LatAm Tech Weekly

#219: Are tech IPOs are back?, early stage momentum, deals of the week... and much more!

Weekly writing about what is happening in LatAm tech. By day, I am part of the corporate development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,300+ weekly readers by subscribing here!

Happy Sunday!

2026 is officially underway.

If you had any doubts — maybe because it feels like half the world is skiing instead of working — the markets have made it clear: the year has, in fact, started. Despite ongoing geopolitical risks and the volatility that comes with a heavy election calendar, it’s fair to say 2026 has kicked off on a noticeably better note than 2025.

If you’ve been reading this newsletter for a while, you know I’m an optimist by nature. And for now, I genuinely believe we’re heading into a very good year.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Speaking of which, there are multiple strong signals that tech is off to a promising start in 2026 — and it’s showing up in both public and private markets.

One of the clearest early indicators is the reopening of the IPO window in the U.S. After a drought of meaningful tech listings, 2026 looks poised to bring a blockbuster pipeline of new comers. Investors are watching a roster of high-profile companies that could define the return of public market liquidity, including:

SpaceX, expected to pursue a 2026 IPO with a valuation potentially above $800B–$1T, which could make it one of the largest tech listings ever.

OpenAI, the AI leader behind ChatGPT, laying groundwork with regulators and banks toward a late-2026 or early-2027 IPO at private valuations often cited near $500B.

Anthropic, another AI giant reportedly valued around $350B, with preparations underway and significant institutional interest.

Discord, the communication platform that has filed confidentially for an IPO and is widely expected to list in early to mid-2026.

Databricks, a major data + AI software company with a ~$134B+ private valuation and strong growth prospects that make it IPO-ready.

Stripe, the fintech payments powerhouse, widely considered IPO-ready sometime in 2026+, with private share trades implying valuations north of $90B.

Revolut, the neobank often linked to a dual London + NYC listing with valuations in the ~$75B range.

Canva, the global SaaS design platform with valuations near $42B and strong revenue momentum.

EquipmentShare (EQPT), a construction tech company already engaged in active IPO marketing and targeting a ~$6B valuation on U.S. markets.

This lineup matters because liquidity generates confidence: a robust IPO calendar helps re-establish clear exit paths for venture portfolios and boosts broader risk appetite in private markets. Public listings also tend to set sentiment and pricing signals globally, not just in the U.S.

On that point, as I regularly emphasize, what happens in the U.S. often ripples into global tech markets — including here in LatAm. A great example is the renewed traction for Brazilian fintechs seeking U.S. listings: PicPay recently filed its Nasdaq IPO registration aiming to raise up to ~$500M, and Agibank (AGI) has filed for a NYSE IPO targeting roughly $1B in proceeds — marking one of the most significant waves of Brazilian digital finance companies heading to U.S. public markets since Nubank’s debut. (Brazil filings widely reported in financial press.)

