LatAm Tech Weekly

#162 - Powered by Nasdaq: Q3 2023 Pitchbook Venture Landscape, Venture Debt by Namari Capital, deals of the week... and much more!

Happy Sunday!

It’s official—the countdown to my first marathon has started! In less than a week, I’ll find out if I’m going to make it or break it... My goal this time? Just to finish. No specific pace in mind; crossing that finish line will be more than enough! So, as you can probably guess, I won’t be sending out a newsletter next Sunday—I’ll be out celebrating this milestone.

I’ve already promised a few of you that I’d share all the prep details, the roller-coaster ride it’s been, and how I feel during and after the race. For those who don’t know, I’ve been running long distances since I was 21 (yep, 14 years ago!), but this will be my first full marathon! Stay tuned for a special post! For the time being, the below picture is from my last (long) run in this cycle, just yesterday.

Follow me on LinkedIn , Instagram for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

On to the usual market update, a great read this week was the Q3 2024 PitchBook-NVCA Venture Monitor. Venture investment is on pace to top $175 billion globally this year, surpassing both last year and 2020 levels, though liquidity constraints still hinder a full recovery. Despite the Federal Reserve’s 50-basis-point rate cut in September, exits remain sparse, with only 14 companies going public in Q3, totaling $10.4 billion in exit value. Still, the quarter’s end brought some optimism as Cerebras filed for an IPO, the first notable tech listing since Rubrik’s $4.25 billion IPO in April.

The slow distribution environment has prompted VC firms to increase due diligence and incorporate stronger investor protections in term sheets. Meanwhile, other investors have pulled back due to funding constraints or reluctance to call additional LP capital. Despite these challenges, the venture market is cautiously positioning itself for a potential rebound. Although LP distributions have been low, valuation corrections and investor-friendly deal terms provide a foundation for long-term gains as venture-backed companies mature and strategically plan for exits.

Deal activity remains resilient, supported by insider rounds and bridge financings that allow promising startups to continue moving forward. Funds are placing capital with increased selectivity, optimizing for high-impact opportunities. With just 23.1% of available dry powder deployed over the past year, there’s significant capital ready to drive high-value deals once the exit market strengthens.

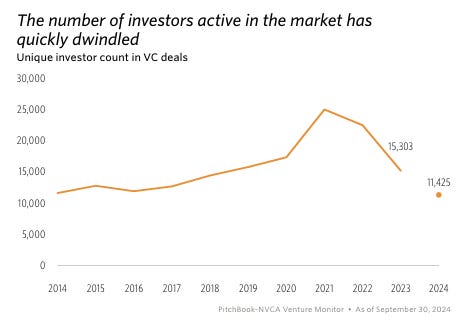

The venture landscape has seen a shift toward quality over quantity. Although investor numbers are down from 2021’s peak, current participants are more focused and strategic, with established managers raising over 80% of the capital in 2024. This underscores the market’s confidence in experienced players who can navigate the current conditions and steer the next growth phase.

Despite tightened standards, fresh capital continues to flow into startups, with over 4,300 companies receiving initial investments in 2023 and an additional 3,000 in 2024. Companies securing funding now are well-positioned to lead future growth, creating a strong foundation for the ecosystem.

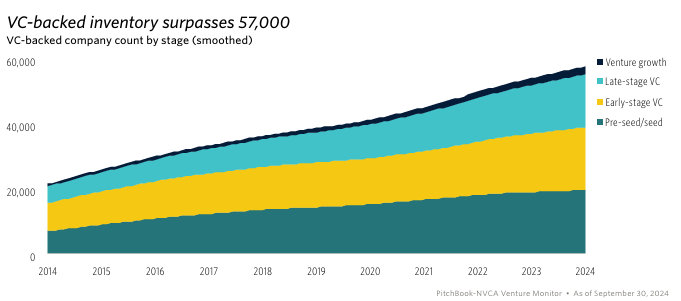

With limited exit opportunities, venture-backed companies are staying private longer, swelling the U.S. private company inventory to a record 57,674 firms. Late-stage and growth startups make up a growing portion of this inventory, taking a strategic approach to timing exits amid current market conditions. By focusing on cost-cutting over rapid expansion, startups are extending their cash runways, which enables them to choose optimal exit timing. While this shift may curb sky-high valuations, it builds resilience and profitability.

