LatAm Tech Weekly

#217: Welcome to 2026, State of Venture 2025 and what matters, deals of the week… and much more!

Weekly writing about what is happening in LatAm tech. By day, I am part of the corporate development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,200+ weekly readers by subscribing here!

Happy Sunday—and welcome to the first LatAm Tech Weekly of 2026. Let’s make it a good one.

I started this publication back in August 2021, which means we’re officially entering year five. That still blows my mind a bit. Watching this project evolve—and seeing the community around it grow—has been one of the most rewarding parts of my work as a writer. What’s been especially interesting to observe is how the profile of my readers has changed over time. In the early days, most of you were founders, GPs, and people deeply embedded in the tech ecosystem. Today, more than 30% of readers come from what people call “traditional” industries.

On one hand, this reinforces a truth we all see playing out in real time: technology is no longer a standalone sector. It’s inseparable from finance, manufacturing, retail, healthcare—you name it. The future of these industries is tech - I say this almost every week in this newsletter. On the other hand, it also tells me I’m doing something right: translating a fast-moving, often noisy tech world into insights that resonate beyond the usual insiders…

So yes—small moment of self-congratulation here. :)

As every new year rolls in, I like to ask myself the same question: how should this newsletter evolve next? If you’ve been reading for a while, you know I experiment every year. In 2025, that meant launching the Tech Events Radar and adding country tags and hyperlinks to every piece of news to make things more actionable and easier to scan.

For 2026, I’m introducing something new again—this time driven by one unavoidable reality: AI is everywhere. When I looked back at last year’s editions, about 70% of the intros revolved around an AI-related theme. That’s not accidental. AI is no longer a trend—it’s infrastructure. And one of the questions I get asked most is: How do you keep up with everything that’s happening in AI when the news cycle never stops? The honest answer is: a lot of sources, a lot of filtering—and a lot of context-building.

So I decided to make that process more useful for you.

Starting this year, I’m adding a new section to the newsletter. Every single week, I’ll highlight just one AI story—the most important one. Not five. Not ten. One. If it makes sense to dive deeper, I’ll unpack it in the intro. If not, I’ll still flag it clearly with a short comment and a link, so you never miss what actually matters. My goal is simple: help you stay informed on AI without feeling overwhelmed—every week.

I’d love to hear what you think. As always, comments and suggestions are more than welcome.

Now, without further ado—let’s get into the first newsletter of 2026

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

The State of Venture in 2025 (through a different lens)

In this week’s edition, I spent time going through Carta’s 145-page “State of Startups 2025” deck. It’s a dense, data-rich report and one of the best snapshots we have of what actually happened in venture over the past year.

Instead of doing a short-sighted, slide-by-slide summary, I tried something else. I connected Carta’s data with everything I’ve been reading and thinking about toward the end of 2025—commentary from a16z, Clouded Judgement, earnings from public tech companies, and broader AI and liquidity conversations. The result is a deeper, more opinionated read of what actually changed in venture in 2025, and why it matters going into 2026.

If you don’t have time to read everything and want a one-sentence takeaway, here it is:

Venture in 2025 is healthier—but more concentrated, more selective, and increasingly reliant on alternative liquidity paths (M&A and secondaries), while AI pulls capital toward fewer, faster-scaling outcomes.

Now, let’s unpack that.

