LatAm Tech Weekly

#161 - Powered by Nasdaq: Itau BBA MacroVision recap, AI & Consumer apps, deals of the week... and much more!

Happy Sunday!

First off, thanks so much for the kind messages about my struggle with pneumonia (which is thankfully behind me). I’m about 85% recovered now and was able to knock out a 32k run this weekend—the longest before my full marathon! I’m in the final stretch, so let’s see if I can pull this off….

The Itaú BBA MacroVision panel with Ricardo Guerra (CIO at Itaú Unibanco), Daniela Amodei (Co-Founder at Anthropic), and Vasi Philomin (VP of GenAI at AWS) was incredible! I was a little nervous going in, but I think it went great. We hit on some really important topics around AI in business. If you want to see this panel - and all of the others from the event, click here.

Follow me on LinkedIn , Instagram for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Moving on to our usual market update: this week, Itaú BBA released its report in partnership with Sling Hub, covering venture capital figures for LatAm in Q3 2024. I know I’ve already shared the basic numbers in previous editions, but I think it’s worth diving into a few insights from the full report.

The region saw 151 funding rounds during the quarter, totaling USD 680M (-46% QoQ). Series B deals led the way, up 3% YoY. This is really great news, as growth rounds picking up—and happening at all—signals that investors are more willing to write larger checks and back more mature companies, which is key to a broader tech rebound. Nine LatAm startups raised over USD 50M this quarter. Special shoutout to Mexican fintech Stori, which raised USD 105M, and Brazilian foodtech Cayena, raising USD 55M.

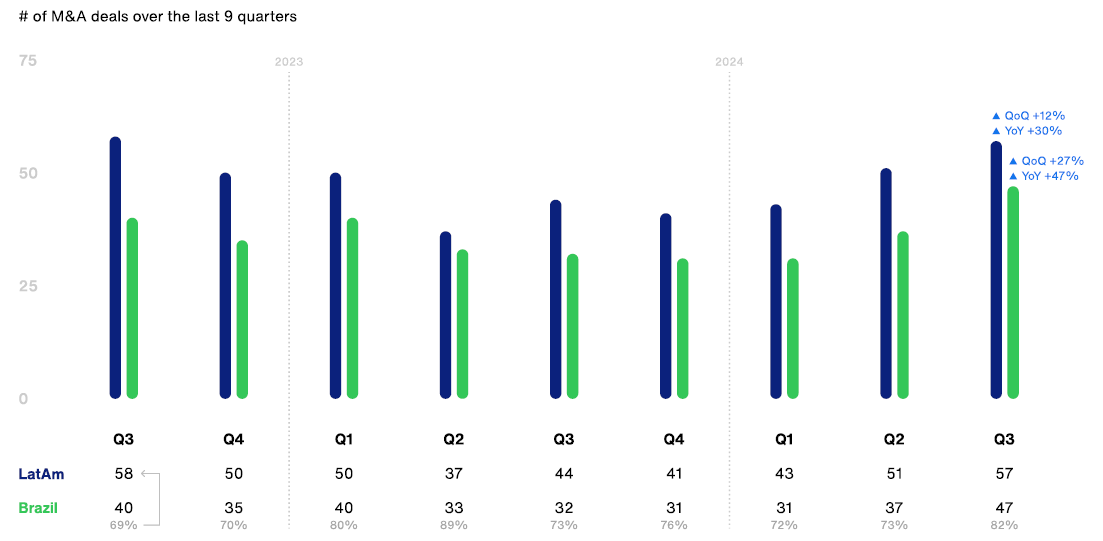

Sector-wise, fintech dominated, drawing 43% of total funding. Shifting gears to the hot topic of the moment—AI startups (whether AI-enabled or AI-first)—they pulled in USD 194M across 37 rounds in LatAm. On the M&A front, things are starting to gain momentum, as expected due to the alignment of bid and ask prices as mulltiples reach a common ground. There were 57 M&A deals this quarter, a striking 30% increase YoY and a 12% bump QoQ.