Median deal sizes and valuations are trending up, largely driven by significant AI investments. Companies that secured high valuations in the ZIRP era and have since streamlined operations are raising additional funds with strong investor interest. AI’s appeal continues to dominate, exemplified by Anduril Industries’ $1.5 billion Series F and Safe Superintelligence’s $1.0 billion first round, indicating that substantial bets are still being placed on tech innovation, often with favorable terms.

Despite a cautious market, enthusiasm around AI has introduced more balanced deal terms for startups. While investor protections remain stringent across most sectors, AI’s appeal is encouraging more neutral dealmaking in an environment flush with dry powder. The extent of venture’s recovery will depend on renewed exit activity and the realization of returns that align with past high-valuation expectations.

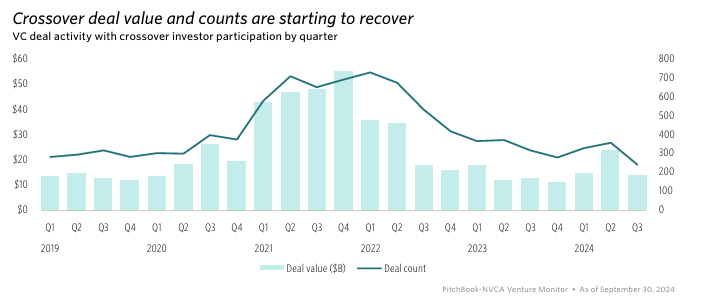

Crossover investors have become vital in bridging the capital gap, especially as traditional VC participation at late and growth stages has waned. While the number of active crossover investors has dropped by 30.1% since 2021, they are crucial for supporting companies through private rounds and eventual public listings. Deals involving crossover investors are anticipated to reach $70 billion this year—a 30.3% increase over 2023 levels. While Q3 activity returned to typical levels, the long-term outlook for crossover participation remains positive, especially as exit opportunities begin to pick up.

In the face of current challenges, crossover investors are poised to re-enter the market more actively when exit conditions improve, providing vital support for late-stage companies that continue to defer public listings. This group’s influence underscores their importance to the future of venture capital as the market navigates its current cycle.

On to a Brazilian research, Namari Capital released this week a report developed in partnership with Endeavor Brazil and Sling Hub. It aims to address common questions entrepreneurs have about Venture Debt. Below you can find my TL;DR version!

Venture Debt Overview: Venture debt is a form of corporate financing geared towards high-growth, innovative companies. It offers long-term funding without diluting equity, making it suitable for companies aiming to expand their operations.

Market Growth: In the U.S., venture debt represented around 18% of all venture capital investments in 2023, with a compound annual growth rate (CAGR) of 16% over the past decade.

Applications: Venture debt can be used to extend a company's runway before the next funding round, fund mergers and acquisitions, support capital expenditures (CAPEX), and restructure equity stakes.

Ideal Candidates: This financing is best suited for companies that have achieved product-market fit and demonstrate healthy unit economics. It is sector-agnostic, with no restrictions on the industry.

Cost Structure: Venture debt costs typically include interest and a "kicker," which is an additional fee due upon certain liquidity events or milestones. Collateral is often based on receivables, restricted accounts, and intellectual property, aligning with the needs of innovative companies.

History in Brazil: Venture debt started gaining traction in Brazil in 2019, with the first fund launched in partnership with SP Ventures. Namari Capital followed in 2022, focusing on this financing option for scale-up and growth-stage startups.

General news:

Latin American startups raised $274 million in 42 rounds in September, a 17.8% drop compared to the same month in 2023. Brazilian startups led the region, capturing 66% of the total with $183.3 million. Fintechs dominated, raising $167.2 million, followed by retailtechs and foodtechs, each securing $53.1 million. Notably, Cayena and Rock raised $55 million each. Despite the decline, there are signs of recovery, particularly in late-stage investments, reflecting renewed investor confidence in more mature startups.