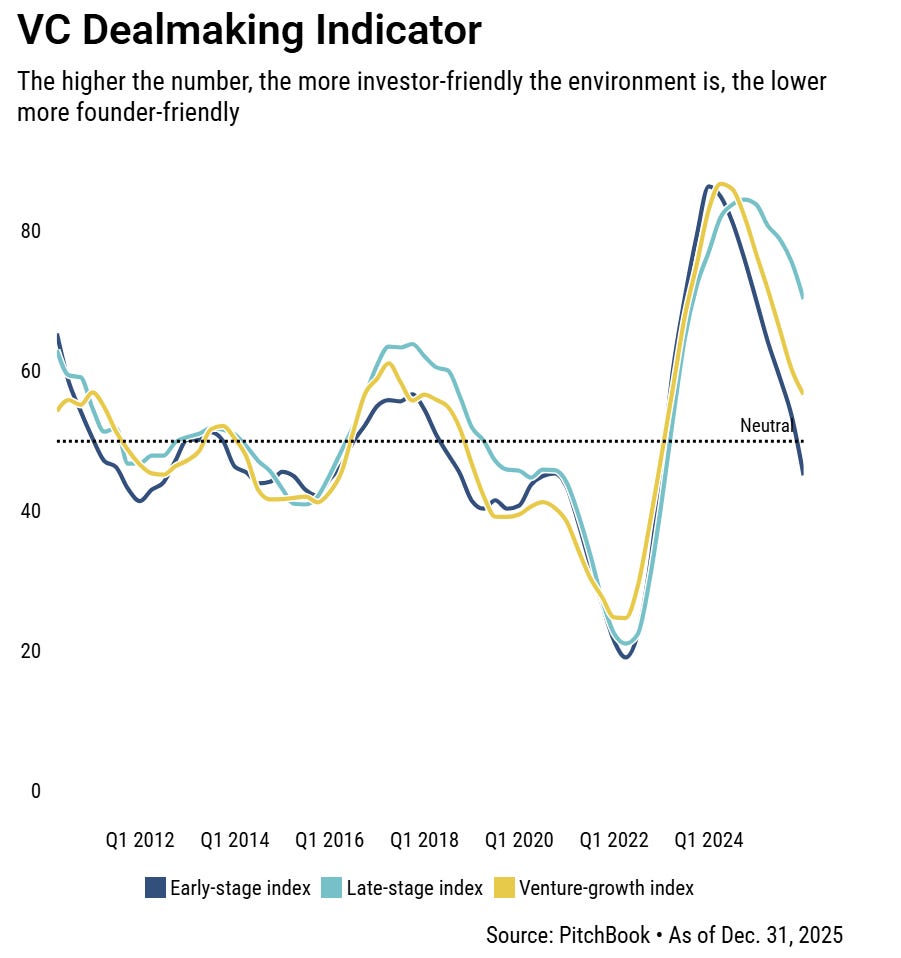

The private markets are showing encouraging signs too. According to PitchBook’s most recent data, the VC Dealmaking Indicator — which quantifies how founder-friendly the fundraising environment is — has flipped in favor of early-stage founders for the first time in three years, suggesting that capital supply is expanding relative to startup demand and giving founders more leverage and pricing power.

Additionally, other PitchBook and market analysts point to a wider trend of improving liquidity conditions and deal activity — including stabilization of exit paths and renewed investor interest in growth rounds anchored on AI — which collectively is helping drive better private market dynamics heading into 2026.

Taken together, these signs — from a deepening IPO pipeline to founder-friendly private capital dynamics — point to a meaningfully improved macro environment for tech compared to recent years. And while volatility and geopolitical risks remain, the combination of reborn public markets and strengthening private market signals suggests that this year could indeed deliver more constructive outcomes for founders, investors, and tech ecosystems worldwide.

General news:

Mexican fintech unicorn Stori expands into Colombia after securing regulatory authorization, marking its first international move beyond Mexico. Valued above US$1.2B, the company plans to invest up to US$100M locally as it scales savings, lending and financial services ahead of a possible 2026 IPO. 🇲🇽

Argentine fintech Pomelo prepares expansion into Panama and Puerto Rico as it builds on operations across six Latin American markets. The card issuing and processing infrastructure provider has doubled revenue year over year and continues to deepen its regional footprint. 🇦🇷

Startups.com.br launches Startups Academy and expands beyond journalism with its first course, “From Zero to MVP,” targeting early-stage founders. Entering its sixth year, the company reinforces its role in Brazil’s innovation ecosystem by combining editorial scale with practical, market-driven education. 🇧🇷

Google launches the Universal Commerce Protocol inside Gemini AI enabling end-to-end shopping, from discovery to payment, through AI agents. Built with partners like Shopify and Walmart, the move positions Google at the center of AI-driven commerce and challenges traditional retail platforms. 🇺🇸

Google rolls back AI-generated medical summaries after accuracy concerns following reports of misleading health information. The episode highlights rising scrutiny over AI in healthcare and the responsibility tied to Google’s dominant share of global search traffic. 🇺🇸

Portuguese consultancy plans to build blue economy clusters in Brazil focusing on ocean, river and coastal solutions outside traditional tech hubs. The initiative targets US$10–20M in blended capital and positions Brazil as fertile ground for scalable blue economy startups. 🇧🇷

Deals:

Aliado raises R$13M seed round to scale AI for physical retail in a round led by Headline and Nestal. Founded eight months ago, the startup uses AI and audio analysis to turn in-store sales conversations into real-time conversion insights. 🇧🇷

General news:

Alphabet hits a US$4T market cap after Google–Apple AI partnership as Apple confirms it will use Google’s Gemini models to power a major Siri overhaul, reigniting investor confidence in Alphabet’s AI leadership. The rally builds on Gemini updates and Google Cloud momentum, even as regulatory and antitrust risks remain a long-term overhang. 🇺🇸

AI-driven platform Oraion bets on Brazil to scale enterprise intelligence unifying structured and unstructured data across ERPs, CRMs and internal documents to reduce manual work and AI hallucinations. After a US$3.5M pre-seed round, the startup targets global expansion and ~US$20M in ARR by the end of 2026, with Brazil as a strategic market. 🇧🇷