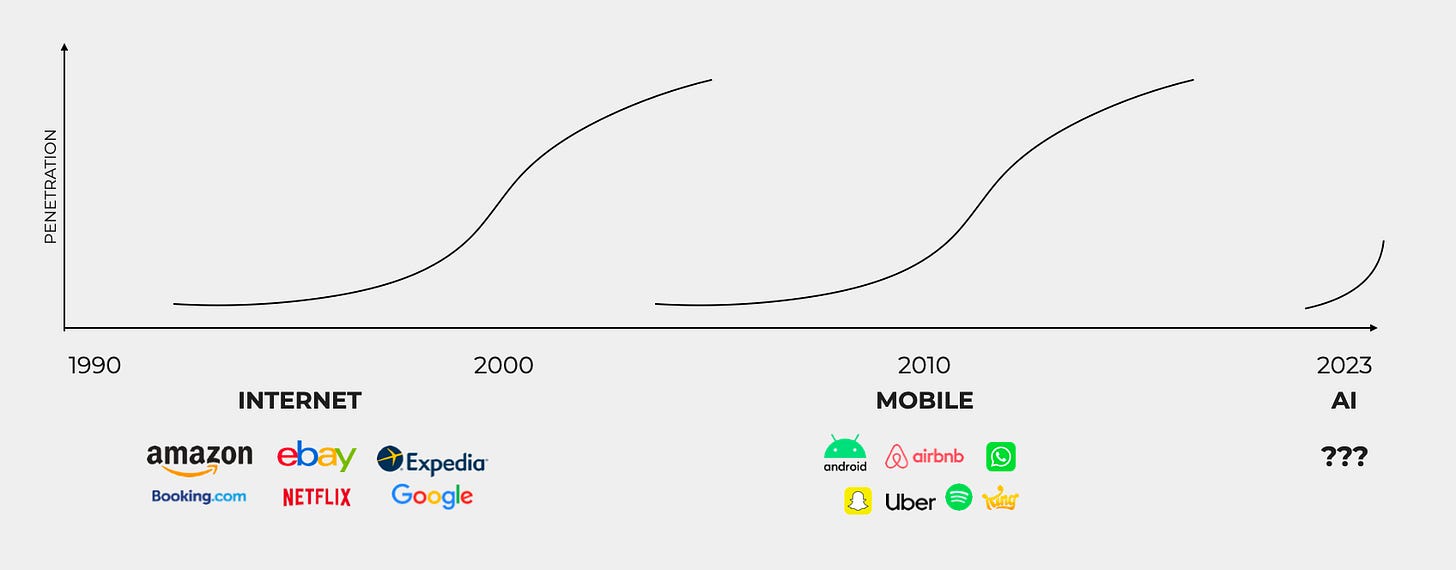

Shifting gears to my new favorite subject (as it should be, since I’m trying to learn and read as much as I can given its relevance)—a great read this week was Sequoia’s recent piece on AI and Rex Woodbury’s Digital Native. The latter argues that the next USD 100B AI company will come from Consumer AI—and honestly, I think that makes a lot of sense. Right now, there are 31 US tech companies valued at over USD 100B, and with AI being the new frontier of tech, it seems pretty safe to bet the next two will come from this space. Why two? Well, OpenAI is already valued at USD 157B after their last round…

