LatAm Tech Weekly

#90 - Powered by Nasdaq: Global M&A trends, Fintech Nexus USA 2023 takeaways, deals of the week... and much more!

Happy Sunday!

Back to the usual format! Let’s start with some good news: Copec/Wind Ventures, the strategic investment arm of Copec, LatAm energy company, conducts every year a VC survey in different regional markets. This year, it revealed that the interest in China dropped 74% while interest in LatAm rose 142% as US investors switched their focus away from China. Go LatAm!

Follow me on LinkedIn , Instagram or Twitter for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

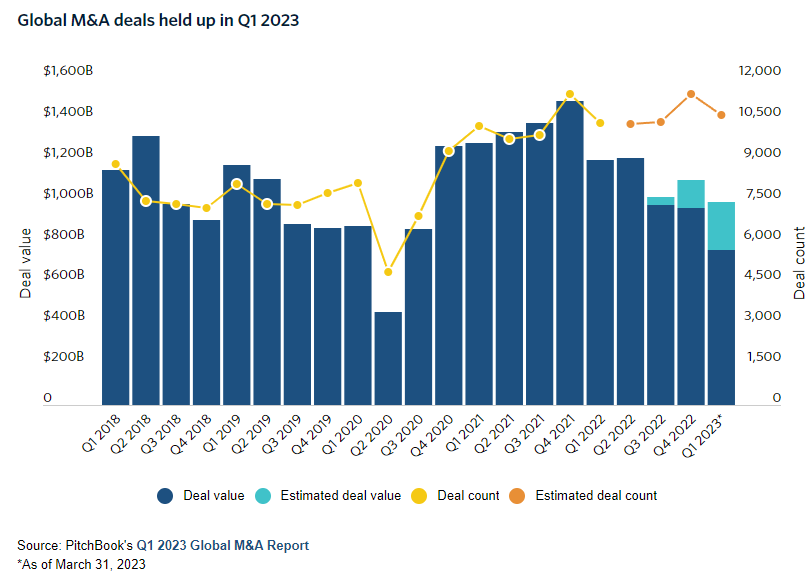

On to the usual market update, according to recent Pitchbook data, sellers have started to lower their prices to meet the buyers halfway, thus increasing the number of M&As. 10,625 M&A deals were closed globally in Q1, representing an estimated $993 billion. While this figure represents a QoQ decline of 7%, the performance is fairly robust when compared to the quarterly figures seen between 2017 and 2019. As for valuations, the greatest declines was seen in smaller deals (sub USD 100m range). The median enterprise value to revenue multiple of this category was of 1.1x based on the last 12 months of deal flow, a 31.3% discount compared to last year. For comparison, the median TTM revenue multiple for global M&A overall was 1.6x.

Talking about interesting sectors for tech, the B2B M&A activity continued to deliver mixed results. The sector saw an estimated 4,102 deals in Q1, which represents a 5.1% decrease QoQ, but up 27.4% from the lower end of 2022. Financial services, on the other hand, saw a decline in activity. The sector saw an estimated 856 deals transpire, a decrease of 11.4% QoQ. Finally, IT (pure tech), saw an estimated 2,043 deals closed or announced for a combined value of $146.8 billion. After three consecutive quarterly declines, deal value fell to its lowest level since Q2 2020.

League tables for the industry were also revealed. Below you can see a snapshot of the most active VC funds.

Finally, Fintech Nexus USA 2023 happened one week ago. As the leading event for the fintech industry globally, recurring themes included unit economics, profitability, fraud prevention, regulation, lending and credit, payment solutions, embedded finance, the role of data, and (of course) generative AI. Be sure to read the “What did I learn from readers” section as one reader who is a friend and founder and participated in the event, sent over more details that I will also share with you!

General news:

Oxygea – Braskem’s Corporate Venture Capital and Venture Builder vehicle – launched the first cohort of Oxygea Labs, an investment and acceleration program for startups focused on sustainability and digital transformation. The entire journey is centered on creating value for participating founders and startups through individual assessments, mentoring and relationship building with investors and stakeholders. Oxygea Labs offers each selected startup a BRL 100K incentive with no equity consideration, in addition to the possibility of the startup being selected for a BRL 1.5MM investment at the end of the program. Registration is open until May 28th. Learn more and register here.

Alelo launched a flexible benefits card that includes the Elo acceptance network, following the same strategy conducted by Flash, Ifood and Swile. The company aims to generate BRL 1 billion in revenue and attract 25,000 companies in 2023 with Alelo Pod.

Google is adding two new features to its image search to reduce the spread of misinformation, especially now that artificial intelligence tools have made the creation of photorealistic fakes trivial.

Insurtech Azos, which created a platform to facilitate the access and adoption to life insurance and has attracted the attention of heavyweight investors in recent years, is stepping on the accelerator to expand its geographical footprint in the country by announcing its entry into Curitiba and two major cities in São Paulo - Santos and São José dos Campos.

