LatAm Tech Weekly

222: SaaSpocalypse, AI goes to the Super Bowl, deals of the week... and much more!

Weekly writing about what is happening in LatAm tech. By day, I am part of the corporate development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly. And obviously, always running!

If you have not subscribed yet, join the 14,400+ weekly readers by subscribing here!

Happy Sunday!

One of the most gratifying aspects of writing this newsletter is the spontaneous feedback I receive from people I have never met. When I started it nearly five years ago, I could not have imagined that it would grow into a global community of more than 14,400 readers across 25+ countries. What began as a personal initiative has quietly become a shared space for people deeply engaged in Latin America’s tech ecosystem.

This week was a particularly meaningful reminder of that. I had the honor of being cited — completely organically — by two different people. In a LinkedIn post, Claudio Schlegel, an angel investor based in Mexico City (a place I have yet to visit), mentioned this newsletter as one of the top publications covering LatAm tech. Separately, Rodrigo Barros, a finance and strategy leader, also included it among his recommended industry reads in this podcast. And in a moment that felt especially surreal, I was recently at a restaurant when a highly respected industry leader told me, unprompted, that he reads it every week.

These moments may seem small, but to me they represent something much bigger. Thank you to everyone who has mentioned, shared, and supported this newsletter — and to all of you who carve out time in your busy weeks to read it. It does not go unnoticed, and it is the reason I continue to write.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Last week, I mentioned that one of the most striking takeaways from my recent trip to San Francisco was hearing, repeatedly, that “SaaS is dead.” It’s an intentionally provocative statement — and, in many ways, an exaggeration — but it captures a very real shift in how people are thinking about software in the AI era. Since then, I’ve continued to see this theme everywhere: on X, across investor blogs, and in several thoughtful industry publications. When a narrative starts showing up across multiple credible sources at the same time, it’s usually worth paying closer attention.

If you’ve been following this newsletter for a while, you know that I listen to the AI Daily Brief almost every day. In a recent episode titled “Is Software Dead?”, the host unpacks exactly what’s driving this conversation — and more importantly, what it actually means for the future of software. A few key takeaways stood out:

1) Public software valuations have compressed significantly — but selectively.

Since the peak in 2021, many publicly listed SaaS companies have seen their multiples decline materially. Best-in-class SaaS companies that once traded at 20–30x forward revenue are now trading closer to 6–12x, with weaker or slower-growing companies compressing even further. This reflects not just higher interest rates, but a deeper structural concern: investors are questioning whether traditional SaaS business models can maintain their long-term pricing power in a world where AI can technically replicate software functionality faster and cheaper.

2) The core fear: AI reduces the marginal value of traditional SaaS applications.

Historically, SaaS companies created value by packaging workflows into structured software interfaces — CRMs, ERPs, support tools, etc. But AI agents can now perform many of these workflows directly, often without requiring a traditional software interface. Instead of paying for dozens of separate SaaS tools, companies may increasingly rely on AI systems that orchestrate tasks across multiple functions. This shifts value away from the application layer and toward the AI and data layers.

3) However, incumbents with proprietary data have a massive advantage.

One of the most important counterpoints raised in the episode is that SaaS incumbents are far from defenseless. Companies like Salesforce, ServiceNow, and Snowflake sit on enormous volumes of proprietary enterprise data — and in the AI era, data is the most defensible moat. AI systems become exponentially more valuable when trained on rich, structured, real-world enterprise data. This means incumbents are uniquely positioned to integrate AI and strengthen their platforms, rather than being displaced by it.

4) Distribution, not just product, is becoming the key competitive advantage.

Traditional SaaS companies already have embedded distribution inside their customers’ workflows. Even if AI fundamentally changes how software works, companies that already have trusted relationships, installed bases, and data pipelines are in a strong position to evolve. In contrast, new AI-native entrants may have superior technology, but still face the classic challenge of enterprise distribution.

5) The real shift is not “software disappearing” — but software becoming more autonomous.

The consensus among industry experts is that software isn’t dying — it’s transforming. Instead of users navigating software, software will increasingly operate on behalf of users. The interface layer becomes thinner, while the intelligence layer becomes thicker. In practical terms, this could mean fewer seats per customer, different pricing models (usage-based, outcome-based), and a reallocation of value across the software stack.

6) The winners will likely be hybrid: AI-native companies and AI-adapted incumbents.