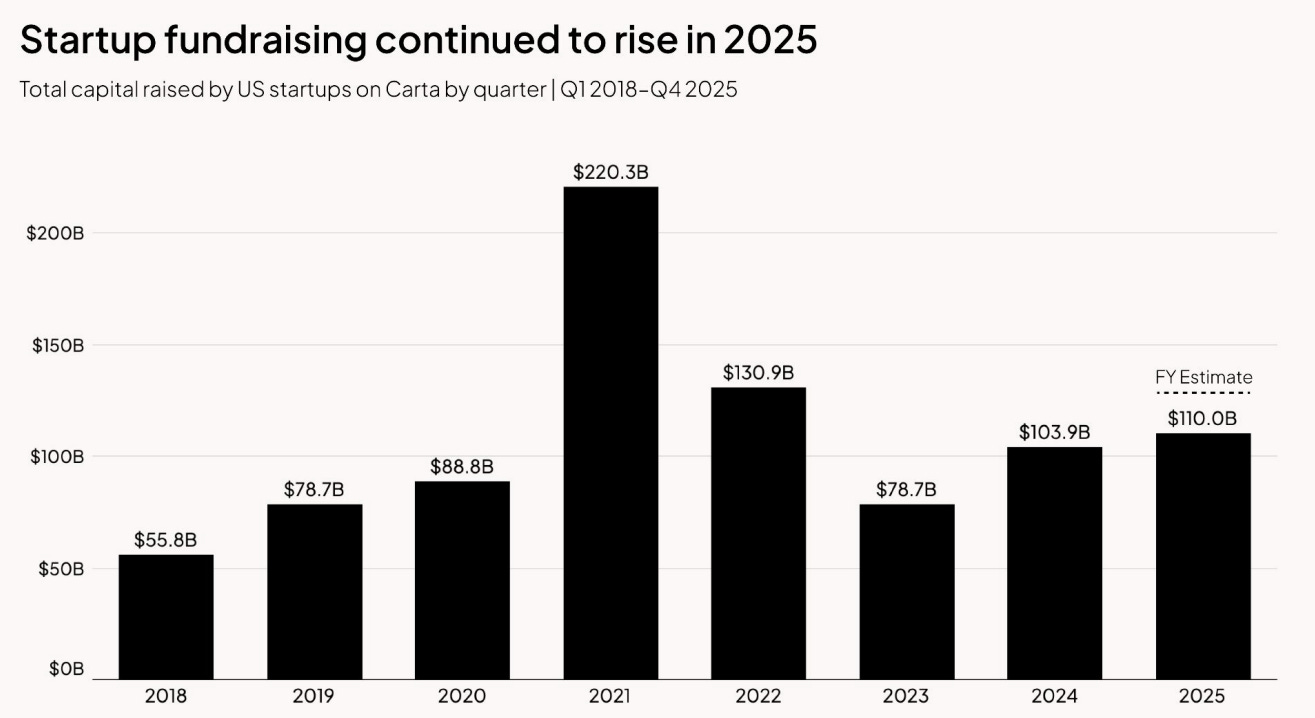

1) The recovery is real—but it’s not “back”

Funding is up again. Total capital deployed in 2025 grew meaningfully compared to 2023 and 2024. But here’s the key nuance: the number of rounds hasn’t increased at the same pace.

More money is flowing, but into fewer companies. This creates a barbell dynamic—capital concentrating at the top while the middle of the market remains tight. It’s a healthier ecosystem than the post-2022 reset, but it’s not a return to the “spray and pray” days of 2020–2021.

This dynamic shows up everywhere else in the data.