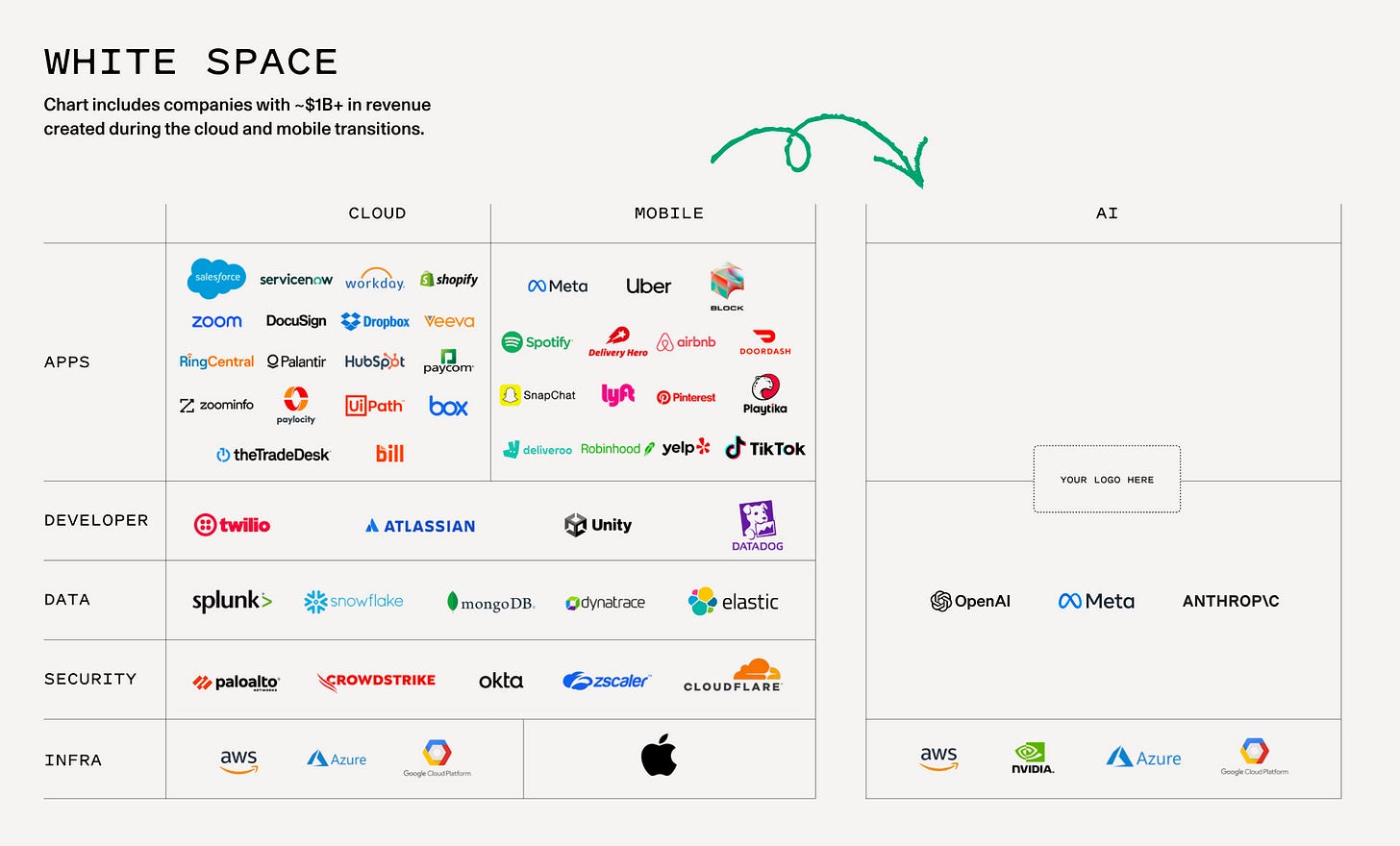

I think it’s safe to say that the foundational layer of AI has solidified. OpenAI (aligned with Microsoft), Anthropic (Amazon AWS), and DeepMind (Google) are the frontrunners in this tech stack. For those unfamiliar, AI can be broken down into three layers: the Pre-training Layer, or “infra” (think NVIDIA); the Reasoning Layer, or “models” (like OpenAI and Anthropic); and the Application-Specific Cognitive Architecture, or “apps.” The app layer is still in its early days, and we’ll probably see 2025/2026 as pivotal years for AI applications, while the “infra” and “models” layers are more established.

According to Sequoia’s analysis, we already have solid applications in the cloud and mobile space (those that emerged during the “Mobile” era, as seen in the graph). Given that the infra and models layers are largely dominated, it’s logical to conclude that there’s still plenty of white space in the app layer waiting to be filled.

Even though VCs are still skeptical about the B2C/consumer space right now, big consumer wins are typically much larger than big enterprise wins. For example, Uber’s market cap is about 3x that of Snowflake, Airbnb is roughly 2x, and DoorDash is nearly the same size. (And remember, Snowflake is the largest enterprise IPO of the last decade.) On the flip side, there’s a saying that if you’re an early-stage fund and a category is out of favor, it might be the perfect time to jump in… so, to sum it all up—consumer AI could very well be the next big thing. In other words, AI apps designed for the end consumer could follow in the footsteps of massive successes like Uber, Airbnb, or DoorDash.

Another point worth considering is the current imbalance between B2B and B2C AI companies. There are far more entrepreneurs focused on B2B opportunities right now, making the B2C space less crowded—and possibly ripe for a breakout in the coming years. So to my entrepreneur readers and early-stage VCs: something to think about…

General news:

Seedstars and Mexico's Redwood Ventures have announced a strategic partnership aimed at boosting startup innovation across Latin America. By combining Redwood’s expertise in post-Seed and Series A investments with Seedstars' global reach in emerging markets, the alliance will accelerate growth for high-potential startups in the region.

