Jorge Soto as GM for Latin America, emphasizing its commitment to regional fintech growth. Soto brings expertise in payments and business expansion to strengthen Nuvei’s presence in this fast-growing market.

Brazilian CVM proposes changes to crowdfunding rules to increase limits for issuers and investors, including frameworks for tokenized assets. These updates aim to align with market maturity and foster innovation, reflecting a sector that reached R$1B in 2023.

Neon names Fernando Miranda as CEO as founder Pedro Conrade transitions to Executive Chairman. The unicorn, valued at $1B, serves over 32M clients and logged 100M Pix transactions in October, aiming to accelerate growth.

Deals:

Klubi raises R$45M in Series A co-led by L4 Venture Builder and Vivo Ventures. The fintech, which has issued R$500M in credit, plans to enhance its consortia products and partnerships in the R$283B market.

Zig secures R$155M in Series B extension led by Kaszek. Known for streamlining payments at major events, Zig plans to expand internationally to Mexico, Portugal, and Spain, aiming to become the ultimate nightlife app.

Onze raises R$110M led by Ribbit, Atlantico, and Red Ventures. The corporate pension fintech will use the funds to enhance its solutions and expand to midsize and large companies, managing over R$4B in assets.

CloudWalk raises R$2.7B FIDC to support credit card receivables for its SME clients. With a tripled customer base in a year, the fintech now serves all Brazilian municipalities and expands in the U.S. with annual revenue exceeding $500M.

General News:

Wise launches Wise Empresas, a global multi-currency business account for Brazilian microenterprises, paired with an international Visa debit card. Entrepreneurs can receive payments in 18+ currencies, convert funds strategically, and pay globally with transparent fees, addressing pain points like high transaction costs for international expansion.

Visa tests biometric authentication in Brazil to enhance online payment security and combat fraud in Pix transactions. The solution integrates fingerprint or facial recognition, aligning with the demand for secure and user-friendly digital payment systems.

Google for Startups launches GenAI Founder Starter Kit to help Brazilian startups adopt Generative AI. The kit offers resources to identify AI opportunities, build learning loops, and prototype solutions, addressing challenges like talent shortages and lack of strategy.

BrainBox AI targets LatAm expansion with its AI solutions for optimizing HVAC systems and reducing emissions. Backed by $30M in funding, the Canadian startup plans a 2025 funding round to support its entry into Latin America and global growth.

Stark Bank and BRX Finance bring receivables securitization to blockchain, enhancing security and efficiency. Tokenization enables transparent trading of assets, improving credit access for SMEs and creating investor opportunities.

Nomad introduces "Dólar Nomad", offering a R$0.15 discount on exchange rates for customers who lock in rates for 12 months. The solution aims to strengthen customer loyalty while providing smarter financial planning options.

Yuca considers selling over half its real estate fund assets, backed by Monashees and ONEVC. Investors will vote on the R$16M proposal, with additional earn-out terms tied to profits from 27 properties in the fund.

Juno shuts down Brazil operation Velo six months after launch. Initially aiming for 500K users, the crypto bank’s platform offered a USD-backed wallet but failed to meet expectations. Clients must withdraw funds by January 6.

Deals:

Softplan acquires Runrun.it, marking its 12th acquisition after raising R$250M.

Resend raises $18M led by a16z with its transactional email automation platform. Founded by Brazilians, Resend serves clients like Warner Bros and Decathlon and aims to scale globally to 200M emails/month by 2025.

Chile's Vambe raises $3.85M to expand its AI-driven conversational commerce platform. Backed by Monashees, Nazca, and M13 Ventures, Vambe leverages GPT-4 to transform customer interactions, targeting LatAm growth.

General news:

Denmark's IDC Ventures eyes Brazil for 2025 expansion, drawn by resilient SaaS founders. With $550M AUM, the VC firm plans to deepen its focus on fintech, B2B, and cashflow-positive SaaS startups, highlighting São Paulo's strong entrepreneurial returns.

Brazil’s Open Finance Association elects new board with Hugo Rangel (Fitbank) as president and Lucas Lago (Genial Investimentos) as vice president. The team aims to drive innovation and expand open finance adoption.

Central Bank considers new Pix rules to strengthen security and operational standards. Proposed changes include higher capital reserves and stricter compliance measures, enhancing trust amid Pix's growing adoption.

Brazilian financial institutions raise fiscal risk concerns as 31% cite fiscal issues as a top concern in November, up from 27% in August. Uncertainty over public debt sustainability drives increased caution.

Brazil’s insurance sector to invest R$19.6B in technology and innovation in 2024, focusing on product development and sales processes. Despite growth, only 8% of insurers allocate over 5% of revenue to innovation.

The Senate committee approves Brazil's AI Legal Framework, outlining rules for responsible AI use. Prohibited uses include autonomous weapons, while high-risk systems face stricter oversight, aiming to balance innovation and safety.

Rappi revamps app with AI-driven personalization, social features, and influencer content to boost engagement. Its "Turbo" 10-minute delivery service is central to competing in Brazil's crowded food delivery market.

Colombian paytech Akaunt partners with Mastercard to launch a digital card enabling global purchases with digital dollars. Users can seamlessly use their digital dollars for worldwide transactions, both in-store and online. The virtual card integrates with Apple Pay and Google Pay for secure payments

Deals:

Colektia raises $9M led by Mouro Capital with participation from Endeavor’s Forward Fund. The Chilean startup leverages AI for debt recovery, targeting 30M clients by 2025 in a $3.5B market across Mexico, Chile, Peru, and Colombia.

Digital bank BS2 launches R$100M Corporate Venture Capital fund to invest in 12-15 startups over 18 months. The fund focuses on "beyond banking" solutions and includes initial investments in Bloxs, Somos Young, and Norte Ventures.

Portuguese sportstech Hoopers raises R$13M to expand in Brazil and Latin America. Backed by NBA champ Neemias Queta, Hoopers leverages AI for personalized experiences, aiming to triple community actions by 2025.

FCamara invests R$10M in Distrito to scale AI initiatives via Distrito's AI Factory unit. The investment includes board representation, enabling FCamara to expand its impact in AI-driven solutions.

General news:

São Paulo Labor Court orders iFood to pay R$10M fine and formalize employment for its delivery workers, challenging the gig economy model. iFood plans to appeal, citing incompatibility with current labor laws and worker flexibility demands. The decision could reshape debates on platform labor in the delivery sector.

Amadeus AI aims to lead Brazil’s AI transformation with custom solutions for local businesses. Backed by the AWS Generative AI Accelerator, the startup focuses on B2B services using proprietary AI models to drive digital transformation and competitiveness.

Bloxs to launch Capital Markets as a Service platform in 2025, connecting SMEs with investment funds through boutique advisors. The fintech plans a $20M Series A round to enable funding via CRIs, CRAs, and debentures, leveraging its tech and regulatory infrastructure.

€50M fund launched by GVC Gaesco and Next Tier Ventures to boost AI startups in Latin America, targeting 30-35 B2B investments in Mexico, Colombia, Argentina, and Chile. The fund aims to transform industries with AI-driven innovation and strategic support.

I’ll have the honor of conducting the Q&A session with Benedict Evans ( if you are an avid reader you know that I love citing his reports) live during FUTURE 2024! It will take place in Sao Paulo on December 9th. If you like tech, you cannot miss it. See you all there? Click here for tickets!

Gigacast with Mateus Lambranho, Partner COO/CFO at Hypr

“It’s about finding your values, and committing to them. It’s about finding your North Star. It’s about making choices. Some are easy. Some are hard. And some will make you question everything.” Tim Cook, Apple CEO