Venture capital investments in generative AI startups soared to $3.9 billion in Q3 2023, with 206 startups receiving funding. Notably, $2.9 billion of this amount was allocated to 127 U.S.-based companies. Major deals included Magic's $320 million and Glean's $260 million funding rounds. However, challenges remain, particularly around the legality of AI models trained on copyrighted data. Despite skepticism, experts predict a growing adoption of generative AI, with Forrester estimating that 60% of skeptics will eventually use the technology. In Brazil, 63% of AI startups lack a clear strategy for generative AI, highlighting investment and strategic planning challenges.

This year, Cade, the Brazilian antitrust authority, clarified how it interprets control by investment funds. While this brings helpful guidance, it also adds challenges, potentially requiring more transactions to undergo pre-approval. Typical veto rights – essential for investment protection – might now indicate control, creating friction for venture capital funds. This misalignment could delay investments critical to startups. Marcus Valverde recently published an article on the matter in NeoFeed, discussing potential solutions, such as revising Resolution 33/2022 or issuing guidance to reduce regulatory burdens and maintain market agility.

Chilean startup DataScope is set to expand into Mexico, leveraging new funding to enhance its platform for digitalizing mining operations.

Omie, a cloud-based ERP startup, is in talks with Bromelia Capital to create a digital bank tailored for doctors, leveraging the Linker platform.

Caixa Econômica Federal is now the 40th payment initiator in Brazil's Open Finance framework, enabling it to process payments via Pix. This allows transactions outside traditional banking, such as e-commerce and cash-in deposits in fintech apps.

Consumers using Mercado Pago's credit card shop five times more on Mercado Livre, according to Petra Ferraz, VP of Marketing for Mercado Pago.

The upcoming launch of Pix via biometrics in Brazil, scheduled for February 2025, will enable users to make payments using Face ID, fingerprints, or PINs without accessing banking apps.

Conta Azul has secured authorization from Brazil's Central Bank to operate as a Payment Institution, enabling it to manage prepaid payment accounts with an initial capital of R$ 2.5 million.

Plug and Play, a prominent venture capital firm from Silicon Valley, is making strides in expanding its operations in Chile and Latin America. The firm is focusing on enhancing its innovation ecosystem by fostering global partnerships and investing across sectors like fintech, healthcare, and sustainability.

Nuvemshop has appointed Letícia Vaz, founder of LV Store, as its new partner and head of Fashion Innovation. This partnership aims to boost the fashion segment in Brazilian e-commerce and support entrepreneurs. Letícia will enhance marketing strategies for the fashion sector and engage in campaigns and training initiatives.

Deals:

Akua, a new payment processing startup founded by a Brazilian, Uruguayan, and Colombian, has successfully raised $4.3 million in a pre-seed round led by Flourish Ventures.

General news:

EBANX has partnered with Canva to boost payment accessibility in Latin America, offering tailored local payment options across Brazil, Mexico, Argentina, Chile, Colombia, and Peru. This move, including methods like digital wallets, instant payments, and local installment plans, comes as digital inclusion rises and the region’s digital economy is projected to exceed $1 trillion by 2027.

A new report, "Deep Techs Brasil 2024," reveals that Brazil’s deep tech startups are primarily focused on biotech and agriculture. Of the 875 startups mapped, 42% operate in biotech, with half of those specializing in agribusiness and 42% in healthcare. Despite growth, 70% of these startups remain in the tech validation phase, with limited venture capital interest.

The BNDES (Brazilian development bank) has approved a record R$9 billion in credit for innovation projects as of September, with R$6.6 billion coming from its "BNDES Mais Inovação" program. This funding marks the highest amount ever for innovation in the bank's history, accounting for 6.5% of total approvals.

Lev, a Brazilian electric bike startup, is expanding into the B2B market while opening a new factory in Manaus. The 3,200m² plant, set to launch in December 2024, will boost production and reduce costs. With nearly 150 B2B partners already onboard, Lev aims to double sales and have B2B represent 70% of deliveries.

Aiqfome, acquired by Magalu in 2020, is expanding across Brazil’s smaller cities, now operating in 700 municipalities and aiming to reach 1,000.

Deals:

Brazilian tech startup Orbital has secured a R$14 million partnership with Oman-based aerospace company ANKAA. Over five years, the collaboration aims to boost digital transformation and sustainability in line with Oman Vision 2040.

