LatAm Tech Weekly

#218: CES highlights, Venture figures for 2025, deals of the week... and much more!

Weekly writing about what is happening in LatAm tech. By day, I am part of the corporate development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,300+ weekly readers by subscribing here!

Happy Sunday!

The first full week of the year was full of surprises as CES 2026 kicked off in Las Vegas — and once again AI was at the heart of the show, shaping the biggest conversations and coolest demos across robotics, consumer tech, and computing.

Here are the top AI highlights from CES 2026 that experts and media outlets are buzzing about:

Nvidia’s Vera Rubin AI platform — Nvidia stole the spotlight with its new Vera Rubin AI computing stack, promising orders-of-magnitude improvements in training performance and setting a new bar for datacenter-scale AI.

Hyundai + Boston Dynamics’ humanoid Atlas demo — The live unveiling of Atlas showcased next-gen humanoid robotics with real-world mobility, underscoring how AI is driving the future of physical automation.

AI robotics & “physical AI” everywhere — CES was filled with robots — from coffee-pouring automatons to self-folding laundry helpers and companion bots — spotlighting the trend toward tangible, interactive AI systems in the home and workplace.

CES 2026 made one thing clear: the next wave of AI isn’t just software-centric — it’s physical, personalized, and present in nearly every corner of tech innovation.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

The 2025 venture reset: bigger checks, fewer winners — and what matters in LatAm (and Brazil)

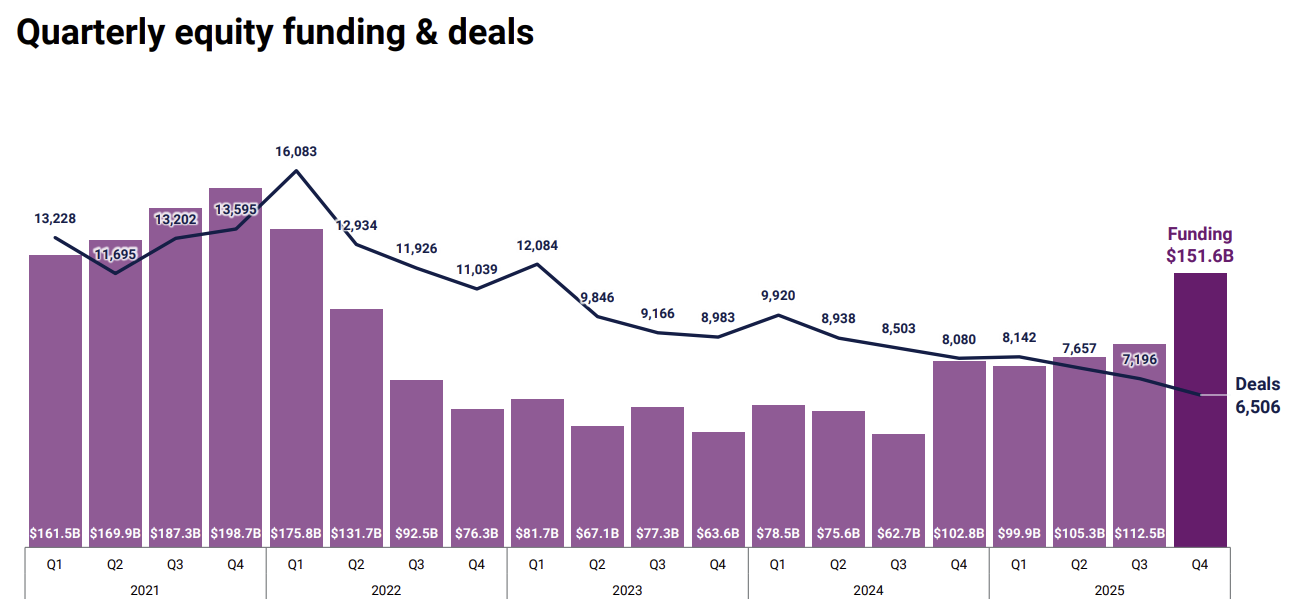

Global: 2025 was the “$90B+ per quarter” era — powered by AI concentration

If it felt like venture “came back” in 2025, you weren’t imagining it — but it came back in a very specific form: mega-rounds, fewer deals, and an AI-dominated cap table.