Rather than a complete replacement cycle, the more likely outcome is a reshuffling. Some incumbents will successfully reinvent themselves as AI platforms. Others will struggle. And entirely new companies — built AI-first from day one — will emerge as major players.

The phrase “SaaS is dead” makes for a good headline, but the reality is more nuanced. Software isn’t disappearing — it’s being rebuilt around intelligence instead of interfaces. And as with every major platform shift, the biggest winners will likely be those who adapt early and leverage the unique assets they already have: data, distribution, and trust.

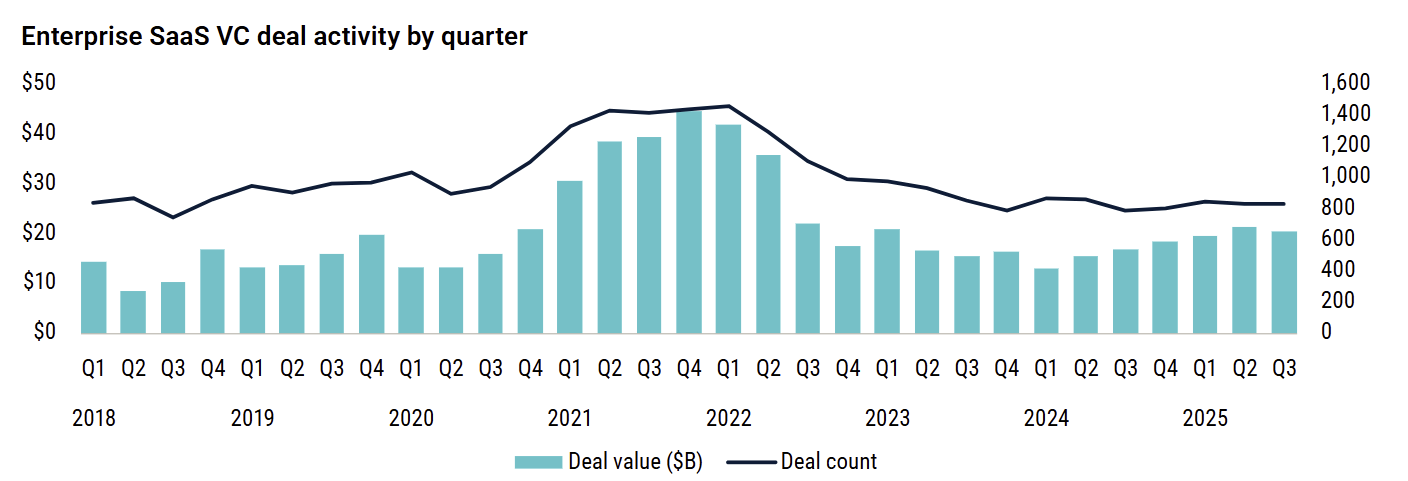

Moving on, Pitchbook also published an interesting paper on the theme. One of the most notable findings is that enterprise SaaS deal activity has plateaued after a decade of uninterrupted expansion. Following the surge in 2020–2021, fueled by zero interest rates and accelerated digital transformation, deal volume and capital deployment have stabilized at materially lower levels. Investors are no longer funding SaaS growth indiscriminately; instead, capital is concentrating in fewer companies with clearer differentiation, stronger retention, and credible AI integration strategies. This reflects a shift away from the “growth-at-all-costs” mindset toward a more disciplined focus on durability, efficiency, and long-term defensibility.