The Central Bank of Brazil aims to regulate the Banking-as-a-Service (BaaS) market to enhance legal security and address concerns like anti-money laundering and customer identification. Director Otavio Damaso emphasized the need for clear regulations to ensure responsible and transparent innovation within the financial system. A public consultation on BaaS regulations is expected in the last quarter of 2024. This regulatory move comes as BaaS gains traction, allowing various sectors to offer financial services without direct licensing from the Central Bank.

InfinitePay, part of CloudWalk, has disbursed R$1 billion in credit to 500,000 entrepreneurs, marking a 300% growth from last year. This success is fueled by AI and Open Finance, allowing quick access to funds. Their Intelligent Credit system evaluates over 1,200 factors, enabling credit access for those often overlooked by traditional banks.

Brazilian proptech Rooftop has launched a R$100M real estate fund to finance its new product, HomeCash. This service allows homeowners to sell their properties, receive payment within 45 days, and repurchase them within 18 months while still living there.

Banco Safra has received approval from Brazil's Central Bank to launch its fintech, Safra Sociedade de Crédito Direto (SCD). With R$7 million in initial capital, the new SCD will offer credit using its own resources, manage prepaid payment accounts, issue credit cards, and initiate payment transactions.

0xCarbon has launched Joori, an AI assistant designed for the legal sector, aiming to reach 200k users by 2025. Developed over two years with a R$ 3M investment, Joori reduces time spent on operational tasks, allowing lawyers to focus on high-value work.

Brazilian fintech Nomad is expanding beyond international accounts and debit cards, now offering travel and telecom services. The company launched Nomad Trips, an AI-powered travel platform, and Nomad Chip, a virtual eSIM for international connectivity.

Rogério Xavier, CEO of SPX Capital, warned that Brazil risks repeating the "lost decade" of the 1980s due to its rapidly escalating debt and lack of political will to control public spending. Speaking at Itaú BBA's Macro Vision event, he stressed that without fiscal adjustments, the country could face high inflation and economic stagnation.

Chilean company Biofoods, founded by Asunción Ried, Jorge Iriarte, and Bárbara Musalem, launched AluSweet Alulose in 2016 as a sugar alternative. With over 20 products, including sugar-free condensed milk and syrups, Biofoods has become a leader in healthy foods.Now targeting the U.S. market through Amazon, they aim for supermarket placement after achieving double-digit sales growth.

Deals:

HRtech Mentora has raised R$ 1.5 million in a pre-seed round led by DOMO.VC, with participation from angel investors, including iFood co-founders. Mentora, which focuses on leadership development, will use the funds to enhance its AI-driven technology and expand its customer base.

General news:

The New York Times is expanding its AI-focused strategy by launching a new generative AI platform called "Tally." This initiative aims to provide users with real-time news updates and answers to questions about current events. Tally is part of a broader effort by the Times to compete with AI-driven platforms like Perplexity, backed by Jeff Bezos, which already leverages AI to deliver information and insights. The Times is also investing in personalized content recommendations to enhance user experience and maintain its competitive edge in the media landscape.

If Totvs were to acquire Linx from Stone, it could reshape Brazil's software market. Itaú BBA estimates a potential acquisition cost of around R$ 2.5 billion. This move would enhance Totvs's SaaS portfolio by integrating Linx's retail management solutions with its ERP systems, boosting competitiveness against global firms. However, the deal would face regulatory scrutiny over market concentration and antitrust issues in Brazil, reflecting a wider trend of consolidation in the tech sector.

Sheriff, the Chilean risk management platform, has joined Google's prestigious "AI First Latin America" accelerator and expanded into Peru, marking its first international venture. Founded in 2021, Sheriff uses AI to analyze over 847,000 RUTs in seconds, offering deep insights for safer business decisions. With 189 clients, the company now plans to launch its MVP in Peru and explore future expansions into Colombia and Mexico.

iFood is testing OpenAI's new Realtime API, powered by GPT-4, to enhance user and delivery experiences. This API offers near-instant response times and human-like conversational nuances. Initial tests with iFood’s delivery assistant, Jhow, showed positive results, allowing couriers to interact via voice commands for real-time updates.

Rivool Finance has launched an Investment Banking division, led by co-founder Fernando Fegyveres, to develop structured and transparent credit operations using blockchain and AI. The fintech, already a key player in Brazil’s agricultural credit market, aims to expand its presence in the capital markets.

