LatAm Tech Weekly

#215: Rebound in Tech M&As, Carta's Fund Economics Report 2025, deals of the week... and much more!

Weekly writing about what is happening in LatAm tech. By day, I lead the business development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,200+ weekly readers by subscribing here!

Happy Sunday!

Last week I mentioned how I always get a little sentimental as we approach year-end… and today you’ll definitely feel that mood.

It’s been eight days since the last time I ran. And it’s amazing how, once your body gets used to something, everything feels different without it—your energy, your mood, your routine. My body clearly needed a break. I’d been dealing with a basic flu for weeks and (for those who know me well) doing the worst possible combination: working 12-hour days, running anyway, and popping Tylenol to keep the symptoms at bay.

After a week of that brilliant strategy, my body rebelled. Last Sunday night I couldn’t sleep, ended up in the hospital, and found out I had a bad ear infection. So there was no escape: antibiotics (the first one didn’t even work—I had to switch), plus corticosteroids. I’m finally getting better, but as you can imagine, running is absolutely off the table for now.

This actually happens every year, usually right around December. It’s like my body starts screaming: “I CAN’T TAKE THIS ANYMORE!” I never listen, and it inevitably turns into something more serious. And every time I swear I won’t do it again… that next time I’ll rest when I’m sick… that I’ll pay attention to the signs. New Year’s resolution material, right? Let’s see if 2026 will be any different.

In any case, I cannot wait to be back running. Below is a picture from last Saturday—when I was ignoring my flu. It’s funny how you only realize how good something is for you when you can’t do it. I’m a running addict, and yes, eight days feels like a lifetime.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Moving on to what moved tech markets this week…

The headline story is Netflix’s intention to acquire HBO’s parent (Warner Bros Discovery), in a deal rumored around US$80–85B. If it moves forward, it would bring two of the most iconic modern TV brands—Netflix and HBO—under one global streaming platform. But more importantly, it signals something broader: we’re officially entering the consolidation phase of the streaming era.

For years, traditional TV has been quietly losing ground. Cord-cutting, declining cable bundles, sports shifting online, younger viewers living inside apps—not channels. Netflix taking a shot at HBO isn’t proof that “TV is dead,” but it reinforces that premium storytelling is no longer tied to traditional distribution. Prestige used to live on cable; now prestige increasingly lives inside tech platforms.

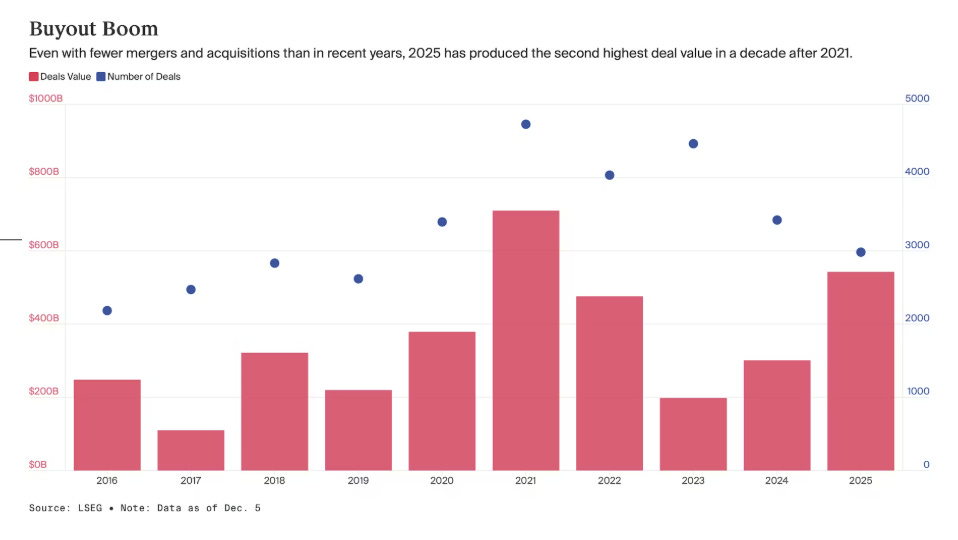

And this brings us to a much bigger 2025 story: tech, media and AI are converging again through M&A. While overall deal volumes remain lower than the pandemic-era highs, the value of deals is spiking—meaning fewer transactions, but much larger ones. In fact, 2025 is already shaping up to be the second-biggest year for global M&A in the past decade—only behind 2021.