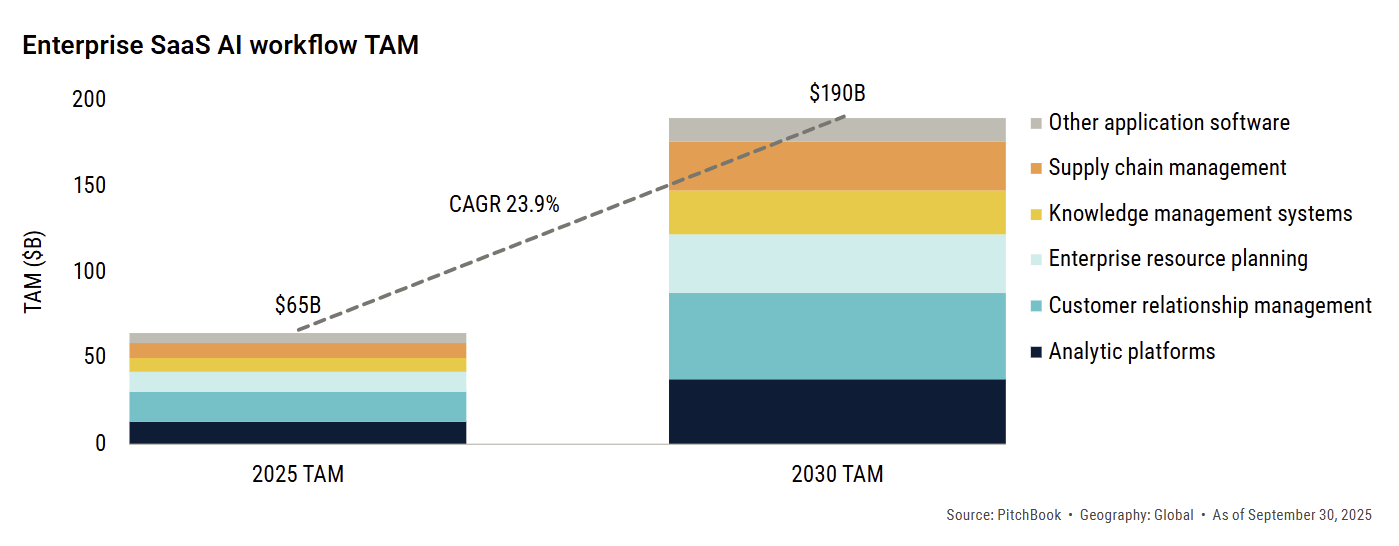

Despite this near-term slowdown, PitchBook emphasizes that the long-term TAM for enterprise software remains enormous — and continues to expand. Global enterprise software spending is expected to grow steadily over the next decade, driven by ongoing digitization, automation, and, increasingly, AI adoption. Rather than shrinking the market, AI is reshaping it. Entirely new categories are emerging — particularly around autonomous workflows, AI agents, and decision automation — which expand the scope of what software can do inside organizations.