Funding re-accelerated sharply in 2025, with multiple quarters landing at — or above — the $90B mark. Total global venture funding reached $469B for the year. AI companies captured 48% of all capital, while mega-rounds ($100M+) accounted for roughly 65% of total funding, underscoring how concentrated capital allocation became.

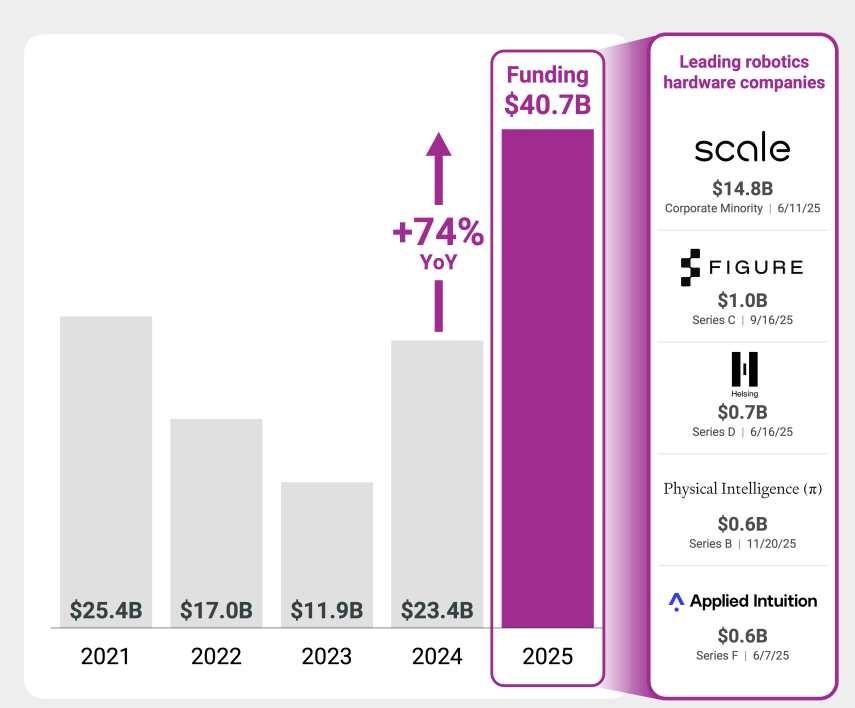

CB Insights’ State of Venture framing is clear: funding and exits climbed to a three-year high, “decacorns raised record dollars,” and even niche category callouts — such as humanoid robots leading deal count growth — point to the same conclusion: investors are paying up for conviction themes. Robotics emerged as the next frontier, with funding jumping 74% YoY, from $23.4B in 2024 to $40.7B in 2025.

On the investor side, activity concentrated among the largest platforms: General Catalyst led with 213 deals, followed by a16z with 178 and Sequoia with 139.

Why this matters for everyone else (including LatAm):

When nearly half of global venture dollars concentrate into a single theme, everything outside that theme becomes more price-sensitive, more proof-driven, and more structured — with greater use of debt, secondaries, and tranche-like rounds. That is exactly the environment LatAm has been adapting to, often out of necessity rather than choice.

