LatAm Tech Weekly

#216: LatAm SaaS Survey by Riverwood Capital, last call for The NextBig Thing 2026, deals of the week… and much more!

Weekly writing about what is happening in LatAm tech. By day, I lead the business development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,200+ weekly readers by subscribing here!

Happy Sunday!

Alright — last call! We’re officially at the home stretch. In less than 10 days, The Next Big Thing LatAm 2026 will be out!

For those who are new here — The Next Big Thing LatAm is our annual trend report and strategic guide that brings together the voices of founders, investors, operators, and thinkers across Latin America’s tech and innovation ecosystem. Each year since 2022, my co-creator Lucas Abreu — the writer behind Sunday Drops — and I (from LatAm Tech Weekly) invite leaders to share their one big insight: what will be the next big thing in the year ahead?

Across editions, we’ve featured perspectives from luminaries!!!

👉 Think you should be featured in this year’s edition?

There’s still time to get in: drop us a note! Whether you’re leading a startup, investing in the future, building emerging technology, or shaping the narrative of innovation in LatAm — we want to hear from you. Tell us why your perspective matters for 2026.

Reply to this email or send us a message — don’t miss your chance to be part of the conversation shaping the next year of Latin America’s tech and innovation scene.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Riverwood’s LatAm SaaS Survey 2025

The LatAm SaaS Survey 2025, conducted by Riverwood Capital, offers one of the most comprehensive snapshots of the Latin American software ecosystem. Based on responses from nearly 150 private SaaS companies, representing over US$2.1 billion in aggregated revenue, the report shows a region that is no longer playing catch-up, but steadily converging toward global SaaS benchmarks in growth, retention, efficiency, and AI adoption.