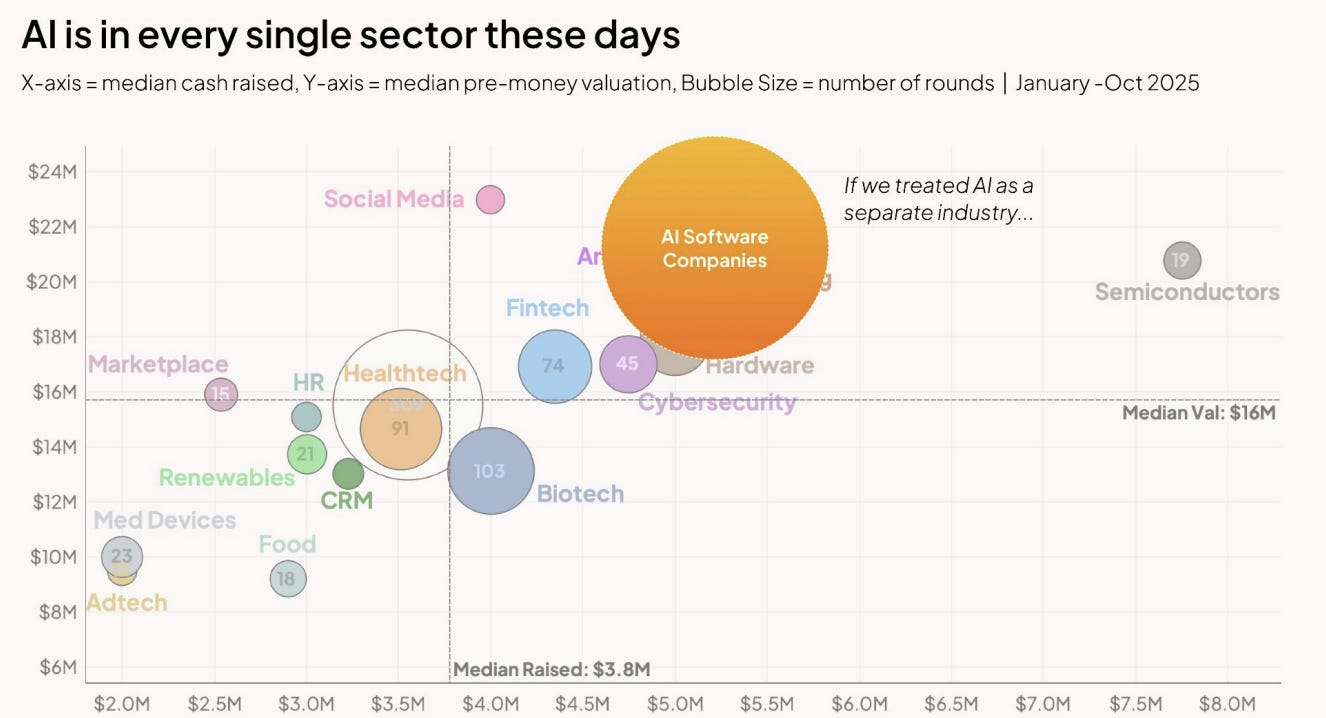

2) AI is no longer a sector—it’s the allocation framework

One of the clearest signals in the entire deck is how dominant AI has become. Roughly 44% of all VC capital in 2025 went to AI-related companies, up from ~39% in 2024 and ~31% in 2023.

What matters more is where that capital is showing up. AI is taking share across every stage, but especially at later stages—helping explain why total dollars are up while total rounds are not. Capital is piling into perceived category leaders.

This fully aligns with what we’ve seen elsewhere: AI companies showing faster revenue ramp, better distribution dynamics, and—in some cases—economics that justify premium pricing even in a disciplined market.

AI should not be a different vertical or sector. It is embedded in all of the different sectors and it has become the lens through which venture allocators are making decisions.

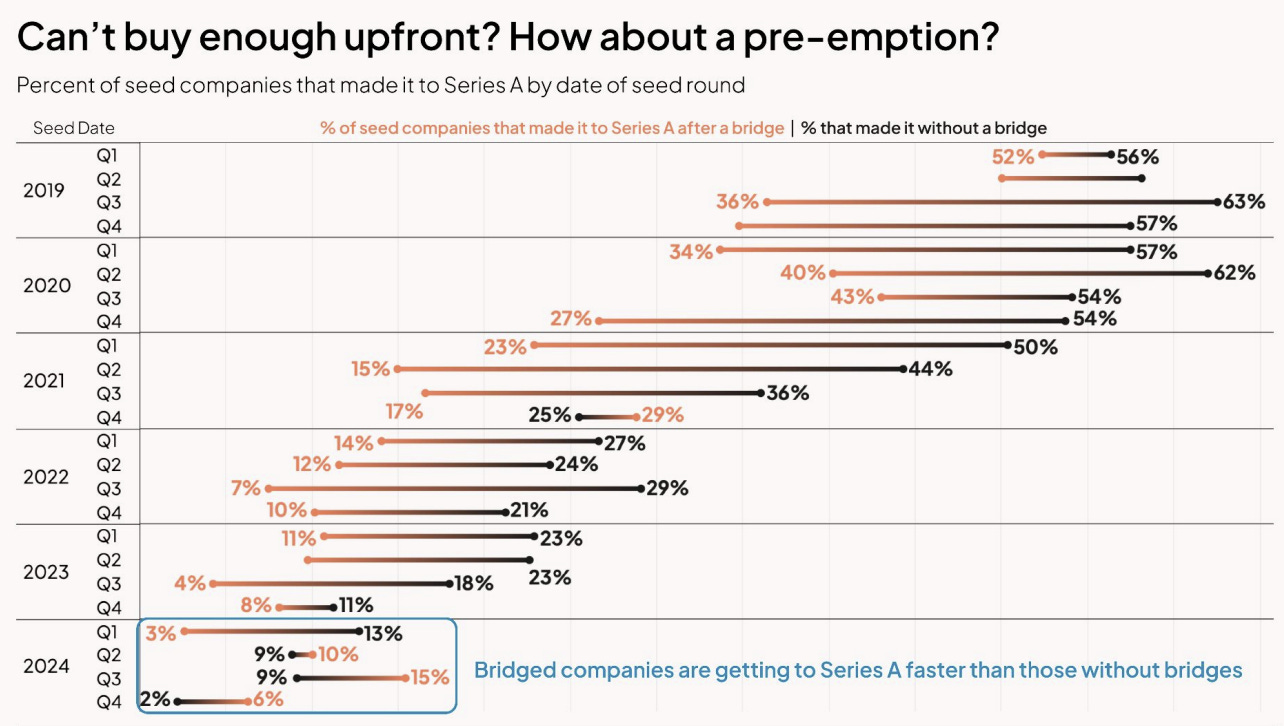

3) Normalization is happening—but slowly and unevenly

Down rounds are declining, but they haven’t disappeared. They’re still materially higher than pre-2022 levels, suggesting the market is healing, not healed.