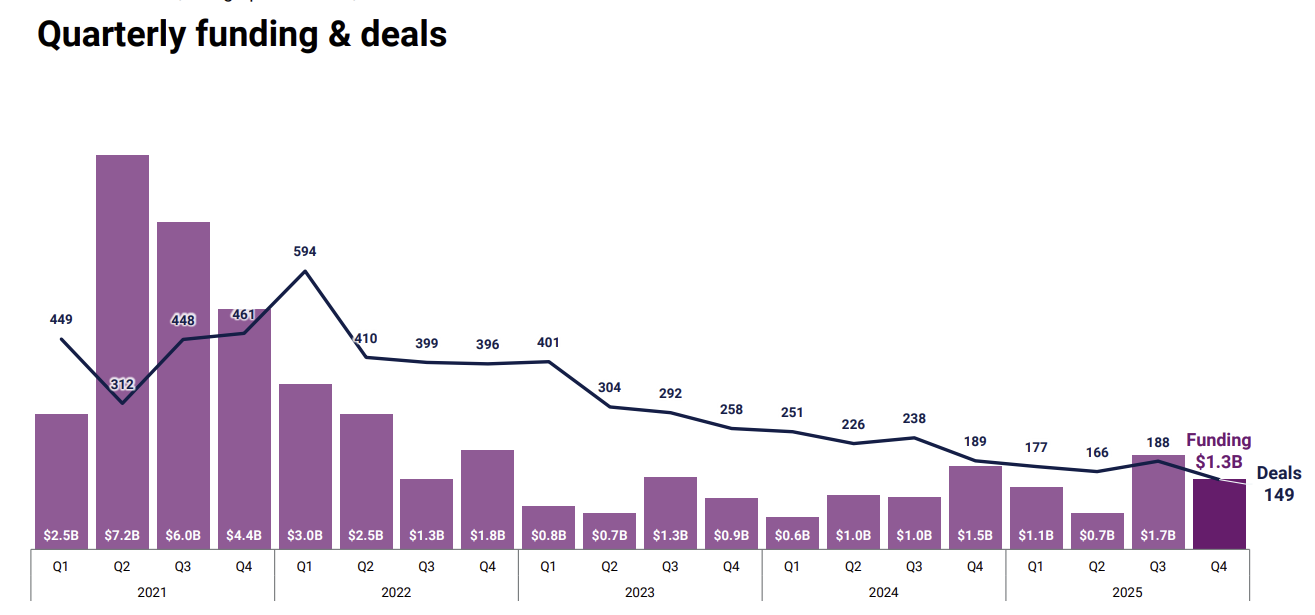

LatAm: the comeback isn’t a hype cycle — it’s a financing architecture shift

LatAm entered 2025 still carrying the scars of the post-2021 correction. The region moved decisively from “growth at any cost” to “durability at any price.”

LatAm closed the year with $4.8B in funding across 680 deals, representing roughly 2% of global venture funding — broadly in line with 2024 levels.

As in the global market, AI captured a disproportionate share of monthly funding. For example, in November, AI startups raised $141M, accounting for ~54% of all LatAm VC capital that month.

While Brazil continued to attract the largest absolute dollars, Mexico stood out: it was the first time in years that Mexico surpassed Brazil in funding in a single quarter, highlighting a shift in regional momentum.

On the exit front, activity improved modestly. The region recorded 336 M&A transactions and 3 IPOs over the full year. By deal count, Bossa Invest, Norte Ventures, and Monashees ranked among the most active investors.

The three trends that explain LatAm 2025 better than “up” or “down”

Three structural mechanics increasingly defining how deals get done in the region:

Venture debt and mixed rounds (equity + debt packaged together)

Secondaries as a liquidity valve, with activity projected to grow ~60% annually

Talent retention pressure meeting reality: ESOP relevance is rising, but adoption remains limited — fewer than 20% of startups offer formal plans

Why this matters: these tools typically appear when markets become selective but founders still need to build. LatAm’s 2025 story is less “growth is back” and more “the region is learning to finance like a late-cycle market.”

Sector gravity: fintech still anchors, but AI is becoming the monthly swing factor

Even when “AI-first” is not the dominant identity across LatAm, AI increasingly represents the marginal dollar — the capital that determines whether a given month looks strong or weak.

Fintech remains the region’s structural base layer, alongside fast growth in proptech and enterprise software.