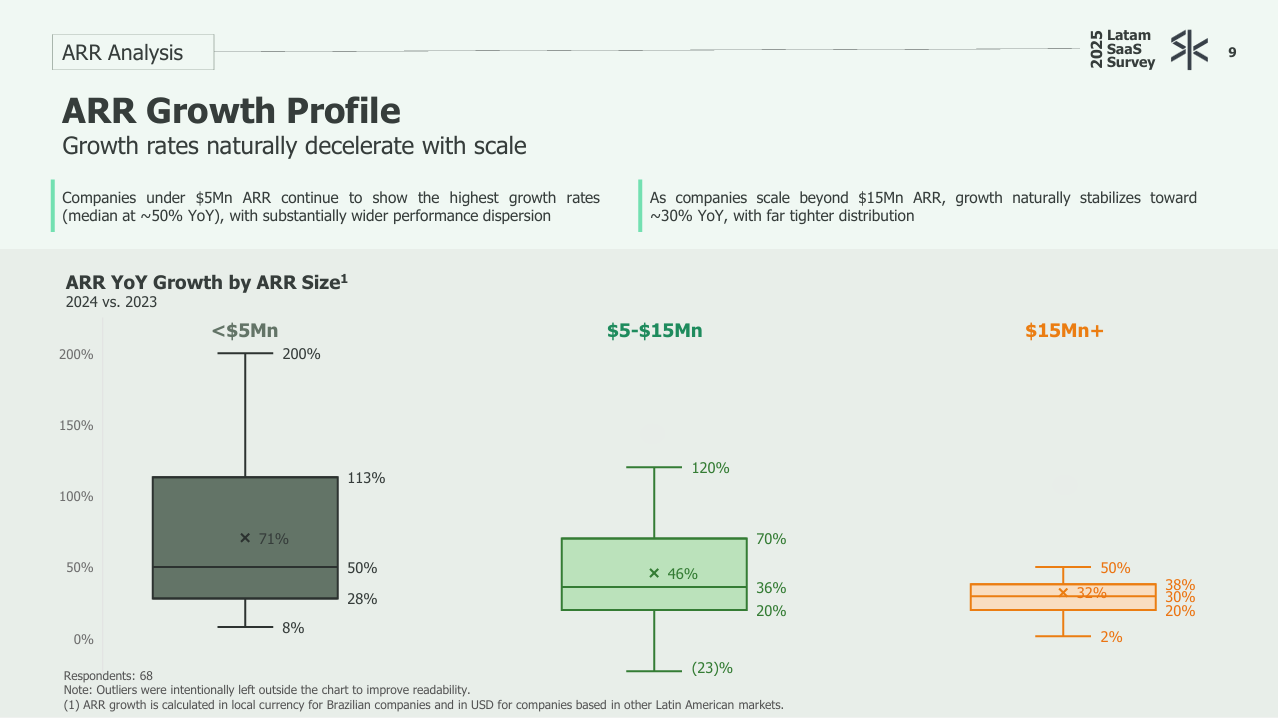

At a macro level, the data highlights a maturing ecosystem. While early-stage companies continue to grow faster, more mature SaaS players are showing healthier balance between growth and profitability. Median ARR growth stabilizes around ~30% YoY for companies above US$15M ARR, while smaller companies (<US$5M ARR) still post median growth close to 50% YoY, albeit with wider dispersion. This pattern reflects a natural scaling curve similar to global SaaS markets.

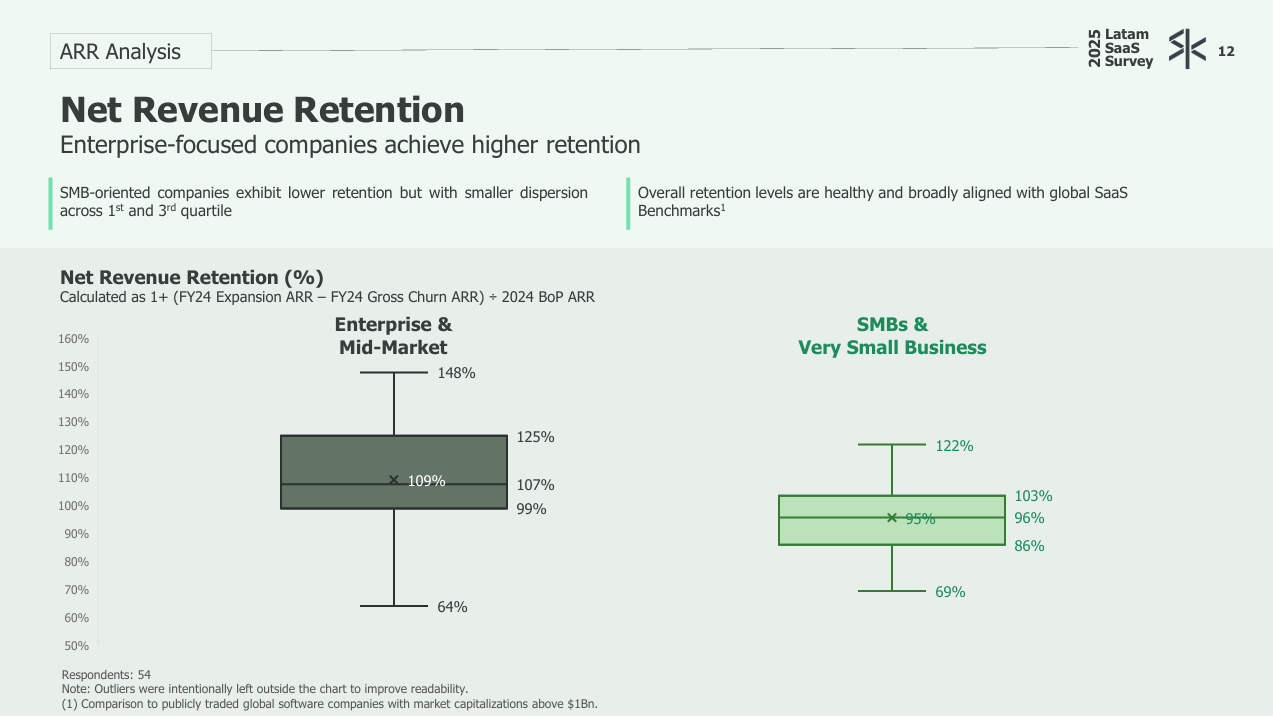

Retention metrics are another strong signal of quality. Net Revenue Retention remains healthy across the region, with enterprise-focused companies reaching a median of approximately 107%, while SMB-focused companies sit closer to 96%. Vertical SaaS companies consistently outperform horizontal peers on retention, both in enterprise and SMB segments, suggesting that industry-specific solutions benefit from deeper product stickiness and expansion dynamics.

On the efficiency front, Latin American SaaS companies are showing solid go-to-market discipline. Sales and marketing efficiency metrics such as CAC payback and Magic Number are broadly aligned with global best-practice ranges for enterprise and mid-market companies. Importantly, over 50% of surveyed companies report operating profitably, with Rule of 40 outcomes clustering between 30% and 40% for scaled companies — a strong signal of financial maturity.