At the same time, bridge rounds have returned to historical norms. That’s an important signal. Bridges today look less like distress and more like strategy—used to buy time, hit milestones, or align timing in a cautious market.

This fits neatly with the “more selective, less frantic” environment the rest of the data points to.

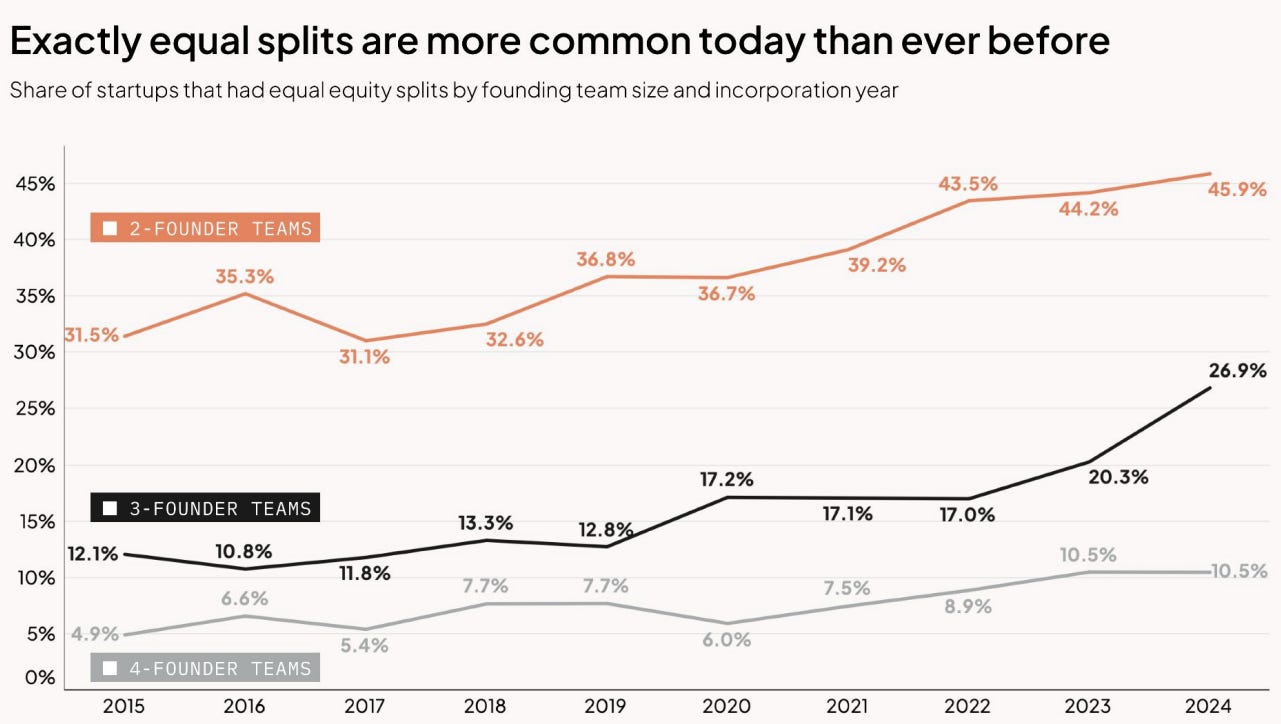

4) Founder dynamics are shifting—but old biases persist

Another interesting thread: solo founders are more common than ever, yet VCs still back them at lower rates than teams.

This is particularly striking in an AI world, where small teams can produce outsized leverage. But higher technical and go-to-market complexity may actually increase investor preference for teams—even as solo founders become more capable.

Equal cofounder splits are also more common, but outcomes still skew toward one “lead” founder over time. And cofounder breakups remain a real risk. The emotional appeal of fairness continues to collide with the operational reality of building companies under pressure.

5) Startups are hiring later—and staying leaner for longer

One of the most underappreciated trends: founders are waiting longer to make their first hires. First, second, and third hires are all happening later than just a few years ago.