BNDES has approved R$ 500M in financing for Eve Air Mobility's flying car factory in Taubaté, São Paulo. Eve, born from Embraer-X, plans to produce up to 480 eVTOLs annually in modular phases. With 2,900 pre-orders from 30 clients across 13 countries, Eve could generate $14.5B in revenue.

Itaipu Parquetec and Nestlé Brasil have formed a strategic partnership to drive technological innovation and sustainability in Brazil. The collaboration focuses on renewable energy, IoT, robotics, and 5G connectivity, aiming to develop sustainable industrial solutions. This initiative will also support tech companies and startups, fostering digital transformation.

Claranet announces a R$160 million investment in Brazil over the next five years to drive innovation and organic growth. The multinational will focus on cloud computing, cybersecurity, AI, and application modernization to expand its local presence.

Brazil's Central Bank (BC) plans to regulate asset tokenization and stablecoins in 2025, according to President Roberto Campos Neto. A public consultation on rules for Virtual Asset Service Providers (VASPs) is also expected this month. The regulations aim to bring efficiency to payments and credit markets while advancing Brazil's capital markets.

Deals:

Healthtech company Funcional has acquired BeFlex, a startup specializing in multi-benefit cards, to accelerate the growth of its Funcional Multi product. With BeFlex’s 70 clients and 20,000 active users, Funcional aims to reach 3 million clients by 2025.

General News:

Harry Stebbings' venture capital firm 20VC has closed a $400M fund, more than double its previous $140M fund. This new vehicle focuses on early-stage investments, with $125M for seed and $275M for Series A rounds. Half of the commitments came from US investors, including MIT and Mubadala. The close comes as UK VC fundraising rebounds in 2024, and Stebbings credits 20VC’s media ties for the rapid raise.

The global AI sector is witnessing a surge in unicorns and decacorns, with companies like OpenAI, Anthropic, and CoreWeave leading the charge. OpenAI tops the list with a staggering $157B valuation, followed by Anthropic at $40B, driven by investments from tech giants like Amazon and Google. Emerging players like Mistral AI and xAI, backed by Elon Musk, highlight the rapid rise in valuations.

Mexican entrepreneurs Alejandro and Carlos Cardini, co-founders of the software development startup Konfront, have been selected for Stanford University’s Latino Entrepreneurship Program. The nine-week program, in partnership with LBAN, supports Latino founders aiming to expand in the U.S. market.

A new report from MIT Technology Review highlights 10 key trends shaping the future of global energy. Among them, artificial intelligence, the Internet of Things (IoT), and nuclear energy stand out as crucial technologies for driving the energy transition. With carbon capture markets set to grow, and innovations like hydrogen, small modular reactors, and sustainable aviation fuels gaining traction, startups and major energy players alike are urged to focus on these technologies to achieve sustainable growth. The report emphasizes strategic innovation and collaboration across government, industry, and tech sectors.

LUZ, an energytech focused on renewable energy and conscious consumption, has appointed Pedro Somma, former COO of 99, as its new CEO. With plans to strengthen operations and drive the adoption of digital solutions in the energy sector, Somma aims to transform how Brazilians consume energy by leveraging AI-driven platforms.

JPMorgan Chase has finalized a $1 billion debt swap deal with El Salvador, aiming to alleviate the country’s financial strain and manage its debt load more effectively. This agreement will convert some of El Salvador's existing bonds into new ones with extended maturities, providing the country with a temporary reprieve from debt obligations and enhancing liquidity. The move is part of a broader effort by El Salvador to stabilize its economy, especially following its controversial decision to adopt Bitcoin as legal tender. The debt swap is expected to help the government address immediate fiscal challenges while aiming for longer-term economic sustainability.

The Brazilian government’s proposal to reform private payroll loans and end the "birthday withdrawal" of FGTS has drawn mixed reactions. Financial institutions welcome the centralization of loan contracts via Dataprev, which could expand credit access, but criticize the interest rate cap and the removal of HR departments from the process.

Brazilian fintech Bullla has received authorization from the Central Bank to operate as a Direct Credit Society (SCD), following its recent approval to act as a payment institution (IP). With a capital of R$ 2.5 million, Bullla aims to become the top credit provider for Brazil’s C and D classes.

Facily, once valued at $1.1 billion, has hired BR Partners to explore a potential sale in a bid to minimize losses for investors. Despite raising $502 million from global backers like Tiger Global and Prosus, the social commerce startup has faced significant challenges, including financial struggles and a wave of restructuring.