This matches exactly what PitchBook highlighted in its latest quarterly analysis: despite geopolitical uncertainty and tariff noise, global M&A hit US$1.1B in Q3 2025, the strongest quarter since 2021, pushing total deal value for the year to around US$3.9B, already above 2024 with a month left to close. Their takeaway is counterintuitive but important: dealmakers are not pulling back—they’re just being more deliberate. (PitchBook)

One detail from the PitchBook piece that really jumped out at me is the rise of earnouts. In simpler terms, earnouts let part of the purchase price depend on what the acquired company actually achieves post-deal. In a world where nobody knows how fast AI monetizes—or how regulatory or pricing pressures will evolve—earnouts are the financial mechanism that lets buyers say: we’ll pay for the upside only if the upside happens. PitchBook notes earnouts now appear in nearly 40% of small and mid-cap deals, and many advisors are seeing that percentage rise.

It also intersects with something else we’ve talked about here over the past few months: if 2021 was the “buy everything and figure it out later” cycle, 2025 feels more like the disciplined AI cycle. Everyone wants exposure to AI—but nobody is willing to price the future blindly. .

So what does Netflix–HBO mean for tech more broadly? In short: the digital entertainment stack is becoming just another layer of big-tech consolidation. Streaming is no longer a standalone media business—it’s part of the broader technology land grab happening in AI, content, distribution, and attention. .

In other words: it’s not just a media story—it’s a tech M&A story hiding in plain sight.

On to another piece that was a great read this week…

Carta published its first-ever Fund Economics Report, and honestly it’s one of the most transparent snapshots we’ve seen of how venture and private equity funds actually operate behind the curtain. While capital raised, assets under management, and occasional fund performance leaks tend to make headlines, the economics of how money flows inside funds—capital calls, GP commitments, fees, expenses—are almost never visible. Carta is trying to change that by aggregating data from ~2,000 private funds that rely on its platform.

A few things stood out:

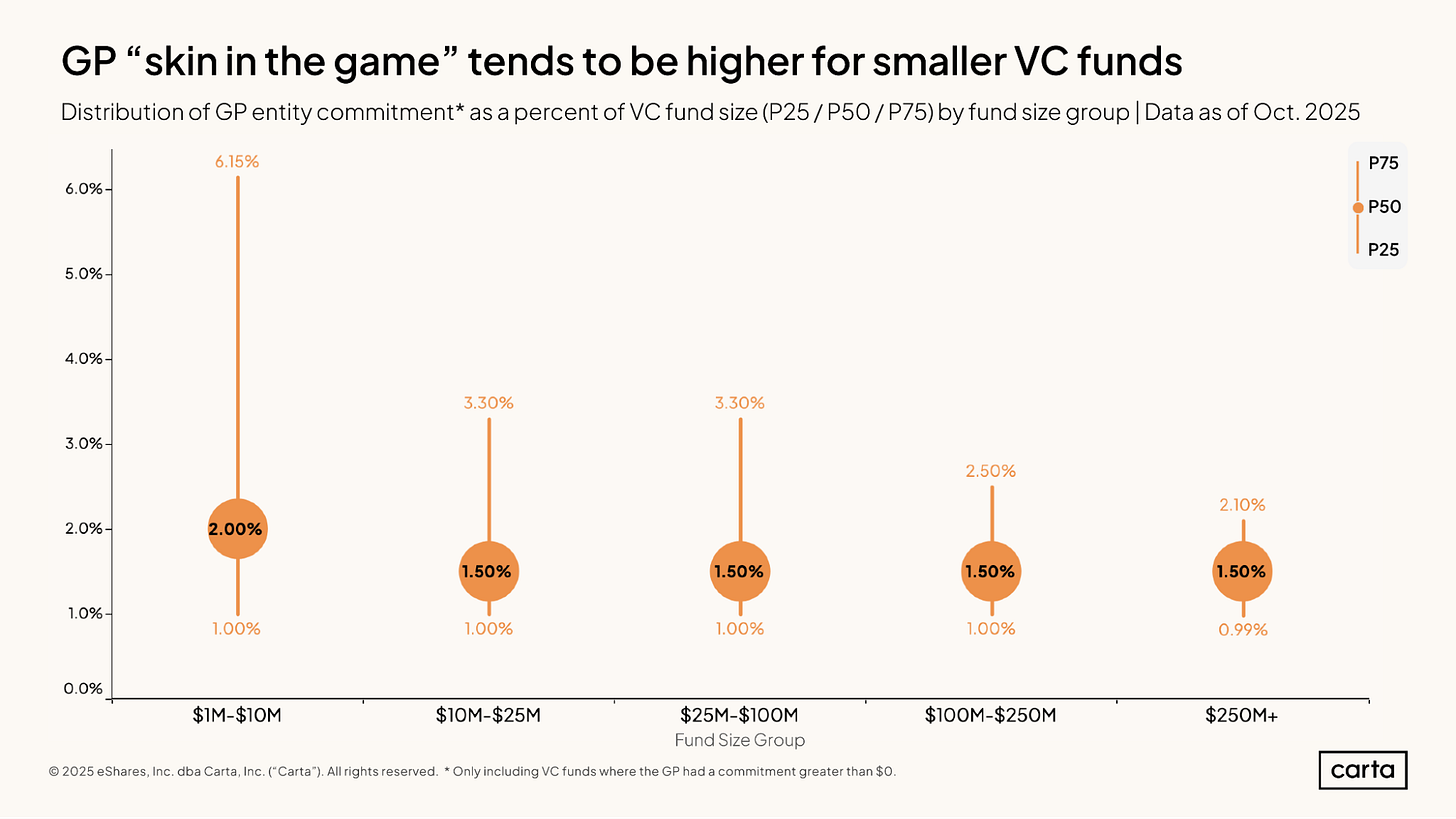

1) “Skin in the game” looks very different across venture and PE.

VC GPs commit a median of 1.7% of fund size, while PE GPs commit 2.55%, roughly 50% more. What’s more interesting: smaller VC funds require much higher proportional GP commitments. A $10M vehicle might require the GP to put in 2–6%, while a $250M fund often requires around 1.5%. In absolute dollars, of course, the numbers flip (1.5% of $250M is still real money).

2) Capital calls mostly work as designed.

At least 75% of LP capital is wired on time, and the more notice LPs get, the earlier they send funds. In other words, liquidity friction is not the bottleneck we sometimes imagine—especially for institutional LPs.

3) 2022 vintage VC funds are pacing more slowly.

After about four years, the median 2022 fund had deployed 67% of capital—versus ~80% for prior comparable vintages. No surprise: deployment discipline tightened after the 2021 excess.

4) Fees remain boring (and that’s the point).

The 2-and-20 model remains the standard, with median 2% management fees and 20% carry. Despite speculation that AI funds or growth funds might “break the model,” Carta’s data suggests the old structure still dominates.

5) Economies of scale matter a lot.

Small funds spend ~3.4% of fund size on operating expenses, while funds over $100M spend ~1%. Said differently: emerging managers pay meaningfully more for infrastructure relative to fund size.

Why this matters right now:

This report lands in a moment when fundraising is harder, LP conversations are slower, and performance dispersion is widening. GPs taking more personal risk (especially in PE), slower deployment pacing in VC, and stickier fee structures all reflect the same macro story: post-2021, the industry is shifting toward discipline and alignment.

And perhaps most importantly—this level of transparency only existed retrospectively or anecdotally before. Now it’s becoming data, which means LP expectations are likely to shift as well.

For LatAm founders and investors: seeing how fast global norms are professionalizing is crucial. We are also are moving toward more structured GP commitments, clearer pacing, and more transparency in capital calls.

General news:

Creditas delivered a strong Q3 2025, hitting record revenue of R$592M and expanding gross margin to 37% while moving closer to operational breakeven. Credit origination reached R$985M (+20% YoY) and the portfolio grew to R$6.77B. Operational loss narrowed to R$68M as the company maintained cash-neutral discipline. Investors highlighted accelerating growth, high cohort margins and rising AI-driven efficiency supporting sustained 25%+ annual expansion. 🇧🇷

Brazil’s logistics market is booming as Mercado Livre and Shopee drove 90% of the 656k m² leased in Q3. Mercado Livre now occupies 3.39M m² (up from 236k in 2020), while Shopee reached 1.23M m² in five years. Vacancy has dropped to 7%, prompting pre-leases and rising rents. With relentless expansion and more shopping events ahead, both players continue reshaping Brazil’s logistics landscape. 🇧🇷