AI tooling plays a role here, but so does capital discipline. Teams are doing more with fewer people and delaying fixed costs until there’s real signal in product or revenue.

This shift also amplifies the importance of early employees—and the equity decisions tied to those first hires.

6) Geography still matters

Despite remote work and global talent narratives, the Bay Area continues to command higher valuations at Seed, Series A, and Series B—especially in software and AI-heavy businesses.

Capital, talent, and ambition are still clustering. And venture outcomes, by and large, follow those clusters.

7) On the fund side: dispersion is the story

If startups are living in a world of concentration, funds are too.

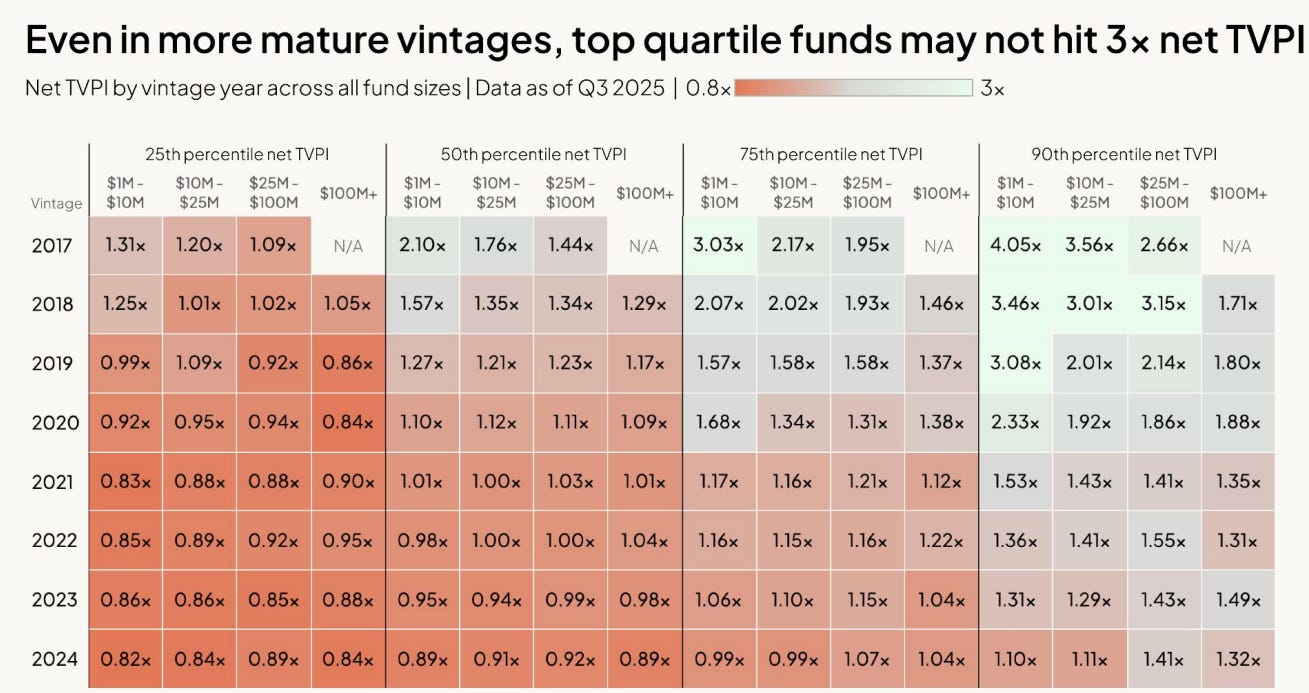

Performance dispersion across vintages and fund sizes is massive. True outperformance—3x net outcomes—is largely confined to the top decile of funds. For LPs, this explains the renewed selectivity we’ve seen over the past two years.

And while TVPI (paper value) has started to recover, DPI (actual cash returned) remains stubbornly low for most vintages.

Which leads to the next point.