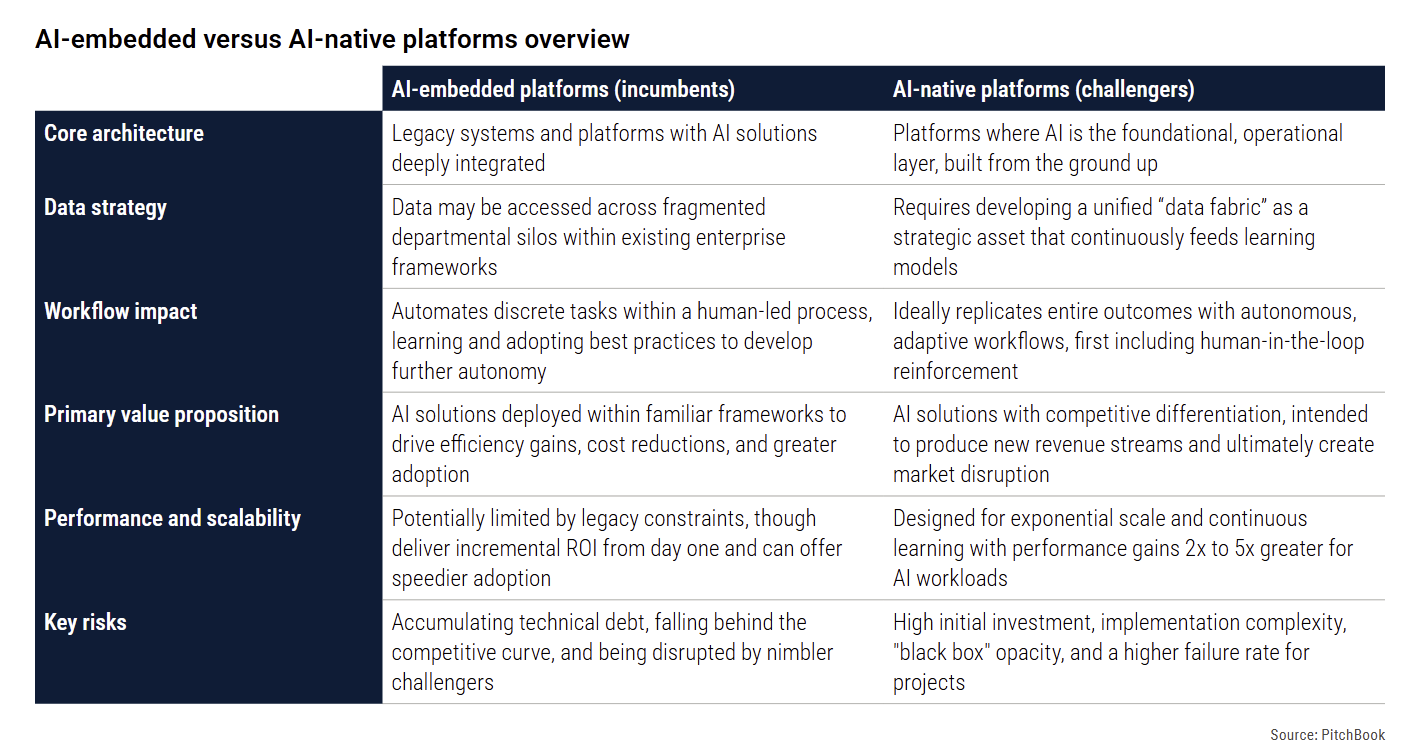

A critical distinction the report highlights is the divergence between AI-embedded incumbents and AI-native platforms.

Incumbent SaaS platforms — such as Salesforce, ServiceNow, SAP, and Microsoft — have a structural advantage rooted in distribution and proprietary data. These companies already sit at the center of enterprise workflows and control vast repositories of customer, operational, and transactional data. This data is extremely valuable in training and deploying AI models, allowing incumbents to embed AI features directly into their existing products. Because they are already deeply integrated into enterprise systems, they can deploy AI enhancements with relatively low customer acquisition costs and high adoption rates. In many cases, AI strengthens their moat rather than weakening it.

In contrast, AI-native platforms are being built from the ground up with AI as the core architecture, rather than as an added feature. These companies are not simply enhancing existing workflows — they are redesigning them entirely. Instead of providing tools that users operate manually, many AI-native platforms automate workflows autonomously. This represents a fundamentally different software paradigm. However, while AI-native companies often move faster and innovate more aggressively, they face significant challenges around distribution, trust, and access to proprietary enterprise data — areas where incumbents remain advantaged.

Importantly, PitchBook suggests that the competitive dynamic is unlikely to be winner-take-all. Instead, the market is fragmenting into two parallel tracks: incumbents that successfully evolve into AI platforms, and AI-native challengers that create entirely new categories. The biggest risk lies with legacy SaaS providers that fail to meaningfully integrate AI and become commoditized over time. Taken together, the report’s central conclusion is nuanced but clear: enterprise SaaS is not in decline, but in transformation.

General news:

Brazil’s Open Finance ecosystem marks five years as the world’s largest surpassing 100M connected customers and 154M active consents, with payment initiation jumping from 7.4M to 64.5M transactions year over year, signaling a shift from infrastructure buildout to UX, data quality and conversion. 🇧🇷

BRQ completes rebranding to sharpen enterprise AI and engineering focus repositioning around complex engineering, digital products and production-scale AI delivery, supported by a R$100M BNDES investment to move enterprises from AI experimentation to governed, scalable deployments. 🇧🇷

MakeOne merges HexaDigital and PurpleBird to form Hexa Security creating an integrated cybersecurity unit spanning MDR, SOC, incident response, forensics and compliance, targeting Brazil’s mid-market as the group bets on recurring security revenue to scale toward R$500M in sales. 🇧🇷

Qik enables instant international remittances to Visa debit cards as the Dominican Republic’s first neobank allows funds from the US and other countries to be credited in under 30 minutes via Visa Direct, with no fees for recipients, strengthening its digital banking ecosystem and positioning Qik to capture growing remittance flows while advancing financial inclusion. 🇩🇴

Yape enables direct cross-border transfers from Peru to Nequi in Colombia connecting over 15M users in Peru with 27M users in Colombia through near-instant wallet-to-wallet transfers, unlocking a remittance corridor exceeding S/500M annually and reinforcing the shift toward digital wallets as faster, more accessible remittance rails in Latin America. 🇵🇪🇨🇴

Brazil makes Pix MED 2.0 mandatory to strengthen fraud recovery enabling end-to-end fund tracing and refunds within up to 11 days after disputes, closing loopholes exploited by fraudsters while granting institutions a compliance grace period until May 10. 🇧🇷

Deals:

Takeat raises R$15M Series A led by DGF and Quartzo Capital to scale its AI-powered restaurant management SaaS nationwide, targeting growth beyond 3,000 customers as investors double down on B2B software digitizing Brazil’s fragmented food service sector. 🇧🇷

Juspay raises US$50M Series D to accelerate global expansion led by WestBridge Capital, reinforcing its push in Brazil and Latin America as demand grows for enterprise-grade payment orchestration on real-time rails like Pix. 🇮🇳

TOTVS agrees to sell Dimensa to Evertec Brasil for R$1.4B completing a full exit after buying out B3’s stake, delivering a 7.4x return and sharpening TOTVS’s focus on cloud and AI while Evertec expands its fintech software footprint. 🇧🇷

SpaceX acquires xAI to form vertically integrated AI and space platform combining rockets, Starlink, communications and AI models under one structure, concentrating data, compute and global distribution at a scale that could exceed US$1T in valuation. 🇺🇸

Tilt Technologies raises US$4M pre-seed to scale distributed cloud computing backing a grid-based model that uses idle devices to cut cloud costs and energy use, as the company expands from the U.S. into Brazil targeting media, finance, retail and healthcare clients. 🇧🇷

Ruvo raises US$4.6M seed led by 1confirmation to scale cross-border payments infrastructure linking Brazil and the U.S., combining Pix, crypto, stablecoins, ACH and Visa into a single dollar account to reduce friction in a major remittance corridor. 🇧🇷

General news:

Itaú Unibanco doubles down on mixed work model while scaling GenAI maintaining on-site, hybrid and limited remote roles with performance-linked reviews, as the bank flags long-term talent risks of fully remote work and expands generative AI across 400+ projects with 350 specialists, including agents for performance reporting and investment advisory tools. 🇧🇷

C6 Bank posts R$2.46B net profit in 2025 and expands secured lending confirming sustained profitability as revenue rose 15% to R$9.2B, customers reached 40M and the credit book grew 49% to R$89.3B, with efficiency improving to a 45% ratio and payroll-deducted loans driving growth. 🇧🇷

Latin American VC turns selective as IPOs seen as catalyst for recovery with tighter liquidity pushing stock picking and profitability focus, while early-stage activity persists and successful public listings are viewed as key to recycling capital and attracting foreign investors back to the region. 🌎

Brazil’s equity crowdfunding market triples to R$3.9B in 2025 as deal count rises to 861 amid regulatory updates, while capital markets issuance hits R$980.9B and investment fund assets grow 15.3% to R$11.13T, signaling deeper infrastructure alongside higher volatility. 🇧🇷

Fictor files for court-supervised reorganization amid fraud probes covering R$4.2B in liabilities as authorities investigate alleged financial misconduct, governance failures and Pix-related breaches, raising concerns over oversight gaps in lightly regulated financial infrastructure players. 🇧🇷

Kravata launches digital dollar inside Claro’s Mi Claro app enabling users to buy, hold and convert digital dollars to pesos through a regulated infrastructure, expanding mass-market access to dollar exposure via a telecom super-app amid currency volatility. 🇨🇴

Deals:

Vela LatAm acquires environmental software firm Onegreen integrating permitting and compliance management into Ius Natura to strengthen its ESG and legal stack for regulated sectors, underscoring Constellation’s buy-and-build strategy in LatAm. 🇧🇷

Revena raises US$7.6M seed led by Canary with Flourish Ventures and Caravela Capital backing its AI platform that automates hospital billing by interpreting clinical data and insurer contracts, aiming to scale across the full revenue cycle. 🇧🇷

Pix Mídia raises R$2.9M led by DOMO.VC with participation from Bossa Invest to expand its cross-channel corporate communications SaaS nationwide after surpassing R$10M in 2025 revenue and serving ~1.5M employees. 🇧🇷

General news:

Itaú Unibanco posts record R$46.8B profit in 2025 delivering the highest net income ever recorded by a Brazilian bank, up 13.1% year over year with ROE at 23.4%, as credit reached R$1.49T with low delinquency of 1.9% and management guides for disciplined, capital-efficient growth in 2026. 🇧🇷

Alphabet surpasses US$400B in annual revenue as AI monetization accelerates reporting US$402.8B in revenue and US$132.2B in net income in 2025, up 15% and 32% respectively, reinforcing strong cash generation and positioning AI as a core driver of future expansion despite rising capex. 🇺🇸