Itaúsa CEO Alfredo Setubal said the group has no plans to reduce its 37% stake in Itaú Unibanco, calling the bank its long-term anchor and key source of value. He reiterated Itaú’s strength against fintech competition and affirmed commitment to Brazil, sustainability and long-term investments. Itaúsa now has nearly 1 million individual shareholders, up from 40,000 in 2015. 🇧🇷

Brazilian startup E-Forth launched the world’s first subscription service covering EV battery repair or replacement after factory warranty expiration, starting at R$97 per month. Backed by a R$2M investment, the service debuts in São Paulo, Campinas and Belo Horizonte, aiming to remove one of the biggest barriers to EV adoption and boost both new and used markets. Nationwide expansion is planned for 2026. 🇧🇷

PicPay launched PicPay Shop, an in-app marketplace unifying payments, data, users and retail into a single ecosystem. With R$4.5B in revenue and 41M active users, PicPay aims to convert its large audience into a powerful commerce channel, leveraging infrastructure built with OmniK to scale operations. 🇧🇷

Brazil’s central bank launched BC Protege+, an opt-in feature that blocks unauthorized account openings or representative assignments. Within five hours, 7,800 activations prevented 273 fraudulent attempts. Users can toggle protection and view which institutions queried their CPF/CNPJ. Future extensions may cover Pix keys and credit products. 🇧🇷

Mercado Bitcoin will invest €50M to expand in Portugal as part of a push to become one of Europe’s top fintechs by 2030. The plan includes product development, infrastructure and cross-border solutions for local and Brazilian clients. The company aims to leverage Portugal’s high crypto adoption and MiCA alignment. 🇵🇹

Headline and XP closed a R$62M fund to acquire secondary stakes in Brazilian tech startups. The vehicle targets Series B/C companies with R$150M+ revenue, buying shares from angels, founders and early funds at 20–50% discounts. The fund aims for 8–10 positions and ~25% annual returns. 🇧🇷

Deals:

Erathos raised a Seed round led by Bossa Invest, bringing total funding to $0.1M to expand its ELT platform for data extraction and ingestion. Founded in 2020 in Vitória, the company builds pipelines, observability tools and connectors for BI and analytics systems. The round supports product enhancement and early scaling. 🇧🇷

Kinea Private Equity invested R$150M in The Led, marking the largest deal ever in Brazil’s LED panel and in-store media segment. The Led plans to scale tech and retail-media operations, targeting 15,000 digital faces by 2025 after acquisitions adding 2,200 stores and 8,000 screens. 🇧🇷

Creditas closed a US$108M Series G led by Andbank, valuing the company at US$3.3B and finalizing its acquisition of Andbank Brasil’s banking license. The round strengthens its funding structure and expands its ecosystem across credit, insurance and investments, while adding Ricardo Forcano as CTO/COO. 🇧🇷

Topsort secured investment from W23 Global to scale its AI-driven retail-media infrastructure worldwide. The company enables unified activation across digital and physical channels using bid-less auctions and privacy-safe data integration. The new capital accelerates global expansion. 🇺🇸

General news:

ChatGPT turns three amid its first major existential crisis, as Sam Altman issues a “red alert” urging rapid upgrades in speed, personalization and answer quality. Competitive pressure is intensifying, with Gemini and Claude outperforming in key benchmarks and gaining user traction.

The Senate’s Economic Affairs Committee approved a bill raising taxes on fintechs, credit firms, payment institutions and betting operators, targeting up to R$6.7B in fiscal impact by 2028. Fintech taxes rise to 12% in 2026 and 15% in 2028, credit institutions to 17.5% and 20%, and betting operators face an 18% tax on gaming revenue. The bill moves to the Chamber and still requires presidential approval. 🇧🇷

Spybee, the Colombian AI-and-drone construction-management startup, is expanding into Mexico after completing 200+ projects at home. Its new Spybee 3.0 platform tackles delays and cost overruns through real-time monitoring and automated issue detection. Pilots in CDMX, Guadalajara and Monterrey show measurable productivity gains as digital adoption in the sector remains low. 🇨🇴

Brazil is emerging as a new front in the AI hardware race as Lenovo begins local production of storage systems and Nvidia-powered workstations to meet rising demand for on-premise inference. The move aims to cut costs, shorten delivery times and democratize access to AI infrastructure as cloud bills surge. Lenovo targets leadership in Brazil’s storage market by 2027, already counting Petrobras as a major client. 🇧🇷

Deals:

Kalshi raised $1B at an $11B valuation as prediction markets surge, marking its third round of 2025. Trading volume hit ~$5.8B in November (+32% MoM). The round, led by Paradigm with major VC participation, accelerates global expansion, new products and institutional distribution. 🇺🇸

Gaudium was acquired by Vela LatAm, marking Constellation Group’s entry into urban mobility. Gaudium powers regional ride-hailing and delivery apps, enabling 500M+ rides and deliveries for thousands of small businesses in Brazil’s mid-sized cities. With Vela’s backing, it will expand product scope and geographic reach. 🇧🇷

General news:

Company Hero is expanding beyond Brazil with its first international operation in Chile, launching virtual office services in key Santiago districts. The HRTech plans to invest R$10M to scale operations, build local teams and broaden its product suite. Chile’s mature freelance market and digital regulatory environment serve as a testbed before entering Mexico and Colombia. The company targets R$50M in international ARR by 2028 while nearly doubling revenue in Brazil this year. 🇨🇱

Creditas is rebranding Minuto Seguros as Creditas Seguros, consolidating auto, home, life, health and SME coverage into a unified ecosystem with 800k+ active policies and R$2.4B in premiums. The move boosts cross-sell opportunities across its credit verticals and leverages AI to sharply reduce service and wait times. 🇧🇷

Cumbuca has pivoted from a B2C expense-splitting app to a B2B Open Finance platform using its ITP license to give enterprises direct, regulated access to official APIs. The model has already reached breakeven, attracting large companies seeking scalable Pix initiation and full infrastructure control. 🇧🇷

Terranova launched as a new Actis-backed data-center company with a US$1.5B investment plan targeting hyperscale AI and cloud infrastructure across Brazil, Mexico and Chile. Its first campus opens in 2026, with regional capacity expected to reach 1GW. 🇧🇷

Bitcoin surged toward US$94K on short liquidations and renewed institutional appetite following Vanguard’s ETF launch. Ether rose above US$3K as overall crypto market cap reached US$3.24T. 🇺🇸

Anthropic has hired Wilson Sonsini to explore an IPO that could be among the largest globally. The company projects revenue surging to US$26B next year, backed by Microsoft and Nvidia, and its valuation has climbed to ~US$350B. 🇺🇸

TikTok will invest more than R$200B to build its first Latin American data center in Ceará, powered entirely by wind energy. The facility will support large-scale AI and cloud workloads and represents one of the largest tech investments ever made in Brazil. 🇧🇷

Mastercard is awaiting the Brazilian Central Bank’s next steps for Drex after the pilot’s DLT phase was shut down. Executives highlight rising stablecoin trading in LatAm, which now accounts for ~35% of global activity. 🇧🇷

Brazil’s Ministry of Justice launched a five-year national plan to combat banking and digital fraud, coordinating more than 20 initiatives across the Central Bank, ANPD, Federal Police, Anatel, Receita Federal and major industry associations. The effort aims to unify prevention, response and data-sharing infrastructure. 🇧🇷

Deals:

NTT Data acquired Curitiba-based SAP partner SPRO as the Japanese tech giant expands its Brazilian footprint. SPRO brings 350 employees and 70 clients, strengthening SAP capabilities for agribusiness and enterprise sectors. 🇧🇷

Senior Sistemas acquired ERP provider Cigam for R$162.5M in shares, unifying two of Brazil’s most comprehensive management platforms. Cigam adds 10k+ customers and expands Senior’s reach across industries. 🇧🇷

Starian, spun off from Softplan, acquired Contato Seguro to anchor its new Governance & Compliance vertical. The deal adds 3,000 clients and AI-driven whistleblowing tools, supported by Starian’s recent R$640M raise. 🇧🇷

Vambe raised a US$14M Series A led by Monashees to scale its AI-powered conversational commerce platform across Latin America. The round brings Rappi’s Simón Borrero to the board and supports Brazil expansion in 2026. 🇨🇱🇲🇽

General news:

Avenue Securities will now be controlled by Itaú after the bank exercised its option to raise its stake to 50.1%. CEO Roberto Lee says the partnership positions Avenue to capitalize on a generational shift as young Brazilians move aggressively into offshore investing. The integration accelerates access to global assets and reflects a structural transformation in Brazilian investment behavior. 🇧🇷

Brazil’s Forlex, the official AI of the OAB, is expanding globally with HIVE, a platform of AI agents for public institutions. The startup has opened a U.S. entity, launched pilots in Europe and the U.S., and is raising US$15M to accelerate international growth. 🇧🇷