8) Secondaries are becoming a structural feature—not a workaround

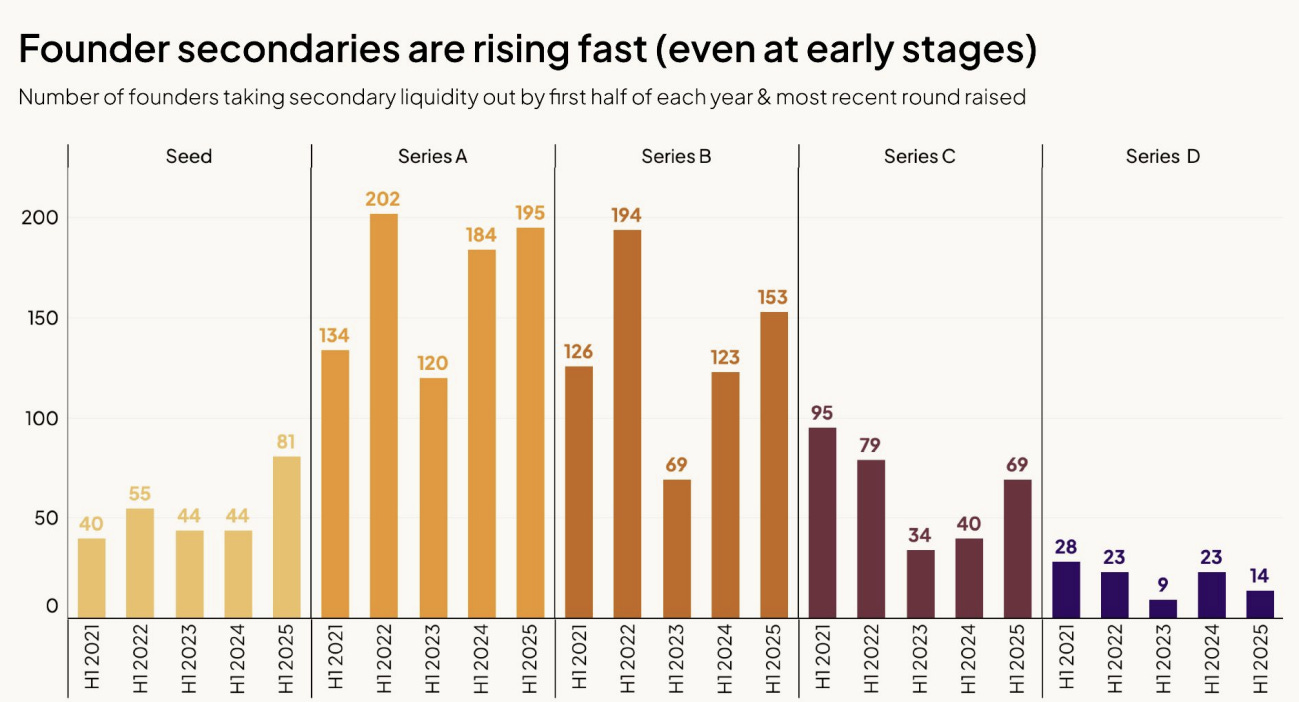

Founder secondaries are rising rapidly, even at earlier stages. This isn’t about lifestyle liquidity—it’s about system design.

Longer IPO timelines and slower distributions have created a mismatch between how venture works and how long people can stay fully illiquid. Secondaries are filling that gap. They’re the pressure-release valve in a market still waiting for large-scale exits.