LatAm is beginning to mirror the global pattern in miniature: AI doesn’t need to be everything to become the thing that drives the tape.

Brazil: 2025 wasn’t a boom — it was a rotation

Brazil is the clearest case study of LatAm’s selective recovery. The year looks weak in aggregate, stronger in the middle, and very explicit in where investor conviction actually landed.

The top line: down on equity, less down once structure is included

According to Bloomberg Línea, citing preliminary Sling Hub data:

~$1.7B in equity investment in 2025, down 34% YoY (from ~$2.6B in 2024)

~$4.3B including debt, reducing the decline to ~17%

That gap tells the real story. Brazil didn’t lose capital — it repriced and restructured it. In a world where global VC absorbed AI mega-round gravity, Brazil expressed the same risk preferences through instrument choice, not valuation expansion.

The 2025 “top checks” in the region — and what each one signals in my view

Omie — $150M (Partners Group; including $100M secondary for ~15%)

Signal: late-cycle tools like secondaries are no longer “US-only.” Liquidity engineering is now part of Brazilian scale equity.Starian — $115.5M (General Atlantic)

Signal: demand for B2B platforms with clear GTM discipline and consolidation paths.Canopy — $100M (Bessemer + Cloud9)

Signal: platform-driven growth and M&A logic are back.QI Tech — $63M+ extension (General Atlantic + Across)

Signal: infrastructure fintech remains fundable when unit economics and compliance maturity are credible.Solinftec — $52.8M Series D (YvY Capital)

Signal: applied AI in productive sectors (ag) attracts capital when framed as operational advantage, not hype.MotoristaPX — $46.5M (Bicycle Capital / Marcelo Claure)

Signal: logistics efficiency remains a uniquely Brazilian problem worth solving.Vammo — $45M Series B (Ecosystem Integrity Fund + others)

Signal: climate and energy transition plays win when paired with immediate, high-frequency use cases.Paytrack — $38.8M Series B (Riverwood) and OnFly — $40M Series B (Tidemark + others)

Signal: corporate travel and spend management emerged as a repeatable, defensible wedge.

A5X — $37.6M Series C (ABN AMRO, IMC Trading, Optiver, others)

Signal: market-structure bets are back when paired with institutional syndicates and regulatory seriousness.

General news:

Avenue secures Central Bank approval to operate as an investment bank strengthening its regulatory footprint in Brazil and enabling more independent FX operations and new cross-border financing products. The license reinforces Avenue’s long-term infrastructure strategy under Itaú’s control and supports further expansion into custody, clearing and institutional services abroad. 🇧🇷

OpenAI signals a strategic pivot toward audio hardware as it reportedly prepares a new audio language model for early 2026, laying the groundwork for a voice-first physical device. The move aligns with broader bets by Meta, Google and Tesla on audio as the next interface, even as OpenAI continues to face heavy cash burn. 🇺🇸

Brazil launches its first bond token with investments starting at US$1 as Cainvest, Liqi and Foxbit tokenize an international Pemex bond paying a 5.95% coupon due in 2031. The initiative combines blockchain, regulated distribution and digital custody to democratize access to global fixed income for Brazilian investors. 🇧🇷

Asaas upgrades its license to operate as a financial institution after receiving Central Bank approval to become a full SCFI and boosting capital above R$10M. The move strengthens credit operations for the fintech serving over 220,000 SMEs and reflects a broader push by fintechs to diversify funding and reduce costs. 🇧🇷

Deals:

Mexico’s AI-powered edtech Luca raises US$8M Series A led by 6 Degrees Capital to consolidate its leadership in K-12 education. With over US$13M raised to date and more than 30,000 students served, the company plans to expand across Latin America with a scalable and profitable AI-driven learning model. 🇲🇽

General news:

The reopening of the US IPO market revives PicPay’s Nasdaq plans as the fintech files with the SEC to list under ticker PICS, nearly five years after shelving its 2021 IPO. Backed by J&F and a US$75M investment from Marcelo Claure’s Bycicle, PicPay is reportedly targeting a ~US$500M raise, signaling renewed appetite for profitable Latin American fintechs with over 66M users. 🇧🇷

Meta delays global rollout of Ray-Ban Meta Display smart glasses after stronger-than-expected US demand and supply constraints, prioritizing the domestic market. The voice-first AI device, developed with EssilorLuxottica, now has waitlists extending into 2026 as Meta reassesses its international launch timeline. 🇺🇸

Morgan Stanley files with the SEC to launch Bitcoin and Solana ETPs offering crypto price exposure through traditional exchange-traded products. The Solana ETP may include staking rewards, reflecting the expansion of regulated crypto instruments in the US following spot Bitcoin ETF approvals. 🇺🇸

Brazil’s central bank authorizes Visa Conecta to operate in the FX market allowing it to buy and sell foreign currencies and expand cross-border payment services. The move strengthens Visa’s Open Finance strategy in Brazil, complementing its payment initiation and e-money licenses. 🇧🇷

Banco ABC Brasil adopts Liqi’s tokenized credit protocol in R$300M transactions using blockchain infrastructure to manage highly granular credit portfolios. The solution enables standardized data registration, continuous monitoring and traceability across thousands of contracts. 🇧🇷

Brazil’s BC Protege+ fraud-prevention system blocks 111,000 suspicious accounts within its first month, after 545,000 users activated the tool. Mandatory checks reinforce individual control over personal data as digital fraud risks rise. 🇧🇷

PicPay seeks authorization to enter Brazil’s fixed-odds betting market through subsidiary Nosso Time iGaming, according to its Nasdaq filing. The move targets revenue diversification in a sector that generated R$17.4B in gross revenue in H1 2025. 🇧🇷

Mercado Pago launches its own AI-driven credit score ranging from 0 to 1,000 and updated daily within its app. Built on proprietary data, machine learning, open finance and credit bureaus, the system analyzes over 2,000 variables to guide users toward better credit conditions. 🇧🇷

Nvidia projects to double revenue in Latin America in fiscal 2026 driven by accelerating demand for AI and accelerated computing. Brazil alone reached 123,000 developers and 1,000 AI-focused startup partners, reinforcing the region as a key growth hub. 🌎

Samsung plans to double its Galaxy AI device base to 800M units expanding Google’s Gemini as the core on-device AI system across phones, tablets, TVs and appliances. The move significantly strengthens Google’s scale and data advantage in consumer AI. 🇰🇷

Deals:

Elon Musk’s xAI raises US$20B in a Series E round underscoring soaring valuations and the capital intensity of the AI race. The funding supports massive infrastructure expansion, including new data centers and training of the next-generation Grok 5 model for commercial and government use. 🇺🇸

Chilean SME fintech Xepelin raises ~US$20M in a bridge round led by Nazca Ventures to strengthen its position in Mexico and prepare for regional expansion. The round reflects a valuation reset to roughly US$400M as the company serves over 70,000 businesses with ~US$100M in annual revenue. 🇨🇱

Mobileye agrees to acquire humanoid robotics startup Mentee Robotics for ~US$900M betting on embodied AI as the next frontier beyond autonomous driving. The deal expands Mobileye’s reach into warehouse and factory automation, with commercialization targeted for 2028. 🇺🇸

General news:

DeepSeek resurfaces with a new AI training method after fading from the spotlight as the Chinese startup publishes a technical paper proposing Manifold-Constrained Hyper-Connections to improve LLM scalability while reducing energy and compute costs. The open publication fuels expectations of a new model in early 2026 and raises questions about whether DeepSeek can disrupt global AI again. 🇨🇳

Cubo Itaú creates an independent external advisory board to bring strategic insight and global perspectives to Latin America’s largest innovation hub. The first members include Oakley global president Caio Amato and former Google executive André Barrence, serving in a non-fiduciary, consultative role. 🇧🇷