Natura has launched a store on Mercado Livre's marketplace, aiming to diversify its sales beyond its direct-selling model. Analysts at Itaú BBA see this as a "win-win" partnership. Natura can reduce reliance on its consultants, who generate over 90% of sales, while Mercado Livre strengthens its presence in the high-margin beauty category.

Venezuelan startup Clabe Ganadera, founded in 2021, is set to revolutionize the agricultural sector with its new platform, AgroClabe. Inspired by collaborative economic models, it connects rural farmers with urban investors to fund agricultural projects. The platform, launching in November, will scale their operations, while AgroClabe, a financial tool offering microloans to small producers, debuts in December. Clabe Ganadera aims to support 50,000 farmers in Venezuela and expand across Latin America.

Deals:

Digitra.com, a cryptocurrency exchange founded by Rodrigo Batista, has secured a $1 million investment from 4Equity Media Ventures in a media-for-equity deal. The funds will drive the company’s expansion in Brazil and enhance the visibility of its token, DGTA. Batista, who previously founded Mercado Bitcoin, aims to grow Digitra.com’s user base to 1 million by mid-2025.

General news:

Open Co, through its GeruPay platform, is now Amazon's BNPL provider in Brazil, allowing customers to pay in up to 24 installments without a credit card. This partnership marks a major push for BNPL in a market dominated by credit card payments.

A new survey shows that 92% of El Salvador's population does not use Bitcoin for financial transactions, despite government efforts to promote the cryptocurrency. Conducted by Francisco Gavidia University, the survey found that only 7.5% of respondents use crypto, and just 1.3% believe Bitcoin should be the government's main focus for the future.

In the first half of 2024, startups backed by Wayra and Vivo Ventures generated R$ 65 million in contracts with Vivo, a 54.7% increase from the previous year. The portfolio includes 26 active startups under Wayra and five under Vivo Ventures. Israeli-Brazilian startup Tachyonix saw its revenue grow sixfold after securing a contract with Vivo, expanding its client base from 3 to 25.

Starbem, a digital health startup, has appointed Eduardo Machado Perez as its new Country Manager in Brazil to lead the company's expansion. With over 20 years of experience in business development, Perez will focus on driving new revenue streams and strengthening Starbem's position in the healthtech market.

Latin American tech companies are increasingly prioritizing experienced professionals in their hiring strategies, focusing on candidates with a proven track record. Despite the growth of the tech sector, these companies are facing a significant talent gap, especially in key areas like software development, cybersecurity, and AI. To bridge this gap, firms are opting for seasoned experts over younger, less experienced talent, valuing their expertise in navigating complex technological landscapes. This trend reflects the industry's need for efficiency and faster project execution amid rising competition and global tech advancements.

Generative AI is projected to generate over $1 trillion in revenue by 2031, driven by productivity gains and innovation across industries.

Uber is exploring a potential acquisition of the travel platform Expedia, according to the *Financial Times*. This would mark Uber's largest deal yet, potentially integrating flight and hotel bookings into its app. While discussions are still in early stages, the acquisition would align with Uber’s goal of expanding into a “super app.” Shares of Expedia rose 4.7% after the news, while Uber's dropped by 2.4%. No formal offer has been made.

Deals:

Nexpon, the investment arm of NSC (Globo’s affiliate in Santa Catarina), has already invested in three companies in 2024 and is planning up to two more deals before year-end. Operating under a media for equity model, Nexpon trades advertising space for equity stakes, with investments ranging from R$1M to R$10M. This year’s investments include AHOY!, Delivery Much, and Warren. Nexpon’s focus is on high-growth companies, especially B2C startups, where media exposure can drive scale. The fund recently made its first exit, selling BuscaOnibus to a major player in September.

AI startup 2Neuron, founded in Espírito Santo in 2021, has raised R$ 3M from the FUNSES1 fund to expand into new markets. 2Neuron uses AI to predict and identify industrial machine failures, helping clients avoid costly downtimes. With nearly 200 devices installed across Brazil, the company plans to open a São Paulo office, expand its team, and pursue international opportunities. The investment will enhance its ability to serve growing demand, with future plans for a Series A round.

Equity Fund Group (EQF) has acquired a stake in Grupo Empreende Brazil, a business and entrepreneurship events company. This move aligns with EQF's strategy to expand its event-focused business unit, Equity Media Group (EMG), and strengthen its presence in Brazil's media and events sector.