Afya, Brazilian health education group, is the new member of the CVC club - or corporate venture capital. The company did not disclose the total amount available, but its first investment is in Lean Saúde, a healthcare management platform combined with data intelligence. (see more below)

Brazilian Fintech Payface has over 1,000 points of sale already adopting the technology. The company will soon launch a new product called Pixface, where users will have a bank account within the Payface app to perform transactions using only facial recognition through the Pix system.

Brazilian ClearSale reported its results - the chargeback crisis in E-Commerce Brazil, the company’s key vertical, seems to be over – the division posted solid growth of 27% YoY (21% on a 2-year basis). ClearSale's operational cash generation, roughly equivalent to its capex, suggests that the company is on the right track to deliver profitability going forward, despite the impact of seasonal tailwinds from 4Q22 on the cash flow statement for 1Q23.

Registrations by financial institutions to test projects with Real Digital ended last Friday. Now, the Brazilian Central Bank will need to pick 10 companies to participate on the test. Among the volunteers are BTG, Banco do Brasil, Itau and Bradesco. The official launch of the country’s CBDC is expected to occur in 2024.

WhatsApp announced that it’s introducing a new “Chat Lock” feature that is designed to give users an additional layer of security for their most intimate conversations. As its name suggests, the feature lets you lock a chat, which takes that thread out of the inbox and puts it behind its own folder that can only be accessed with your device password or biometric, like a fingerprint.

Deals:

Lean Saude, Brazilian heathtech, raised an undisclosed seed round with Afya Venture Capital

National Soft, Mexican SaaS, was acquired by Duhau Capital. (undisclosed amount)

Laager, Brazilian service-focused company that develops web platforms for data management, was acquired by Constanta Group. (undisclosed amount)

Consolid, Mexican travel tech company, was acquired by Monde. (undisclosed amount)

Charisma BI, Brazilian data analytics and data science company, was acquired by Grupo Nexcon. (undisclosed amount)

General news:

With 4,000 employees in its IT area, more than in its sales department, Brazilian beer giant Ambev has embraced innovation to launch new brands and be recognized as more than an operations manager.

Agtech: RúmiCash, a fintech specialized in credit for milk producers, expects to expand its customer base by 40% this year, reaching 11,000 clients, therefore lending BRL 200 million.

Sam Altman, chief executive officer of OpenAI, told US senators about a variety of areas where he’d support regulation, including preventing election misinformation and making AI-generated content clear to users.

Brazilian fintech Quanto laid off around 85% of its employee base.

Deals:

Totvs announced the acquisition of Lexos, a startup specialized in solutions for integration with online marketplaces. The deal involved the purchase of 100% of Lexos for BRL 13.2 million

Track.co, Brazilian startup that provides reference technology solutions for monitoring and management of customer satisfaction, raised USD 6.1mm with Provence Capital, Green Rock and TM3 Capital.

General news:

Recent survey showed that Chile is one of the countries with the most women leaders in fintech ventures.

Reports showed that Brazilian VC firm Monashees has already written off their investment in Facily.

Research showed that 52% of the Brazilian population use regularly more than three credit cards. According to Serasa, 24% use only one card, another 24% use 2 cards, 22% use 3 cards, 13% 4 cards and 17% 5 cards or more.

Mercado Pago and VTEX launch payment initiator. This functionality allows customers to pay without leaving the store environment. According to the companies, the resource increases the chances of sales conversion, given the better user experience for the customer, and also helps sellers to expand their customer bases.

Despite market momentum, the AI sector has already produced 13 unicorns, 5 of the in 2023. Chat GPT leads the way with a valuation of USD 29bn, followed by Anthropic (USD 4.4bn) and Cohere (USD2bn).

Zenvia reported another set of positive results in 1Q23. Although the company continues to prioritize profitability over growth, the top line improved by 2% QoQ despite the weak seasonality of the quarter, which supported another solid EBITDA performance of BRL 24 million. Operating cash flow reached BRL 95 million, helped by anticipations from Twilio, while EBITDA minus capex remained positive at BRL 13 million.

Stone also reported results: adjusted net income came in at BRL 237 million beating estimates mainly on a combo of higher take rates and lower opex. Overall volumes weakened in the quarter, but Stone gained share with the advances in SMB while continuing to adjust prices/mix upward, which offset the weaker software business.

Avenue Securities received the approval of the Brazilian Central Bank to operate FX directly from its platform (without the need of partnering with a bank).

Deals:

Mob2Con, Brazilian startup that offers technological solutions to increase the commercial and operational performance of the retail ecosystem, raised USD 1m seed VC round with Hindiana.

Digicade, startup that develops and provides georeferencing solutions, was acquired by Squadra.

General news:

Good news: The participation of women in the presidency of Brazilian companies rose to 17% in 2022, four percentage points above the 13% registered in 2019. The data is part of a study conducted by Insper and Talenses Group with 381 companies in the country. There was also good news in the vice presidency, from 23% to 34%.