Neurogram prepares its first international expansion starting in 2026 backed by a partnership with the Mayo Clinic to validate AI-driven neurology tools. After processing around 100,000 EEG exams in 2025, the Brazilian healthtech now targets the US and global markets. 🇧🇷

Discord files confidentially for a US IPO as the reopening of equity markets revives listing plans despite lingering volatility. Valued at around US$15B in its last 2021 round, Discord now exceeds 200M monthly active users. 🇺🇸

Brazil’s data center market heads toward up to R$500B in investments by 2030 as installed capacity is projected to jump from 730MW to 3.2GW, driven by AI demand. Grid readiness and transmission investments of up to R$120B emerge as critical bottlenecks. 🇧🇷

Spotify doubles down on videocasts to compete with YouTube lowering monetization thresholds, expanding video distribution and rolling out new creator tools. The strategy aims to diversify revenue beyond music and capture growth in audiovisual podcasts. 🌍

Lovable reaches US$6.6B valuation by turning product usage into distribution as the Stockholm-based startup scales to 8M users and ~US$200M in ARR in under two years. The company shows how product-led growth can outperform heavy marketing spend. 🇸🇪

Méliuz receives a R$30.7M tax assessment from Brazil’s Federal Revenue Service related to disputed PIS and COFINS credits from 2021. The company says it will challenge the decision through an administrative appeal. 🇧🇷

Caterpillar showcases AI-powered autonomous machinery at CES 2026 unveiling the Cat AI Assistant and five autonomous machines. The company highlighted over US$30B invested in R&D and announced deeper collaboration with Nvidia to scale industrial AI. 🇺🇸

Deals:

Monique Evelle acquires a 5% stake in Ummix Ads valuing the offline media platform at R$5M. Ummix applies data and segmentation to radio, TV, OOH and print, positioning itself as a tech-driven alternative to traditional media buying. 🇧🇷

Automotus raises US$9M to scale AI-driven traffic management bringing total funding to US$26M. The startup uses computer vision to manage congestion in cities and airports, with expansion plans across new markets. 🇺🇸

Anthropic negotiates a US$10B funding round at a ~US$350B valuation led by GIC and Coatue, nearly doubling its last valuation. The deal includes a massive Azure compute commitment and positions the company for a potential IPO as early as 2026. 🇺🇸

Gedanken raises R$12M to expand AI-driven risk and compliance platform in a round led by Citrino Ventures with participation from Abseed. The Brazilian startup serves over 280 enterprises and plans to scale automation and deepen integration with the TOTVS ecosystem. 🇧🇷

General news:

Zhipu’s Hong Kong IPO jumps as investors test appetite for Chinese AI with shares rising up to 15% after raising US$558M. The listing values the LLM developer at about US$551M and highlights both confidence in China’s AI ambitions and constraints from export controls and geopolitics. 🇨🇳

JP Morgan replaces proxy advisory firms with its own AI platform launching ProxyIQ to manage voting across thousands of companies. The move reduces reliance on ISS and Glass Lewis and reflects broader use of AI in institutional governance and decision-making. 🇺🇸

Crypto-related illicit activity jumps 155% in 2025 reaching at least US$145.9B in flagged volumes, driven by a surge in sanctioned-entity activity and state-aligned actors. Stablecoins accounted for 88% of illicit transactions, pushing crypto crime into the realm of national security. 🌍

Carlos Simonsen prepares the launch of Upstream, a new hybrid fund manager following the split that ended Upload Ventures. The firm plans to raise capital in 2026 with a growth-focused strategy combining equity and credit, targeting Brazilian companies with validated products and selective exposure to AI-driven scale. 🇧🇷

Alphabet overtakes Apple in market capitalization for the first time since 2019 reaching US$3.88T versus Apple’s US$3.84T. The shift reflects Alphabet’s AI-driven momentum with Gemini, TPU advances and Google Cloud growth, making it the second most valuable US company after Nvidia. 🇺🇸