Eduvem, a Ceará-based edtech startup, has secured a R$15M Series A round, marking the region’s first edtech raise. This strategic funding will fuel Eduvem’s international expansion and solidify its position in corporate education and digital learning solutions.

Mexican private lender CXC secured a $32.6M Series A funding round led by Kaszek, with participation from Quona, Mercado Libre Fund, and others. This investment will support CXC’s international expansion across Latin America and the U.S., while enhancing its technology and operations.

Brazilian-founded CrewAI, led by João Moura, raised R$100M (US$18M) and attracted high-profile investors, including Jack Altman from Alt Capital and Insight Partners. CrewAI, which develops AI multi-agent technology, already serves 150 Fortune 500 companies.

Stripe has made its largest-ever acquisition, buying crypto startup Bridge for $1.1 billion. This marks the biggest transaction in the crypto space to date. Bridge, specializing in stablecoin payment infrastructure, was co-founded by former Coinbase employees.

General News:

Gupy, a Brazilian HRTech, may delay reaching breakeven to prioritize growth in talent management. Initially aiming to balance revenue and expenses in 2024, Gupy's focus has shifted to accelerating investments, especially in talent management solutions. With a 150% growth in cross-sell and a 50% increase in upsell of recruitment products, Gupy's financial health remains strong.

Anthropic has launched Claude 3.5 Sonnet, a new AI model that can interact with any desktop app via a "Computer Use" API, emulating human actions like clicks and typing.

Brazil's Central Bank is exploring how to adapt financial regulations to incorporate AI principles. Regulation Director Otavio Damaso highlighted the institution's focus on understanding how the financial system is currently using AI and where risks might emerge in the next 5-10 years. While no specific AI regulation is planned yet, the existing legal framework, including banking secrecy laws, already addresses key concerns like data privacy.

Brazilian rewards company Livelo has launched its Innovation Hub to accelerate tech advancements in the loyalty market. With 14 projects already underway and 3.4 million points redeemed, the Hub aims to cut solution implementation time by 50%.

Brazilian rewards company Livelo has launched its Innovation Hub to accelerate tech advancements in the loyalty market. With 14 projects already underway and 3.4 million points redeemed, the Hub aims to cut solution implementation time by 50%.

ODATA is investing R$ 7.4 billion in new data centers in Colombia, part of a larger R$ 26 billion plan across Latin America by 2026. The two new centers, located near Bogotá, will cater to growing demand from big tech companies like Amazon, Microsoft, and Google.

Chilean fintech Retorna is expanding its digital remittance services to the U.S. and Europe, aimed at helping migrants send money quickly and at lower costs.

Deals:

As the creator economy grows, Berlin-based Passionfroot is positioning itself as a bridge for brand partnerships, targeting business and thought-leadership creators with a $3.8M seed round led by Supernode Global.

Argentina-based DeFi provider Karpatkey raised $7M in a seed funding round closing on October 22, 2024, aiming to support DAOs with sustainable financial services. The round attracted prominent backers, including Gnosis, Borderless Capital, and notable figures like Joseph Lubin and Stani Kulechov.

Portuguese autonomous retail startup Sensei has raised €15M (~R$91M) in a Series A round led by BlueCrow Capital to expand in Latin America, particularly Brazil. Known for its cashier-less stores powered by AI and computer vision, Sensei aims to grow its team by 30% and establish 1,000 new locations by 2026.

Sustainable biotech firm Biosolvit, backed by Laércio Cosentino’s GHT4, has acquired the water treatment startup Augen for up to R$48M. Augen, known for its digital water treatment solutions, will help Biosolvit double its revenue to R$180M within two years as it shifts to a "water as a service" model.

General news:

Silicon Valley's General Catalyst has raised $8 billion, the largest venture capital fund in two years. Known for backing Airbnb, Snap, and Stripe, the firm plans to allocate $4.5 billion to new startups, $1.5 billion to venture building, and $2 billion to follow-on investments. This signals a potential rebound in VC activity after a prolonged funding drought. The firm is also exploring health, energy, and defense sectors, recently announcing plans to acquire a hospital system in Ohio as part of its healthcare technology strategy.