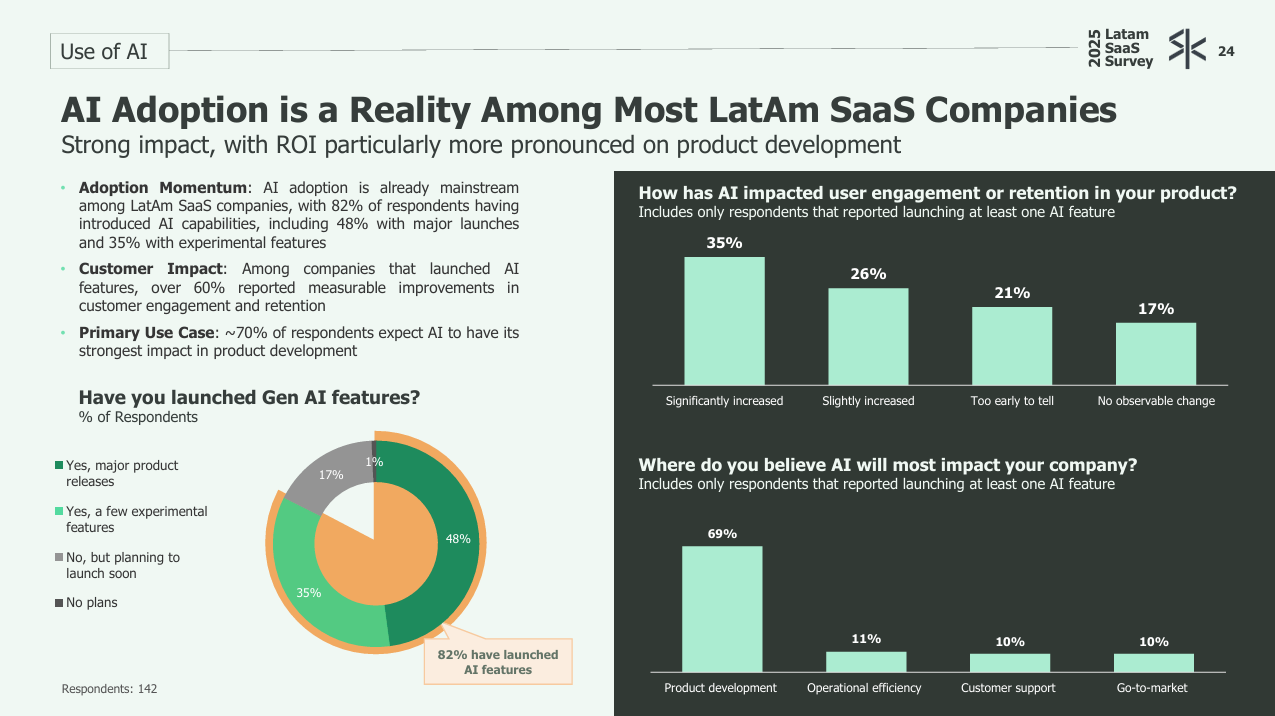

AI adoption stands out as one of the most decisive shifts captured by the survey. More than 80% of respondents have already launched AI features, and among those, over 60% report measurable improvements in customer engagement or retention. AI is no longer treated as an experiment: nearly 70% of companies expect its strongest impact to be in product development, while monetization strategies increasingly embed AI directly into existing pricing plans rather than selling it as a standalone add-on.

Operationally, the report also uncovers structural challenges that still separate LatAm SaaS from global leaders. ARR per employee remains significantly below global benchmarks, averaging US$50k–70k, compared to US$150k–200k in U.S. and European private SaaS peers. At the same time, expense composition evolves with scale: smaller companies invest more heavily in R&D, while sales and marketing intensity increases as companies pass the US$15M ARR threshold.

From a founder sentiment perspective, optimism remains high. Nearly all respondents expect revenue growth in 2025, with mature companies forecasting growth close to 30%, in line with current performance. Hiring intentions are broadly positive, and only a negligible share of companies expects workforce reductions. Fundraising dynamics also reflect healthier balance sheets: while roughly half of VC-backed companies plan to raise within the next 6–18 months, nearly half of bootstrapped companies report no plans to fundraise, signaling increased self-sufficiency across the ecosystem.