Deals:

LG lugar de gente acquires workforce management startup Moavi marking its seventh acquisition as the HR tech accelerates its one-stop-shop strategy. The deal adds AI-driven demand forecasting and staffing optimization, expanding its addressable market to an estimated R$4.6B and supporting a R$500M revenue target for 2026. 🇧🇷

Frete.com raises R$150M via a FIDC structured with XP to scale credit offerings for transport companies using the Fretebras marketplace. The company targets over R$1.5B in credit volume in 2026, deepening its data-driven logistics and financial ecosystem. 🇧🇷

Uruguayan startup Horizon AI raises US$3.5M seed round led by NXTP after growing revenue sixfold in 2025. Serving clients like Mercado Libre, Itaú and PwC, the company plans expansion across Latin America and into the US. 🇺🇾

Chilean startup eGenya raises US$600K to scale its outsourced services platform after validating its model in Chile. The company enables real-time management of services like maintenance and security and plans regional expansion into Brazil and Mexico. 🇨🇱

A new R$50M agritech fund led by ex-XP executive André Amorim is closing after two years of proprietary investing. The vehicle focuses on agtech with hands-on validation by producers and targets tickets of around R$2M with follow-ons. 🇧🇷

IonQ acquires Argentine space tech startup Skyloom Global pending regulatory approval, integrating optical satellite communications to support quantum networking. The deal highlights Latin America’s growing role in frontier deep-tech innovation. 🇦🇷

Vammo plans to aggressively scale its electric motorbike subscription business expanding its fleet from 4,500 to 18,000 bikes and battery swap stations from 100 to 500. Backed by a US$45M Series B, the company will also introduce a hybrid ethanol-compatible model by 2026. 🇧🇷

Evertec’s R$2.5B acquisition of Sinqia reshapes its Latin American strategy transforming a payments-focused business into a hybrid SaaS and financial services platform. Eighteen months post-deal, integration is largely complete and Brazil has become a testing ground for innovation and M&A. 🇧🇷

General news:

DeepSeek prepares the launch of its V4 model to revive its disruptive AI thesis after losing momentum in 2025. Expected in February, DeepSeek V4 may already incorporate the Manifold-Constrained Hyper-Connections training method to improve scalability and reduce compute costs, with early signs pointing to stronger coding performance and long-context support. 🇨🇳

Global venture capital fundraising falls to an eight-year low in 2025 as funds raised just US$80.1B, down over 60% from the 2022 peak. Capital remained highly concentrated in North America, while Latin America attracted only US$0.6B, setting a challenging environment for 2026 despite selective optimism around large AI-focused funds. 🌍

Andreessen Horowitz raises more than US$15B and surpasses US$90B in AUM strengthening its position as one of the world’s most influential VC firms. Capital is allocated across AI, infrastructure, biotech and defense-linked strategies, blending technology returns with geopolitical and industrial priorities. 🇺🇸

Bootstrapped startup PagAmerican enters global payments with an AI-first approach targeting cross-border e-commerce for Brazilian merchants. The platform reported US$233K in revenue in its first month and aims for R$50M this year by integrating payments, logistics and AI-driven checkout and analytics. 🇺🇸

EU–Mercosur trade agreement moves closer to signing after securing majority support among EU member states. One of the largest trade deals ever negotiated by the bloc, the agreement is expected to deepen economic ties with South America, with formal signing anticipated in early 2026. 🌍

Strava files confidentially for an IPO according to The Information, with Goldman Sachs advising and a potential offering as early as spring in the Northern Hemisphere. Valued at US$2.2B in its latest round, the fitness app has over 150M users globally, with Brazil as its second-largest market. 🇺🇸

Deals:

Visma acquires Chilean proptech ComunidadFeliz in a ~US$70M deal marking one of the largest exits in Chile’s real estate tech ecosystem. The SaaS company generated about US$11.5M in annual revenue and strengthens Visma’s expansion strategy across Latin America. 🇨🇱

OpenAI launches ChatGPT Health as a dedicated space for health conversations organizing more than 230M weekly health-related queries while isolating sensitive topics from general chats. The product integrates with apps like Apple Health and MyFitnessPal, emphasizes privacy safeguards, and positions health as a strategic vertical as search shifts toward conversational interfaces.