Mexico’s EdTech Emmi is gaining traction with an AI-powered hybrid learning model that automates up to 40% of teachers’ administrative work. With 100+ schools onboard and 300 targeted by 2026, the company is preparing a US$3–5M Series A to expand across Latin America. 🇲🇽

Brazil’s Central Bank will not regulate installment-based Pix products, allowing banks and fintechs to roll out their own versions as long as they avoid the terms “Pix Parcelado” or “Pix Crédito.” The BC will monitor solutions individually, raising concerns about consumer exposure amid shifting credit dynamics. 🇧🇷

iFood Pago is expanding into consumer finance with tests in installments and BNPL for 60M users. The fintech, which has already extended R$2.83B in credit to restaurants, is piloting microcredit loans and checkout installments tied to groceries and pharmacies. 🇧🇷

Deals:

oiwhite raised a R$5M pre-seed round from Swiss founders David Wiprächtiger and Luca Ernst to scale its D2C oral-care brand in Brazil. The startup grows 60% month over month on TikTok and plans to expand its product portfolio starting in January. 🇧🇷

ZoomHolding acquired ERP specialist CIEL IT to launch a new software, data and automation vertical. The deal embeds Odoo ERP across the group and supports its international expansion across LatAm, Asia, the U.S. and Europe. 🇧🇷

Typcal raised ~R$2M from Belgium’s Biotope to scale its mycelium-based alternative proteins across Brazil and Europe. The company is expanding R&D and building a large-scale factory with patented mycelium technology. 🇧🇷🇧🇪

Unbox raised R$15M led by SRM Ventures to expand into financial services, offering credit and receivables advances to the 15,000+ D2C brands on its platform. The round supports new financial products and TPV growth through 2025. 🇧🇷

Multiagents raised R$1.5M led by Conscience to scale its no-code AI agent platform that automates tasks across WhatsApp, email and voice. The platform has processed 500k tasks and is growing more than 1,000% annually. 🇧🇷🇺🇸

Mission Brasil raised a R$20M seed extension led by Headline and Domo VC to expand its on-demand work platform. The company grew 125% this year and will use the funds to strengthen working capital, expand the team and onboard new enterprise clients. 🇧🇷

General news:

Primelis is entering Brazil as part of its rapid global expansion, following strong U.S. growth that now represents 40% of revenue. With US$40M in annual revenue and 300+ clients, the French martech brings proprietary tech like Signal and Outrank to improve paid and organic performance. Brazil will serve as a major growth engine toward its €100M revenue target. 🇧🇷🇫🇷

OpenAI launched a new free platform offering Portuguese-language AI content to expand access to generative-AI education and tools across Brazil and Lusophone markets. The initiative reduces language barriers and strengthens OpenAI’s multilingual outreach strategy. 🇺🇸🇧🇷

Nacimiento Co.Lab is transforming Chile’s Nacimiento region into an innovation hub, producing 10 tech startups and attracting a US$1M pilot-plant investment from one of them. The initiative—created by Duoc UC, CMPC and Futuregg—has connected local ventures with external startups and industry partners to accelerate regional development. 🇨🇱

Moore Threads, a Chinese chipmaker founded by a former Nvidia executive, surged 425% in its Shanghai debut, raising US$1.13B. The blockbuster IPO highlights China’s drive to build an AI-chip ecosystem independent from U.S. suppliers as domestic players accelerate expansion under eased listing rules. 🇨🇳

Deals:

UNLK made its second acquisition in two months, buying ~50% of Media Hero, a startup valued above R$100M with proprietary AI to measure marketing ROI and predict sales. The partnership will develop new tools and accelerate international expansion into Mexico and the U.S. 🇧🇷

Avedian raised US$2.2M to scale its AI health-tech platform that optimizes hospital workflows, predicts medical risks and reduces operating costs. The startup operates in five Latin American countries and signed a global distribution deal reaching 90+ health systems worldwide. 🇦🇷

Skyone raised a Series C led by Advent International to scale its cloud, data and AI automation platform. Serving 25,000 clients in 35 countries and growing 40% annually since 2018, Skyone is on track to reach R$400M in 2025 revenue as Advent becomes a major shareholder. 🇧🇷

Currently collecting data for next year’s tech events!!!! Please send tips and dates my way!

“AI isn’t a tool you add to workflows. It becomes the workflow.”

— Brad Lightcap, OpenAI