General news:

The battle for Warner is escalating as Paramount–Skydance launched a hostile bid just days after Netflix announced its US$82B deal for Warner Bros. Paramount is offering US$30 per share, valuing Warner Bros. Discovery at roughly US$108B and calling its proposal “superior.” The move bypasses the board and goes directly to shareholders amid regulatory concerns and industry backlash over Netflix’s growing dominance. With political pressure mounting and hefty breakup fees at stake, Hollywood faces one of its most aggressive takeover battles in decades. 🇺🇸

Pix hit a new record on Dec 5 surpassing 300M transactions in a single day for the first time, with 313.3M transfers totaling R$179.9B. The Central Bank described the milestone as proof of Pix’s role as critical public digital infrastructure. The previous record was set on Black Friday with 297.4M transactions. Five years after launch, Pix now serves 178.9M users and has processed R$3.32T as of October. 🇧🇷

Mercado Pago is accelerating in Chile as prepaid cards and “Grow Your Money” accounts gain traction, now used by 70% of prepaid card holders and 2.2M remunerated-account users. The company plans to launch its credit card in 2026, positioning itself to compete more directly with traditional banks and potentially challenge BancoEstado. Mercado Pago notes Chile adopted installment payments without credit cards faster than any other LatAm market, and expects another year of triple-digit growth as it expands credit and payments offerings. 🇨🇱

Deals:

Crown raised a US$13.5M Series A led by Paradigm, marking the U.S. crypto fund’s first investment in Brazil and valuing the fintech at about US$90M. Backed by investors including Valor, Coinbase Ventures and Edward Wible, Crown recently launched BRLV, a stablecoin fully backed by Brazilian government bonds. With more than R$360M in subscriptions, BRLV has become the largest emerging-market stablecoin, reinforcing investor confidence in Brazil as a key crypto adoption hub. 🇧🇷🇺🇸

Klubi expanded its Series A with a new R$32M round bringing total funding to R$77M in just one year. The fintech, the only one authorized by Brazil’s Central Bank to operate consórcios, surpassed a R$2B portfolio and reached R$180M in annualized revenue as it modernizes the sector with a tech-first model. The new capital will support AI development, product expansion and marketing, including its virtual assistant Kris, which resolves 90% of 200k monthly inquiries. Klubi now targets a R$5B portfolio and more than double its revenue by 2026. 🇧🇷

IBM is acquiring Confluent for about US$11B strengthening its cloud strategy and enterprise AI foundation. Confluent’s real-time data-streaming technology will enhance IBM’s intelligent data platform and accelerate the deployment of generative AI and agent-based systems. The deal follows IBM’s recent M&A streak, including HashiCorp and Bluetap, as corporate clients ramp up digital modernization. IBM will fund the acquisition with cash and expects earnings accretion after closing in 2026. 🇺🇸

General news:

Itaú has surpassed R$1T in Private Banking AUM and is planning a major expansion across Latin America and Europe. The bank will strengthen operations in Chile, Colombia, Paraguay, Uruguay and Argentina, while supporting wealthy clients relocating to Europe—especially Italy and Portugal. The strategy mirrors its Brazilian model and deepens integration between onshore and offshore wealth management. With rising demand in the U.S. and a reinforced global team, Itaú aims to become the leading private bank for Latin American clients worldwide. 🇧🇷

Banks are entering a new phase of automation with AI agents that act more like autonomous employees than traditional chatbots. Jabuti AGI is leading this shift by powering BV’s WhatsApp service with agents that cut repeat inquiries by up to 73% through contextual, action-oriented support. Built with strict data controls and structured memory, the agents execute real tasks while personalizing interactions. Jabuti’s bank-grade architecture and security-first growth are positioning it as a key player in the emerging AI-agent era. 🇧🇷

AI became Latin America’s top investment priority in November as AI-focused startups raised US$141M, accounting for 54% of all capital deployed. While total funding fell to US$261M across 38 rounds, AI deal volume held steady, with AI-enabled companies capturing 82% of the segment. Brazil led with US$212M and half of all rounds, while funding formats split between equity (52%), FIDC (44%) and minimal debt. Major raises included Credix’s US$87.4M FIDC, MotoristaPX’s US$46.5M Series B and The Mobile-First Company’s US$12M round. 🌎

Venture Metrix has launched an AI-driven investment intelligence platform following its integration into the Macuco DAO Group. Targeting VCs, CVCs and M&A teams, the solution automates scouting, deal matching and due diligence by combining proprietary AI with global diligence frameworks and access to 1,500+ data sources. The platform delivers executive reports, scorecards and probabilistic valuation and risk models, aiming to modernize decision-making in a venture market that has grown faster than its tooling. 🇧🇷