Sovereign Wealth Funds in the game: SWFs are reportedly seeking to increase their exposure to direct investments in the venture world.

ChatGPT will soon become accessible on mobile as OpenAI confirms the availability of its iOS version. The official iOS version is free, and will allow voice prompt, and will be free from ads. However, only US users will be able to access it in the interim.

GetNinjas laid off 20% of its workforce (around 40 people)

According to a recent survey by Itau Unibanco, businesses have increased their use of PIX in 76%, while the use of credit cards increased in 17% and debit in 10%.

Nubank intends to launch digital accounts in Colombia by the end of the year. The bank also partnered with Globo to launch its new campaign.

Deals:

uMode, Brazilian startup that develops a platform through technology and data that offers solutions for fashion brands with the aim of increasing the impact and disruption in the way products are sold at scale, raised USD 500k in a seed round with Investores.vc and Smart Money Ventures.

General news:

According to a recent research by Itau Unibanco, Brazilians spent 196% more on apps/ tools in their mobile in Q1 2023 when compared to Q1 2022.

Retail giant Americanas is thinking about selling its digital wallet, Ame Digital.

a16z is reportedly thinking about establishing an arm to invest in emerging managers focused on early stage.

Deals:

Portal do Médico raised BRL 20 million from SRM Ventures, the investment arm of SRM Asset. The marketplace to healthcare professionals aims to increase its GMV by over 250% due to the recent raise.

Silverguard, Brazilian tech company that offers a wide range of financial and digital protection services for indibiduals and companies raised a USD 1.5m seed round with Astella and Latitud.

STC Solucoes Tecnologicas, company that provides a tracking platform, was acquired by Datora. The amount was not disclosed.

What did I learn from readers?

Fintech Nexus USA 2023 Conference Observations:

The conference reflected current market dynamics with reduced capital deployment and a shift from B2C to B2B.

Compared to previous years, this year's attendance and displays showed a normalizing environment. Large conference attendees included BHG financial, TrueNorth, Mambu, Visa, MasterCard, and Plaid, but some leading banks and fintech companies were absent.

State of Fintech Venture Capital (VC):

Most investors have adopted a flight-to-quality mindset.

Past fintech investments were based more on option value than intrinsic value, leading to unrealistically high valuations.

Down rounds are viewed as positive for writing off risky investments and reinstating the flow of venture capital.

Investors are bullish on payments, vertical software, orchestration, AP/AR, and embedded finance.

Generative AI:

Most fintech companies haven't yet adopted modern generative AI.

Large language models (LLMs) and generative AI are seen as future tools for customer service and product recommendation in the banking industry.

Neobanks and Neobrokers:

Profitability is now crucial in neo-banking.

Best-positioned neobanks and brokers have managed to build components like checking accounts with direct deposit, paid monthly subscription models, multiple lending products, and investing products.

Additional Takeaway:

User experience and user interface (UX and UI) continue to be differentiating factors in fintech, with good UX/UI leading to greater customer satisfaction.

What am I reading?

Pitchbook: VCs expected an M&A wave. Deal making fell to a decade low instead.

Hashdex Market Pulse Q1 2023: Ecosystem’s developments impacting crypto’s investment case

Bessemer: Efficiency Metrics for Cloud Founders

What am I listening to? What am I watching?

Podcast: Brazil Fintech on Open Banking (PT only) - I had the pleasure of joining this episode

Podcast: Invested by Michael Eisenberg hosting Kathryn Mayne - on VC, investing in people, taking risks, and why Israel in Special

Movie: Air - about the creation of Nike’s hit sneakers Air Jordan

JOB POST // LAYOFFS:

If you want your jobs posted here, just follow the steps:

1. Create your Woke´s All in One Recruitment Platform Account - It is 100% free;

2. Sign-in and open a "new project";

3. Complete the "job Description" (Will help you be more effective);

And you are ready to go! All the new jobs created until every Thursday night will be posted!

NEW JOBS:

Head of People - Confidential Company (Híbrido - São Paulo)

Sales Development Representative - Ouro Preto Investimentos

Sr Manager Information Security - Confidential Company - (Remote- São Paulo)

VP of Sales North America - Confidential Company (Houston, TX, USA)

Especialista em Projetos Digitais - Vibra

JOBS (Still open):

Head of Talent Acquisition - Empresa Confidencial

Estágio - Coordenação Pedagógica - Lingopass

Front-end React Senior - Bettha

Gerente de Aquisição - Empresa Confidencial (São Paulo - Brasil)

Gerente Executivo de Eventos - Empresa Confidencial

Trader - Power Trader - Confidential Company (Houston - USA)

Quote of the week:

"I think if this technology goes wrong, it can go quite wrong...we want to be vocal about that. (…) We want to work with the government to prevent that from happening." Sam Altman, CEO and Founder of Open AI

Done !