Brazil’s BC Protege+ blocks over 255K suspicious account openings as the fraud-prevention system reaches 843K activated users and 70.9M checks by financial institutions, becoming a mandatory infrastructure layer to curb identity-based fraud across the banking system. 🇧🇷

Naranja X applies for full banking license in Mexico to expand beyond Argentina as the Grupo Financiero Galicia–owned digital bank targets its first international market with over 9.5M users and 9.4M cards at home, entering Mexico amid rising credit risk with NPLs climbing to 10.8% and intensifying competition in one of Latin America’s most crowded fintech hubs. 🇲🇽

Deals:

Positron raises US$230M Series B led by Qatar Investment Authority to scale production of energy-efficient AI inference chips, positioning its Atlas architecture as an alternative to Nvidia GPUs amid rising demand for diversified, lower-power AI compute. 🌍

BeConfident raises R$85M Series A led by Prosus valuing the Brazilian AI language-learning startup at R$530M and funding aggressive international expansion of its WhatsApp-based conversational education platform. 🇧🇷

Tapi raises US$27M Series B led by Kaszek Ventures to expand its hybrid payments infrastructure across Mexico, launch new products and pursue selective M&A, as monthly transaction volume reaches 25M and total funding surpasses US$60M. 🇦🇷

Signa raises US$1M seed to scale AI-driven anti-counterfeiting backing its platform that uses AI agents to detect illicit goods, generate legally admissible evidence and coordinate enforcement, as the startup posts US$138K in MRR and expands beyond the Americas. 🇨🇴

General news:

Itaú Unibanco launches Protected Mode to add new layer of mobile fraud prevention introducing transfer caps outside user-defined trusted Wi-Fi locations and mandatory facial recognition for higher-value Pix and TED transactions, targeting theft and coercion scenarios as part of a broader digital security strategy. 🇧🇷

Instituto Caldeira launches Startup Tech Journey backed by Dell and Intel selecting five Brazilian startups for a seven-month mentoring track focused on strategy, enterprise access and AI capabilities, reinforcing corporate-led pathways to scale innovation in Brazil. 🇧🇷

Big tech capex set to exceed US$600B in 2026 as AI infrastructure race accelerates led by Amazon’s US$200B plan, Alphabet’s US$175B–185B and Meta’s US$115B–135B, driving massive demand for data centers, AI chips and suppliers like Nvidia and Broadcom while Apple remains cautious. 🌍

Mercado Pago says full banking license in Brazil is not a near-term priority opting to focus on security, insurance and trust while pursuing bank charters in Argentina and Mexico, citing higher regulatory costs and complexity under Brazil’s tighter prudential rules. 🇧🇷

Bitcoin plunges over 10% in a single session as risk aversion spreads pushing year-to-date losses to 33% and erasing roughly US$1T in market value, with the asset increasingly trading in sync with US tech stocks and undermining its safe-haven narrative. 🌍

Deals:

Clara renews US$150M credit line with Goldman Sachs lifting total debt capacity above US$250M to support expansion of corporate cards, payments, travel solutions and AI-driven financial automation across Latin America. 🇲🇽

General news:

Goldman Sachs has been working with the artificial intelligence startup Anthropic to create AI agents to automate a growing number of roles within the bank. 🌍

Barte closes 2025 with R$250M+ in revenue and infrastructure-led profitability as the Brazilian payments and corporate banking fintech reaches nearly R$10B in TPV. 🇧🇷

VERT suffers cyber incident with ~R$50M withdrawn from funds after a breach linked to a third-party banking connectivity provider, with operations restored the next day and reimbursement plans underway, putting renewed scrutiny on counterparty and operational risk across financial infrastructure providers. 🇧🇷

Brazil’s Redata data center tax incentive moves through Congress amid delays as uncertainty stalls an estimated R$1T investment pipeline through 2030, despite Brazil’s energy advantages and AI-driven projects requiring up to US$7B per 100MW, highlighting timing risk in a global race for compute capacity. 🇧🇷

Deals:

Remote acquires Argentine fintech Atlas to add payments and benefits layer integrating payroll cards and benefits infrastructure into its global HR platform, reinforcing demand for end-to-end cross-border employment, payroll and benefits tooling. 🇦🇷

Quipu raises US$300K bridge round to expand AI credit for informal businesses led by Impacta VC with participation from Decelera, Vertical Partners, Corteza Capital and Comfama, backing API integrations with banks and regional expansion after scoring 300K+ users and enabling US$7M+ in loans. 🇨🇴

It has been an exceptionally busy week on the AI front. While the news of xAI’s merger with Tesla is clearly consequential — further reinforcing the trend of frontier AI labs integrating directly with distribution, hardware, and real-world infrastructure — Super Bowl Sunday makes one thing even clearer: the AI race has entered a new phase. Not just a race for model performance, but a race for narrative, trust, and ultimately, mindshare.