Latin America is emerging as the world’s hottest fintech market attracting more than 60% of regional VC funding as US$735M flows into startups serving populations excluded from traditional banking. Generative AI and LLMs are reshaping credit by analyzing conversational and behavioral data, enabling instant mobile underwriting without legacy records. AI agents are also transforming operations through autonomous support, fraud prevention and real-time loan actions, accelerating financial inclusion across the region. 🌎

Cora is expanding beyond finance with a new Benefits Hub offering SMEs access to curated partner discounts spanning sales tools, education, ERPs and flexible benefits. The initiative supports the 1.5M businesses on Cora’s platform as they digitize operations, while increasing engagement across its ecosystem. Following breakeven and profitable growth in 2025, Cora says it is entering a new expansion cycle without relying on external capital. 🇧🇷

Deals:

Eve Air Mobility secured R$200M from BNDES as it began trading BDRs on Brazil’s B3, expanding local investor access to Embraer’s eVTOL venture. The financing, linked to Climate Fund and innovation programs, will support electric propulsion integration and certification preparations. Eve now holds 2,800 global orders, with its first prototype flight expected in December. The funding advances a critical development phase as Brazil positions itself in the global clean urban air mobility race. 🇧🇷

Kala secured a US$55M debt round bringing total funding to US$61M as the Colombian fintech scales credit access for unbanked consumers. Kala’s technology enables fast, low-bureaucracy approvals for borrowers rejected by traditional banks, focusing on socioeconomic segments 2 and 3, including customers up to age 90. The capital will fund operational growth as the company targets serving more than 10,000 customers by 2025. 🇨🇴

Morada.ai raised R$17M led by Parceiro Ventures to scale its generative-AI platform supporting nearly 200 developers across 17 Brazilian states. A spin-off from Kunumi, the company combines GenAI, financial APIs and automation through its assistant Mia, which has handled more than 50M messages for 2M homebuyers. The funding will strengthen technology and expand customer journey coverage as Morada.ai continues sustainable growth backed by a research partnership with UFMG and an in-house engineering team. 🇧🇷

General news:

Z.ro Bank has launched Z.ro Digital Assets a new business unit focused on processing international transfers and payments using crypto, following Brazil’s regulation of digital-asset services and stablecoins in FX markets. Backed by proprietary processing technology and a custody base in Switzerland, the unit will create payment corridors between Latin America and Europe, the U.S. and Asia. Z.ro targets US$20B in cross-border transactions by 2030, aiming to reduce intermediaries and deliver faster, more predictable global payments. 🇧🇷

Construtechs are entering a more cautious phase as Liga Ventures reports just R$16M raised in 2025 across three deals, down sharply from R$68M in ten rounds last year. Despite the slowdown, the sector still counts 267 active startups, many founded after 2020 and focused on efficiency, digitalization and smarter project execution. AI adoption is rising, with 29 companies applying it to automation, monitoring, cost prediction and digital twins, while São Paulo continues to lead activity. 🇧🇷

Deals:

FlowCredi raised R$3.5M in a pre-Seed round led by Verve Capital and Norte Ventures as CEO Bruno Gama bets that home equity will be Brazil’s next major credit wave. Gama, who previously founded Credihome, estimates the segment could reach R$11B in 2025 and up to R$500B long term under the new Legal Framework for Guarantees. With lower rates than personal loans and rising consumer awareness, FlowCredi will use the capital to expand B2B and B2C channels, build white-label partnerships and scale operations. 🇧🇷

BASE Digital has acquired Atendo to add an AI-powered relationship and automation layer to its digital-transformation platform. Atendo’s multichannel system—spanning WhatsApp, chatbots, email and social networks—will remain a standalone brand while operating in full synergy with BASE. The deal aims to lift revenue by 20% and unlock new enterprise contracts as BASE targets R$50M in revenue and deeper expansion across Latin America. 🇧🇷

Caveo closed a R$54M Series A including a new R$34M investment from Enseada, joining backers such as Zenda, ONEVC and Norte Ventures. Founded in 2022, the startup offers digital accounts, accounting tools and an AI assistant via WhatsApp for doctors, now reaching nearly all medical schools in Brazil. With referrals driving 95% of sales and NPS close to 90, Caveo is expanding from early-career doctors to seasoned professionals as healthcare digitalization accelerates. 🇧🇷