Automated IVF lab delivers at least 19 babies using AI and robotics as Conceivable Life Sciences tests its fully automated AURA system in Mexico. Leveraging a more flexible regulatory environment, the startup reports implantation rates well above U.S. averages and aims to enter the U.S. market to address high IVF costs. 🇲🇽

Revolut launches credit cards in Mexico to deepen its banking push rolling out three tiers with perks such as VIP lounge access and lifestyle subscriptions. The move positions Revolut against incumbents and digital rivals in one of Latin America’s most competitive card markets. 🇲🇽

Pix payment initiation volumes jump to R$15.3B in 2025 nearly five times higher than 2024, driven by Open Finance adoption. Transaction counts surged to 64.5M. 🇧🇷

China’s open AI models gain ground across the Global South as Microsoft warns that subsidized, open-access systems are accelerating adoption in Africa and other emerging markets. The spread of DeepSeek highlights how affordability and openness can challenge U.S. AI leadership. 🌍

Revolut reaches a US$75B valuation in secondary transaction delivering a US$2B gain to Balderton Capital and cementing Revolut as one of the world’s most valuable digital banks. The deal underscores strong investor confidence despite a tougher global fintech backdrop. 🇬🇧

Meta launches Meta Compute to aggressively scale AI infrastructure with plans to build tens of gigawatts of energy capacity this decade. The initiative formalizes infrastructure as a core strategic pillar in the race for AI dominance. 🇺🇸

Global data center investments may exceed US$3T by 2030 according to Moody’s, driven by AI, cloud expansion and digitalization. Hyperscalers are expected to lead a wave of spending on construction, computing equipment and energy capacity. 🌍

Brazil’s antitrust authority orders suspension of Meta’s new WhatsApp API rules amid concerns that restrictions on third-party AI chatbots could harm competition. Similar probes in Europe increase regulatory pressure on Meta’s AI strategy. 🇧🇷

Deals:

VelaFi raises US$20M Series B to expand stablecoin infrastructure globally in a round led by XVC and Ikuyo, bringing total funding above US$40M. The platform connects banking rails, payment networks and stablecoin protocols as it scales across Latin America, the U.S. and Asia. 🌍

OpenAI acquires health startup Torch Health in an acqui-hire to strengthen ChatGPT Health. The Torch team brings expertise in unifying fragmented medical records, accelerating OpenAI’s push into healthcare with a deal reportedly valued at around US$100M in equity. 🇺🇸

General news:

BRL1 real-pegged stablecoin is listed on OKX and Kraken expanding global access to the token created by a consortium including Cainvest, Bitso, Foxbit and MB. Launched in 2024, BRL1 has surpassed R$1B in volume and now trades internationally against major cryptocurrencies and stablecoins, accelerating the internationalization of Brazil’s digital currency market. 🇧🇷

ABVCAP and ApexBrasil launch Inova+Invest to accelerate startups in Brazil’s Northeast selecting up to 15 companies for fundraising and growth support. Run by ACE Ventures, the program targets high-potential hubs such as Porto Digital and aims to better connect qualified capital with scalable regional startups. 🇧🇷

Pana launches the Global Card to replace traditional remittances enabling instant access to global balances across the US and Latin America. By combining US banking, stablecoins, blockchain and AI into a single ledger, Pana aims to eliminate friction and make legacy remittance models obsolete. 🇩🇴

Oracle faces bondholder lawsuit over undisclosed AI infrastructure financing needs after investors alleged losses tied to a $38B capital raise following a massive data center deal with OpenAI. The case raises questions around disclosure standards as AI infrastructure spending accelerates. 🇺🇸

Seguros Unimed launches Sinapse open innovation program to attract mature startups with validated solutions across finance, sales, marketing and operations. Led by its Stormia hub with Innoscience, the initiative focuses on paid pilots and large-scale deployment to drive digital transformation in insurance. 🇧🇷

Deals:

Brazilian fintech Magie raises US$5M led by Lux Capital to accelerate its B2B strategy around conversational financial services on WhatsApp. With over 400,000 users and R$2B in transaction volume, the startup is positioning itself as a white-label financial infrastructure for enterprises and eyeing expansion across Latin America. 🇧🇷