General news:

TIVIT, a Brazilian multinational tech company, has appointed Pierella Paola as its new General Manager of Marketing for Brazil and Latam. Pierella, with leadership experience from LG Electronics, Samsung, GoPro, and Getnet, will focus on strengthening TIVIT's brand and driving digital transformation initiatives across the region.

RecargaPay has received approval from Brazil's Central Bank to become a financial institution, allowing it to expand its credit, personal finance, and investment offerings. This upgrade from a Direct Credit Society (SCD) to a Financial Credit Society (SCFI) enables RecargaPay to access broader funding sources, such as bank deposit receipts and credit notes.

Oppenheimer warns that demand for data centers, driven by AI, will exceed current infrastructure by 2025. The report highlights a shortage in capacity for training large language models (LLMs), leading to higher pricing for data center services. As companies recognize the value of data and migrate to the cloud, there’s a shift toward smaller, more efficient AI models to balance latency, cost, and accuracy. Besides major players like AWS, Google, and Microsoft, firms like DigitalOcean and Cloudflare are also competing in this space. In Brazil, investments are surging, with Scala IT raising $500M and Microsoft pledging R$14.7B to expand its AI infrastructure.

Brazilian startup Banlek is expanding globally with acquisitions in Paraguay and Portugal as part of its international growth strategy. Additionally, Banlek acquired Brazilian competitor Epics for R$9.5 million, strengthening its presence in the local market. The company is also planning to accept payments in USD and EUR to support its global reach.

Delend, a fintech focused on facilitating credit for small businesses, is transitioning to provide its receivables management technology as a service. After processing R$ 32 billion in receivables in two years, Delend aims to help other companies automate credit solutions using its platform.

Deals:

Agrolend has secured R$ 300M in a Series C funding round, marking the largest agtech investment in Brazil for 2024. Led by Creation Investments and Syngenta Group Ventures, the round also attracted Vivo Ventures, L4, and Japan's Nochu Bank. The digital agribusiness bank, which provides fast, easy credit to small and medium-sized rural producers in Brazil, plans to expand its services to large national and multinational players. Since its founding in 2020, Agrolend has raised nearly $100M and aims to grow its credit portfolio to R$ 3 billion.

Agibank has raised R$400 million through its sixth issuance of Financial Bills (LFs), in two series with maturities of two and three years. The strong demand allowed rate reductions, with the series priced at CDI + 1.10% and CDI + 1.15%. Coordinated by Itaú BBA and Bradesco BBI, the funds will be used to diversify Agibank’s funding base and support its credit operations.

Descartes Systems Group has acquired e-commerce platform Sellercloud for $110 million, aiming to enhance its inventory and order management services. This acquisition strengthens Descartes' e-commerce offerings by integrating Sellercloud's omnichannel solutions with Descartes' existing shipping and warehouse management tools. The deal includes a potential $20 million performance-based payment, contingent on revenue goals over the next two years.

If you like tech events, I encourage you to access my LinkedIn post that has the entire list!!!!

REC ‘n’ Play

Date: November 6-9

Location: Recife

Description: Annual innovation and technology festival aimed at fostering creativity, technology, and entrepreneurship. It brings together professionals, students, and enthusiasts through workshops, lectures, and cultural activities, providing a platform for learning, networking, and collaboration. The event highlights Recife's role as a growing hub for innovation in Brazil, connecting participants with industry experts and new trends.

Stats Conf

Date: November 8-9

Location: São Paulo

Description: Bitcoin only technology event - crypto, finance, blockchain

#fswk24 - O Momento Atual dos VCs na Saúde

Date: November 6

Location: Rio de Janeiro

Description: This event focuses on the current landscape and opportunities for venture capital investments in the healthcare sector. Attendees will gain insights into the latest trends, challenges, and strategies for investing in health tech startups and innovative healthcare solutions.

TechCrunch: Investor FOMO returns, and what happened with WordPress and WP Engine?

Podcast by Atlantico: “Atrás do Retorno” interview with Fernando Marques Oliveira (Partner at HIG)

Founders Podcast: I had dinner with John Mackey, Founder of Whole Foods

"Current employees are a company’s greatest asset – they’re your competitive advantage. You want to attract and retain the best; provide them with encouragement, stimulus and make them feel that they are an integral part of the company’s mission."

Anne M. Mulcahy, former CEO and chairwoman of Xerox Corporation