9) Liquidity isn’t gone—it’s just rerouted

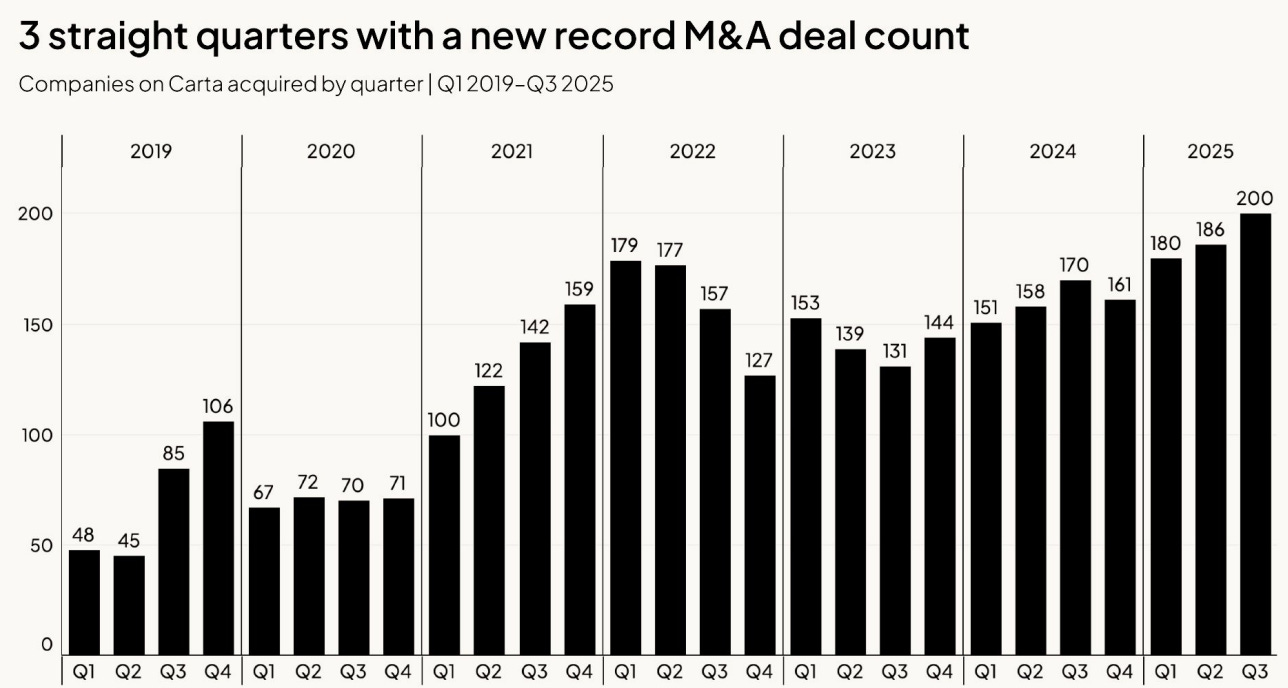

M&A activity is picking up meaningfully, with multiple record quarters in deal volume. Not every good company becomes an IPO candidate—and that’s okay.

Between M&A and secondaries, liquidity is re-entering the system through multiple channels. This is how a venture market heals in practice: gradually, unevenly, and without a single headline moment.

Final thought

Taken together, Carta’s data doesn’t just describe a recovering market. It describes a re-shaped one—where concentration, patience, AI-driven allocation, and alternative liquidity are now core features, not temporary conditions.

Understanding that shift is, in my view, one of the most important mental upgrades founders, investors, and operators need heading into 2026.

General news:

TQI launches TQI Ventures with BR Angels to back B2B startups under a CVC-as-a-service model, with up to R$5M to invest in solutions accelerating digital transformation for large enterprises. The initiative targets data-intensive sectors such as finance, insurance, telecom, retail and healthcare, combining capital with access to BR Angels’ network of 400+ executives for mentorship and enterprise connections. 🇧🇷

Brazil passes law increasing taxes on fintechs and financial institutions with the enactment of Complementary Law No. 224, gradually raising CSLL rates for payment institutions from 9% to 12% by 2027 and 15% from 2028, while other financial institutions reach up to 20%. The law also raises taxes on online betting, cuts federal tax incentives by 10%, and increases income tax on interest on equity, with tax effects starting in April 2026. 🇧🇷

Deals:

V.tal acquires Um Telecom to expand fiber infrastructure in Brazil’s Northeast adding around 20,000 km of fiber across 200 cities and bringing contracts with roughly 1,000 corporate and wholesale clients. The deal marks V.tal’s first major infrastructure acquisition since its spin-off from Oi and is subject to regulatory approval. 🇧🇷

Coforge agrees to acquire Encora for US$2.35B in enterprise value creating a ~$2.5B global technology services group focused on AI-native engineering. Funded mainly through equity, the deal gives Encora shareholders about 20% of Coforge and significantly strengthens its U.S. presence and AI-driven services portfolio. 🇺🇸

SoftBank Group agrees to acquire DigitalBridge for about US$4B paying US$16 per share in cash, a premium to recent trading levels. DigitalBridge will continue operating independently under current leadership, with the transaction expected to close in the second half of 2026, subject to regulatory approvals. 🇯🇵

General news:

SoftBank completes US$40B investment in OpenAI after the company finalized its transition to a for-profit structure, with the final US$22–22.5B tranche wired last week. Backed by Microsoft, Thrive, Coatue and others, the round cements OpenAI’s valuation, even as the company faces mounting capital pressure to fund trillion-dollar AI infrastructure plans. 🇺🇸

Brazilian venture capital closed 2025 with over US$2B invested as deal volume rebounded past 1,000 transactions and exits rose about 9%. Capital remained selective, favoring startups with recurring revenue, solid unit economics and mature governance, pointing to steadier growth in 2026. 🇧🇷

Brazilian climatech Carrot signs first circularity environmental credit contract combining methane reduction and biomass recycling. The blockchain-tokenized credits can exceed US$153 per ton, improving traceability and reducing greenwashing risks in the carbon markets. 🇧🇷