Passabot raises its first R$1M round to scale AI-powered flight booking on WhatsApp at a R$15M valuation. Founded in 2025, the startup automates flight search, purchase and ticket delivery via chat, growing around 35% per month and planning international expansion and a follow-on round within 12–18 months. 🇧🇷

General news:

Itaú launches “Limite Garantido” to boost credit card limits using investments as collateral allowing customers to instantly increase spending power without credit analysis. Funds remain invested and earning returns, strengthening Itaú’s super app positioning in self-backed credit access. 🇧🇷

Fabrica Ventures enters a harvest phase as the US IPO market reopens with exposure to late-stage companies such as Databricks, Anthropic, Circle, Netskope and CoreWeave. Based in Palo Alto, the Brazilian VC firm has built a differentiated strategy focused on secondary-market investments and is now evaluating the launch of a third fund amid renewed liquidity events. 🇺🇸

Agentic AI could reshape retail and capture up to 25% of e-commerce by 2030 according to estimates from Deloitte and McKinsey. Retailers see both opportunity and risk as AI agents replace traditional browsing, potentially shifting power toward big tech unless brands accelerate their own AI and data strategies. 🌍

Yape Bolivia plans to launch credit for microbusinesses in 2026 expanding beyond payments to deepen engagement with more than 1.7 million affiliated merchants. The move reflects a broader push by payment apps to add lending and management tools as interoperability compresses fees. 🇧🇴

Abacatepay pivots from Pix gateway to financial data orchestration platform repositioning itself around insights, automation and a “mini virtual CFO” powered by natural language. Backed by Latitud, the startup plans a seed round in 2026 and expansion beyond Latin America. 🇧🇷

Thinking Machines Lab loses cofounders back to OpenAI amid intensifying AI talent war as senior researchers rejoin the ChatGPT creator months after the startup raised US$2B at a US$12B valuation. The departures highlight aggressive talent reacquisition strategies among leading AI labs. 🇺🇸

Deals:

Grupo Omni acquires online grocery startup Jüsto and injects US$100M to relaunch the business after its December shutdown. The deal excludes founder Ricardo Weder from management and marks a reset following years of heavy losses, rehiring more than 500 employees and overhauling governance. 🇲🇽

Agibank files confidentially for a US IPO seeking to list on the NYSE under the ticker AGBK with a dual-class share structure. The digital bank plans to use proceeds for growth, acquisitions and technology investments as the US IPO window reopens. 🇧🇷

Bicycle secures special anchor terms in PicPay’s planned Nasdaq IPO committing US$75M and receiving inflation-adjusted warrants from J&F. The structure boosts IPO demand without diluting other shareholders and could significantly amplify Bicycle’s returns. 🇺🇸

SPX Capital invests up to R$400M in Vision to consolidate cybersecurity in Brazil taking majority control of the ISH Tecnologia spin-off. The capital will fund an aggressive M&A strategy in a fragmented market, with Vision targeting R$480M in revenue by 2026. 🇧🇷

Enerlink raises US$3.1M to expand EV charging management across Latin America in a round co-led by Kayyak Ventures and Dalus Capital. The Chilean startup manages more than 3,000 charging points and serves around 180 enterprise clients in the region. 🇨🇱

General news:

Inter secures a U.S. banking license to expand lending and funding capabilities replacing its previous MSB structure with a foreign banking organization license. The move grants Inter its own routing number, direct access to U.S. banking rails, and the ability to deploy local deposits into credit and issue cards and debt at near-Treasury funding costs, strengthening its long-term U.S. strategy. 🇺🇸

Tecto announces R$200M investment in a new data center in Porto Alegre with a 20 MW facility connected to the Malbec submarine cable linking Brazil and Argentina. Designed with zero water consumption and 100% renewable energy, the project positions Porto Alegre as a strategic digital infrastructure hub in southern Brazil. 🇧🇷

Amazon signs copper supply deal to support surging AI data center demand sourcing metal from a revived Arizona mine operated by Rio Tinto’s Nuton project. The agreement highlights Big Tech’s race to secure critical materials as copper demand rises alongside AI, power grids, EVs and renewables. 🇺🇸

Equity shrinks and credit dominates startup funding in Brazil in 2025 as startups raised US$4.5B across 459 rounds, but only US$1.74B came from pure equity. FIDC, debt and hybrid structures led volumes, reflecting a more cautious market focused on mature companies and defensive sectors. 🇧🇷

U.S. judge sends Elon Musk’s lawsuit against OpenAI and Microsoft to jury trial keeping alive claims that OpenAI abandoned its original nonprofit mission. The case could set important precedents for AI governance and nonprofit-to-commercial transitions. 🇺🇸