Anthropic will air during Super Bowl a series of ads that are unusually direct in their messaging, clearly taking aim at OpenAI’s recent move to introduce advertising inside ChatGPT. In the commercials, chatbot interactions begin innocently — helping users with fitness goals, personal communication, or everyday questions — but then subtly shift into sales pitches, recommending products and services unrelated to the original intent. Words like “deception” and “treachery” flash across the screen, culminating in a simple but pointed message: “Ads are coming to AI. But not to Claude.” The implication was unmistakable. Anthropic is positioning itself as the trust-first alternative — an AI assistant aligned solely with user intent, not commercial incentives.

OpenAI’s response was characteristically different. Rather than engaging directly in the messaging battle, it responded through product velocity and scale. The company released new model improvements this week, further strengthening performance across reasoning, multimodal interaction, and real-time responsiveness. Implicitly, OpenAI is making a different strategic bet: that utility, ecosystem breadth, and rapid innovation will matter more than any single monetization decision. While Anthropic is competing on alignment and purity of incentives, OpenAI is competing on becoming the default AI platform for both consumers and enterprises.

Taken together, this week made one thing clear: the competitive frontier has expanded beyond technology into brand, perception, and platform control. Just as importantly, both companies also released new model upgrades in parallel — reinforcing that this is not just a marketing battle, but a deeply technical one as well.

Click here to see the commercials and read a piece on the theme

Mobile World Congress (MWC) 2026

Date: March 2–5, 2026

Location: Barcelona, Spain

Description: A leading global event focused on connectivity and mobile technologies, bringing together device makers, operators, and digital innovators.

More infoSouth by Southwest (SXSW) 2026

Date: March 12–18, 2026

Location: Austin, TX, USA

Description: The world’s most influential festival blending technology, culture, innovation, and entertainment through talks, workshops, and immersive experiences.

More infoSmart City Expo Curitiba 2026

Date: March 25–27, 2026

Location: Curitiba, Brazil

Description: A major smart cities event focused on sustainable urban development, digital transformation, and innovative public solutions.

More infoSouth Summit Brazil 2026

Date: March 25–27, 2026

Location: Porto Alegre, Brazil

Description: A global innovation platform connecting startups, corporations, and investors to foster entrepreneurship and scalable business growth.

More infoBrazil at Silicon Valley 2026

Date: April 6–8, 2026

Location: Sunnyvale, CA, USA

Description: A conference connecting Brazilian leaders and entrepreneurs with Silicon Valley to promote innovation, investment, and cross-border business.

More infoVTEX Day 2026

Date: April 16–17, 2026

Location: São Paulo, Brazil

Description: One of the world’s largest digital commerce events, bringing together global retail leaders, brands, and technology innovators.

More infoGramado Summit 2026

Date: May 6–8, 2026

Location: Gramado, Brazil

Description: A technology and innovation festival combining business, strategy, marketing, and public-sector innovation discussions.

More infoRIO2C 2026

Date: May 26–June 1, 2026

Location: Rio de Janeiro, Brazil

Description: A creativity-driven event connecting technology, media, audiovisual, music, sustainability, and entrepreneurship.

More infoSouth Summit Madrid 2026

Date: June 3–5, 2026

Location: Madrid, Spain

Description: A global innovation conference connecting startups seeking scale with investors and corporations looking for new opportunities.

More infoWeb Summit Rio 2026

Date: June 8–11, 2026

Location: Rio de Janeiro, Brazil

Description: Part of the Web Summit global series, the event connects startups, investors, and tech leaders across Latin America.

More infoFebraban Tech 2026

Date: June 24–26, 2026

Location: São Paulo, Brazil

Description: One of the main financial technology and innovation events for the banking and financial services sector in Latin America.

More info

“Failure is simply the opportunity to begin again, this time more intelligently.”

— Henry Ford