Nuvemshop, a leading e-commerce platform in Latin America, has appointed Bernardo Brandão as its new Chief Marketing Officer (CMO). Brandão, formerly CMO at RD Station, will lead new growth strategies across the region. This move comes as Nuvemshop doubles its marketing investment, aiming to support its 140,000 clients and further expand its brand.

Brazilian fintech Malga, formerly known as Plug, is set to process R$4B in transactions by 2024. With over 60 clients, including Petlove and Alura, Malga offers an intelligent payment infrastructure that connects companies to multiple providers through a single integration.

Bitso, a leading crypto financial services platform in Latin America, has appointed Aimee Fearon as its new Global Chief Financial Officer (CFO). This move strengthens Bitso's female leadership at the executive level.

Flavio Scarpelli has been appointed as the new CEO of Vórtx QR Tokenizadora, a platform for trading tokenized assets formed by Vórtx and QR Capital. Scarpelli, who has been with Vórtx since 2016, replaces Fernando Carvalho, the founder of QR Capital.

Deals:

US-based fintech Conduit has raised $6M to expand its B2B international payments platform across Latin America and Africa. Backed by Helios Digital Ventures, Conduit aims to offer faster, cheaper, and more transparent cross-border transactions without relying on digital currencies.

General news:

Conta Simples has been recognized by CB Insights as one of the 100 most promising fintechs globally for 2024. it’s one of only two Brazilian companies to make the list.

iFood is challenging the dominant players in Brazil's benefits market, aiming to capture a slice of the R$150 billion sector. Its iFood Benefícios unit has grown from 400,000 users in March to 650,000 in September, with a target of 1 million by March 2025. By introducing AI and discounts, iFood is driving engagement in meal benefits, targeting a R$6 billion annual transaction volume.

Sankhya enters the fintech market with its first financial product, Sankhya Venda Mais, an AI-powered receivables advance solution. Integrated with Sankhya's EIP platform, it automates credit analysis and outsources collections, allowing companies to boost sales while minimizing default risk.

Mercado Pago has increased its financial arm, Mercado Crédito, from R$ 1.265 billion to R$ 1.812 billion, receiving approval from the Central Bank of Brazil (BC) for this R$ 547 million capital boost. This decision follows the recent authorization for Mercado Livre to establish its own securities distributor with a capital of R$ 4.5 million.

Creditú has partnered with Ruuf to finance the installation of solar panels in homes across Chile. This collaboration aims to enhance access to renewable energy, allowing homeowners to invest in solar technology with manageable financing options.

Deals:

iFood has acquired a minority stake in Shopper, a leading online grocery platform, solidifying its entry into the competitive online supermarket market. With over 1 million registered users, Shopper operates across 120+ cities in São Paulo, offering unique services like scheduled orders, fresh produce programs, and direct industry sourcing. The acquisition, awaiting regulatory approval by Brazil's CADE, boosts iFood’s expansion beyond restaurant delivery, putting it in direct competition with Amazon, Mercado Livre, and others in the grocery sector.

If you like tech events, I encourage you to access my LinkedIn post that has the entire list!!!!

REC ‘n’ Play

Date: November 6-9

Location: Recife

Description: Annual innovation and technology festival aimed at fostering creativity, technology, and entrepreneurship. It brings together professionals, students, and enthusiasts through workshops, lectures, and cultural activities, providing a platform for learning, networking, and collaboration. The event highlights Recife's role as a growing hub for innovation in Brazil, connecting participants with industry experts and new trends.

Stats Conf

Date: November 8-9

Location: São Paulo

Description: Bitcoin only technology event - crypto, finance, blockchain

#fswk24 - O Momento Atual dos VCs na Saúde

Date: November 6

Location: Rio de Janeiro

Description: This event focuses on the current landscape and opportunities for venture capital investments in the healthcare sector. Attendees will gain insights into the latest trends, challenges, and strategies for investing in health tech startups and innovative healthcare solutions.

Satya Nadella (Chairman & CEO at Microsoft) Yearly letter - 2024 “ Relevance and reinvention” (It cites Itau Unibanco and our efforts in AI for coding!)

This week was quite busy… I did not listen to any new podcasts, just random HipHop music during my training!

“Do not think what is hard for you to master is humanly impossible; but if a thing is humanly possible, consider it to be within your reach.” Marcus Aurelius