Deals:

Mercado Bitcoin acquires Banco Mercantil’s brokerage unit adding regulated trading in securities, FX and capital markets products. Approved by Brazil’s Central Bank, the deal expands MB’s ecosystem to over 4M clients and deepens its role bridging traditional finance and digital assets. 🇧🇷

ByBug launches a US$348K fundraising campaign on Broota to scale its insect-based biofabrication platform for animal health. The Chilean biotech startup has already reached 41% of its target, with backing from international investors such as DraperU Ventures. 🇨🇱

Apple and Google have announced a multi-year partnership under which Google’s advanced Gemini AI models and cloud technology will be used as the foundation for Apple’s next-generation AI features, including a more personalized version of Siri expected later in 2026. In this deal, Apple’s future Apple Foundation Models will be based on Google’s Gemini technology, helping accelerate the long-delayed upgrade of Siri and other AI functions while Apple maintains its privacy standards.

This news matters because it signifies a rare collaboration between two major rivals in tech, showing that even Apple is turning to outside AI expertise to stay competitive. For Google, the deal is a major validation of Gemini and expands its influence across billions of Apple devices, strengthening its position in the AI race. For the broader tech industry, it highlights how foundational models are becoming central to consumer products and could shift competitive dynamics.

AI Day São Paulo 2026

Date: January 27–28, 2026

Location: WTC Sheraton, São Paulo, Brazil

Description:AI Day São Paulo brings together developers and researchers for hands-on training, expert-led sessions, and practical AI applications focused on real-world use cases across industries.

More infoWeb Summit Qatar 2026

Date: February 1–4, 2026

Location: Doha, Qatar

Description: Web Summit Qatar connects startups, investors, and global leaders to discuss innovation, entrepreneurship, and emerging technologies in the region.

More infoMobile World Congress (MWC) 2026

Date: March 2–5, 2026

Location: Barcelona, Spain

Description: A leading global event focused on connectivity and mobile technologies, bringing together device makers, operators, and digital innovators.

More infoSouth by Southwest (SXSW) 2026

Date: March 12–18, 2026

Location: Austin, TX, USA

Description: The world’s most influential festival blending technology, culture, innovation, and entertainment through talks, workshops, and immersive experiences.

More infoSmart City Expo Curitiba 2026

Date: March 25–27, 2026

Location: Curitiba, Brazil

Description: A major smart cities event focused on sustainable urban development, digital transformation, and innovative public solutions.

More infoSouth Summit Brazil 2026

Date: March 25–27, 2026

Location: Porto Alegre, Brazil

Description: A global innovation platform connecting startups, corporations, and investors to foster entrepreneurship and scalable business growth.

More infoBrazil at Silicon Valley 2026

Date: April 6–8, 2026

Location: Sunnyvale, CA, USA

Description: A conference connecting Brazilian leaders and entrepreneurs with Silicon Valley to promote innovation, investment, and cross-border business.

More infoVTEX Day 2026

Date: April 16–17, 2026

Location: São Paulo, Brazil

Description: One of the world’s largest digital commerce events, bringing together global retail leaders, brands, and technology innovators.

More infoGramado Summit 2026

Date: May 6–8, 2026

Location: Gramado, Brazil

Description: A technology and innovation festival combining business, strategy, marketing, and public-sector innovation discussions.

More infoRIO2C 2026

Date: May 26–June 1, 2026

Location: Rio de Janeiro, Brazil

Description: A creativity-driven event connecting technology, media, audiovisual, music, sustainability, and entrepreneurship.

More infoSouth Summit Madrid 2026

Date: June 3–5, 2026

Location: Madrid, Spain

Description: A global innovation conference connecting startups seeking scale with investors and corporations looking for new opportunities.

More infoWeb Summit Rio 2026

Date: June 8–11, 2026

Location: Rio de Janeiro, Brazil

Description: Part of the Web Summit global series, the event connects startups, investors, and tech leaders across Latin America.

More infoLondon Tech Week 2026

Date: June 8–12, 2026

Location: London, UK

Description: A five-day event bringing together founders, investors, and global leaders to discuss technology’s impact on society and business.

More infoFebraban Tech 2026

Date: June 24–26, 2026

Location: São Paulo, Brazil

Description: One of the main financial technology and innovation events for the banking and financial services sector in Latin America.

More info

“Life is really simple, but we insist on making it complicated.” — Confucius