Eveo will receive up to R$100M from XP Asset’s Infra V fund marking the cloud and data-center operator’s first external investment. XP is acquiring a 31.85% stake as the capital funds data-center expansion, new equipment, product upgrades and international growth following Eveo’s Miami launch. Serving clients such as Enel, iFood and DHL, Eveo targets R$100M in revenue by 2025 and R$500M by 2030 as demand for digital infrastructure accelerates. 🇧🇷

Vivo has acquired Telefónica Tech’s cybersecurity division in Brazil for up to R$232M, strengthening its position in the corporate digital ecosystem. The transaction expands Vivo’s B2B portfolio with advanced security solutions across cloud, networks, identity, incident response and managed services. Cybersecurity is now one of Vivo’s fastest-growing digital revenue lines, which reached R$5.1B in the last 12 months, positioning the company as a full-stack enterprise security provider. 🇧🇷

Senior Sistemas has acquired 100% of CIGAM for R$162.5M creating one of Brazil’s most comprehensive ERP platforms, pending CADE approval. The deal combines complementary portfolios across industry, retail, services, logistics and agribusiness, integrating CIGAM’s award-winning ERP and low-code/AI stack into Senior’s ecosystem. Together, the companies will serve 14.5K economic groups and accelerate innovation, data scale and leadership in enterprise software across Latin America. 🇧🇷

Generative Bionics raised €70M in one of Europe’s largest recent deep-tech rounds, backed by AMD, Tether and CDP’s AI fund. A spin-off from the Italian Institute of Technology, the company is developing “Made in Italy” humanoid robots for repetitive, dangerous and physically demanding tasks across manufacturing, logistics, healthcare and retail. The funding will support team expansion, construction of its first factory and advancement of Physical AI systems as the humanoid robotics market heads toward a projected €200B size by 2035. 🇮🇹🇪🇺

General news:

Rappi announced a partnership with OpenAI granting all active users in Brazil one month of free ChatGPT Go access starting Dec 15, while PRO Black subscribers receive six months. The move deepens Rappi’s push into high-tech services as competition heats up with new entrants like Keeta and the return of 99Food. The benefit extends to nine Latin American markets and can be activated via the app’s “Benefícios Pro” section, positioning AI tools as part of everyday consumer services. 🇧🇷

Otto is targeting mid-sized companies with its AI-powered MyCFO model as CFO salaries surpass R$700K and interest rates hover near 15%. The subscription-based service uses WhatsApp-driven agents that analyze context, financial history and internal discussions to recommend real-time actions to improve cash flow, margins and valuation. Early adopters unlocked more than R$2M in cash within 90-day cycles, supported by a “shadow CFO” layer for strategic decisions. Otto aims to scale from 15 to 1,500 companies as AI-driven financial leadership becomes a mid-market standard. 🇧🇷

Brazil’s Central Bank has begun testing no-collateral credit portability within Open Finance with 29 institutions piloting a fully digital process scheduled for public launch in February 2026. The initiative aims to cut loan transfer times from five business days to as little as three and allow consumers to migrate credit entirely through banking apps. By reducing friction and information asymmetry, the BC expects stronger competition and lower interest rates, while maintaining traditional portability as an alternative. 🇧🇷

Biofy is turning AI “hallucinations” into a competitive advantage by using generative models to predict future bacterial mutations and fight infections. Its technology combines fourth-generation DNA sequencing with a proprietary algorithm capable of identifying multiple bacteria in hours, far faster than traditional diagnostics. After generating more than 100k synthetic genomes, Biofy is now designing new antimicrobial drugs while scaling diagnostics through labs in Brazil and abroad, targeting a U.S. launch in 2026. 🇧🇷

BluStone closed its second venture fund at US$12.5M to invest in logistics and supply-chain startups, with Grupo Ultra and Argentina’s Murchison as anchor LPs. Nearly seven times larger than its first fund, the vehicle has already backed Mexico’s OCN and Brazil’s PX Center, following earlier bets such as Zax and GoFlux. BluStone plans to deploy 5–6 checks per year through 2027, targeting a pipeline of 300+ companies in a sector it views as under-digitized despite massive inefficiencies. 🇧🇷🇦🇷