CES 2026

Date: January 6–9, 2026

Location: Las Vegas, NV, USA

Description: One of the world’s largest technology fairs, CES showcases breakthrough consumer technologies shaping how people live, work, and interact.

More infoNRF Retail’s Big Show 2026

Date: January 11–13, 2026

Location: New York City, NY, USA

Description: Organized by the National Retail Federation (NRF), Retail’s Big Show is the world’s leading retail conference, showcasing the latest technologies, trends, and strategies shaping the future of physical and digital retail.

More infoAI Day São Paulo 2026

Date: January 27–28, 2026

Location: WTC Sheraton, São Paulo, Brazil

Description:AI Day São Paulo brings together developers and researchers for hands-on training, expert-led sessions, and practical AI applications focused on real-world use cases across industries.

More infoWeb Summit Qatar 2026

Date: February 1–4, 2026

Location: Doha, Qatar

Description: Web Summit Qatar connects startups, investors, and global leaders to discuss innovation, entrepreneurship, and emerging technologies in the region.

More infoMobile World Congress (MWC) 2026

Date: March 2–5, 2026

Location: Barcelona, Spain

Description: A leading global event focused on connectivity and mobile technologies, bringing together device makers, operators, and digital innovators.

More infoSouth by Southwest (SXSW) 2026

Date: March 12–18, 2026

Location: Austin, TX, USA

Description: The world’s most influential festival blending technology, culture, innovation, and entertainment through talks, workshops, and immersive experiences.

More infoSmart City Expo Curitiba 2026

Date: March 25–27, 2026

Location: Curitiba, Brazil

Description: A major smart cities event focused on sustainable urban development, digital transformation, and innovative public solutions.

More infoSouth Summit Brazil 2026

Date: March 25–27, 2026

Location: Porto Alegre, Brazil

Description: A global innovation platform connecting startups, corporations, and investors to foster entrepreneurship and scalable business growth.

More infoBrazil at Silicon Valley 2026

Date: April 6–8, 2026

Location: Sunnyvale, CA, USA

Description: A conference connecting Brazilian leaders and entrepreneurs with Silicon Valley to promote innovation, investment, and cross-border business.

More infoVTEX Day 2026

Date: April 16–17, 2026

Location: São Paulo, Brazil

Description: One of the world’s largest digital commerce events, bringing together global retail leaders, brands, and technology innovators.

More infoGramado Summit 2026

Date: May 6–8, 2026

Location: Gramado, Brazil

Description: A technology and innovation festival combining business, strategy, marketing, and public-sector innovation discussions.

More infoRIO2C 2026

Date: May 26–June 1, 2026

Location: Rio de Janeiro, Brazil

Description: A creativity-driven event connecting technology, media, audiovisual, music, sustainability, and entrepreneurship.

More infoSouth Summit Madrid 2026

Date: June 3–5, 2026

Location: Madrid, Spain

Description: A global innovation conference connecting startups seeking scale with investors and corporations looking for new opportunities.

More infoWeb Summit Rio 2026

Date: June 8–11, 2026

Location: Rio de Janeiro, Brazil

Description: Part of the Web Summit global series, the event connects startups, investors, and tech leaders across Latin America.

More infoLondon Tech Week 2026

Date: June 8–12, 2026

Location: London, UK

Description: A five-day event bringing together founders, investors, and global leaders to discuss technology’s impact on society and business.

More infoFebraban Tech 2026

Date: June 24–26, 2026

Location: São Paulo, Brazil

Description: One of the main financial technology and innovation events for the banking and financial services sector in Latin America.

More info