Brazil’s private equity and venture capital recovery remains uneven with Abvcap projecting a stronger rebound only after 2027. High interest rates and limited exits still constrain fundraising, while infrastructure, AI demand and distressed assets are seen as the next growth drivers. 🇧🇷

Deals:

Meta acquires AI agents startup Manus in a billion-dollar deal after the company reached US$100M in ARR in just eight months. The technology will be integrated across Instagram, WhatsApp and Facebook, underscoring a shift toward autonomous AI agents that execute end-to-end tasks. 🇺🇸

Bemobi finalizes acquisition of Paytime and buys Celer completing a 50.1% stake in Paytime with earn-outs tied to performance and acquiring Celer for R$8.8M. The moves strengthen Bemobi’s embedded payments and PaaS strategy, expanding its enterprise payments footprint. 🇧🇷

Snap Compliance raises US$2M to expand AI-based compliance platform accelerating its growth across Latin America and launching the FORTALEZA GRC ecosystem. The round supports regional expansion and prepares the company for a future Series A. 🇨🇷

Lumina Capital Management closes US$1.5B Fund III bringing total capital raised in four years to US$5B. Backed mainly by US and Canadian institutional investors, the fund will deploy capital across credit and equity with a global mandate. 🇺🇸

Bionexo acquires Tasy from Philips for €161M marking one of the largest consolidation deals in Brazil’s hospital software market. The transaction adds a leading EMR platform with around 2,000 clients and roughly R$300M in annual revenue. 🇧🇷

General news:

The AI boom is creating a new generation of paper billionaires at record speed as founders of startups like Scale AI, Cursor, Perplexity, Figure AI, Safe Superintelligence and Thinking Machines Lab achieve billion-dollar valuations within just a few years. Most are under 40 and have benefited from post-ChatGPT enthusiasm and mega funding rounds, though investors caution that these fortunes may be fleeting if performance expectations aren’t met. 🇺🇸

General news:

CES 2026 spotlight on AI — As the tech year opened, CES 2026 in Las Vegas (starting Jan 6) was previewed with a strong focus on AI integration, including edge AI devices, humanoid robots, industrial machines, wearables, and autonomous systems — signaling where innovation dollars may flow in 2026.

General news:

Itaú overtakes Petrobras on B3 as Brazil’s most valuable company in 2025, reaching a R$416.4bn market cap as investors favored predictable earnings and recurring cash flow, while Petrobras fell 16.3% amid oil market volatility, reinforcing banks’ renewed dominance.

Bitcoin starts 2026 near US$90k as improving risk appetite, tech and AI momentum, and expectations around US interest rates lift crypto markets, with gains spreading across Ethereum and major altcoins.

Deals:

Tipspace expands to the US after raising US$350k led by Rodrigo Baer, targeting higher-spending gamers to accelerate revenue and position the Brazilian skill-gaming startup for a Series A by late 2026.

Book2Pay launches to fix tourism cash flow by shortening payment cycles for hotels and operators to seven days post-sale, aiming to process R$150m in its first year and reach R$2.5bn annually by 2030.

AI NEWS OF THE WEEK:

Meta’s acquisition of Manus, a Singapore-based AI startup known for building one of the first “general-purpose” autonomous agents, was reported by Reuters and others this week. The deal, valued at more than $2 billion, will see Meta integrate Manus’s technology and team into its broader AI efforts — including Meta AI and other consumer/business products — while continuing to operate Manus’s subscription services. Manus’s agents can independently plan and execute tasks like research, coding, and data analysis, and the company has already surpassed $100 million in annual recurring revenue since launching in early 2025. The move reinforces Meta’s aggressive AI strategy as it competes with Google, Microsoft, and OpenAI — shifting focus from just building large models to owning practical, agent-level execution systems that can perform complex workflows with minimal prompting.

****For those who know me well, I use Manus extensively in my day-to-day work. It’s been really interesting to watch Meta make this move — especially because, in certain tasks, the model genuinely outperforms alternatives.

For a thoughtful commentary on the broader implications of this deal and how it reflects evolving AI strategy and competitive dynamics, see: Why Meta Bought Manus — and What It Signals for Your Enterprise AI Agent Strategy (VentureBeat).

Readers, I need your help! If you have already put together an events calendar for 2026 please send those my way!

“How to guarantee failure: let other people’s opinions determine your priorities.” — Alex Hormozi

👏👏👏