Disney’s US$1B investment in OpenAI marks a strategic shift in entertainment as global AI spending accelerates and access is granted to 200 iconic characters. The agreement licenses IP for use in Sora video generation while explicitly protecting creators’ rights by prohibiting training on actors’ images or voices. The partnership strengthens Disney’s digital strategy across streaming, parks and consumer products, while expanding OpenAI’s footprint in entertainment amid growing scrutiny over the sustainability of massive AI investments. 🇺🇸

Deals:

Nava has acquired GH Brandtech marking its entry into the marketing space and its first M&A move since Crescera’s investment last year. GH operates across branding, growth and digital products, closely aligned with Nava’s strengths in data, app development, cybersecurity and cloud. The acquisition supports Nava’s broader M&A roadmap for 2026 as it targets R$1B in revenue by 2030, with both companies citing cultural alignment and a shared focus on measurable ROI and AI-driven innovation. 🇧🇷

Edtech Árvore has merged with SuperAutor just months after completing two acquisitions, creating a platform now serving more than 11,000 schools and 4M students. The deal accelerates Árvore’s international expansion, including a U.S. operation and partnerships with 150+ American schools starting in 2026. Founder João Leal will serve as global CEO, with ambitions to reach over 10M students and build a reading and writing ecosystem worth hundreds of millions across Brazil and the U.S. 🇧🇷🇺🇸

FlyMedia raised R$20M in a round led by OneVC as Victor Trindade, cofounder of NG.Cash, launches a startup dedicated to creating and operating AI influencers. The company aims to build global, multilingual digital-native IPs powered by advanced technology, positioning AI characters as the next generation of media. Investors include Big Bets, Alter Global, A16z Scout, Norte, Hypersphere and FJlabs, as FlyMedia begins developing its first AI influencers and narrative universes. 🇧🇷

Nexo has acquired Buenbit one of Latin America’s fastest-growing crypto platforms, and will establish its regional hub in Buenos Aires to support expansion across Argentina, Peru, Mexico and beyond. The deal combines Nexo’s global liquidity, security and 100+ crypto products with Buenbit’s regulated operations and deep local expertise. Buenbit users gain access to advanced trading, structured products, crypto-backed credit and the Nexo loyalty program, marking a major step in Nexo’s LATAM strategy. 🇦🇷🌎

Jeeves raised a new US$100M round led by Community Investment Management to expand credit access for Mexican companies using its unified spend-management platform. Mexico is now Jeeves’ largest market, with revenue up 250% year over year and net revenue retention above 130%. The funding expands its total credit line to US$175M and supports rapid adoption of cards, payments, treasury tools and AI-driven compliance features. 🇲🇽

General news:

Upload Ventures is splitting into three independent firms as Brazil’s venture-capital market shows early signs of recovery. Rodrigo Baer will lead I4b, focused on early-stage B2B startups; Carlos Simonsen is launching Upstream, targeting growth equity and venture debt; and Mario Moraes will run UVP, managing TIM’s US$50M growth fund. The split follows strategic disagreements and aims to eliminate conflicts while sharpening each firm’s investment thesis across seed, growth and credit for later-stage startups underserved by banks. 🇧🇷

Deals:

Lead Energy expects to close 2025 with 270% revenue growth after securing R$100M in renewable-energy contracts and raising R$2M from Desenvolve SP-FINEP and angel investors. The company expanded its platform to support customer migration to the free energy market, scaled a network of more than 2,000 affiliates and strengthened governance with a new advisory council. Selected for BNDES Garagem and advanced pilots linked to Brazil’s upcoming low-voltage market opening, Lead Energy is positioning 2026 as a breakout year targeting millions of small businesses as energy liberalization accelerates. 🇧🇷

TIP Brasil is investing R$500M in a new Tier-3 datacenter in Campinas marking its entry into Brazil’s rapidly expanding cloud and colocation market. The facility will support up to 2,000 racks and launch with 10MW of power, serving telecom operators, enterprises and government clients requiring national data residency. With Brazil’s datacenter capacity projected to grow from 0.88GW in 2025 to 1.36GW by 2030, TIP plans phased expansion through the decade, strengthening its digital-infrastructure portfolio and positioning itself among the sector’s leading players. 🇧🇷

Nothing worth mentioning this week…

“We are not given control over events, but we are given control over our response to them.”

— Viktor Frankl (paraphrased from Man’s Search for Meaning)

Love this perspective, especially how you're blending AI focus with futur trends, totally digging the forward-thinking vibe.