LatAm Tech Weekly

#214: The Next Big Thing is here, MIT Iceberg Index, deals of the week... and much more!

Weekly writing about what is happening in LatAm tech. By day, I lead the business development team at Itau Unibanco. By night, I am reading and learning about technology in general (now, with a focus on AI). During the weekends, I’m writing the LatAm Tech Weekly.

If you have not subscribed yet, join the 14,200+ weekly readers by subscribing here!

Happy Sunday!

And just like that, tomorrow we flip the calendar to the last month of the year. 2025 is almost in the rearview, and I keep asking myself: did I actually do everything I set out to do? I always get a bit reflective this time of year. I’ll share more on that over the next few weeks — including a full 2025 recap built from the stories we covered here throughout the year.

For those wondering: yes, The Next Big Thing LatAm is coming back for its fourth edition. If you’re new around here, this is a project I co-created with my friend, writer and podcaster, Lucas Abreu. Every year, we invite leaders across tech, investing and startups to predict what’s coming next. Past editions have featured voices like Martin Escobari (General Atlantic), Diego Barreto (iFood) and many others.

Think you should be part of this year’s lineup? Send us a note by replying directly to this email — we’d love to hear from you.

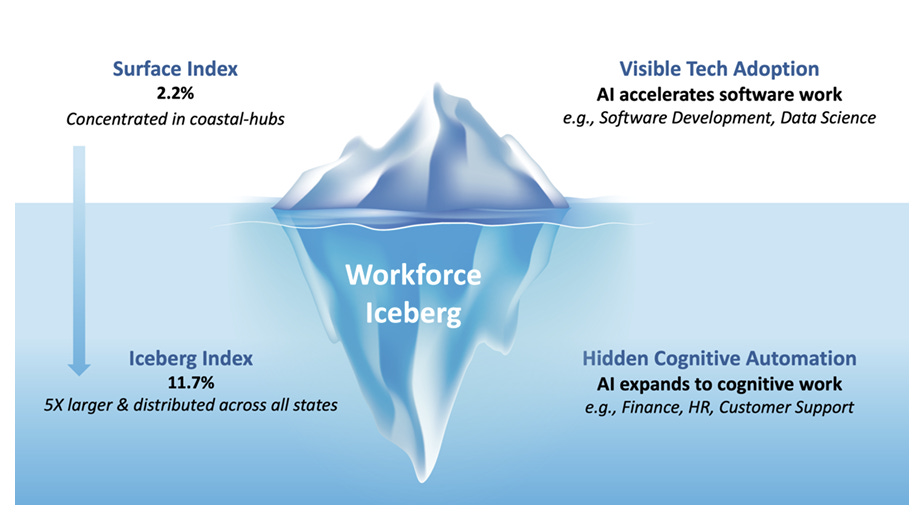

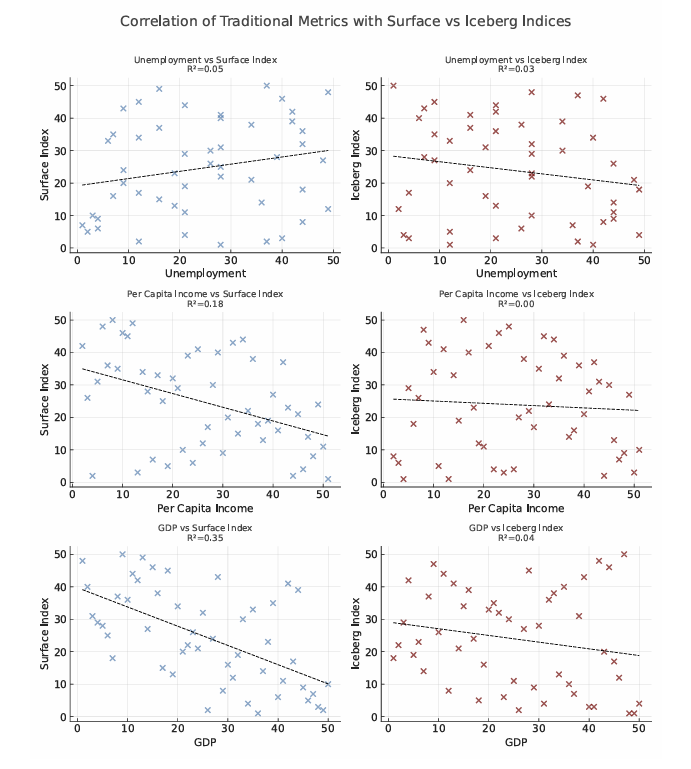

This week, MIT released one of the most important workforce papers I’ve read in a while: The Iceberg Index, part of Project Iceberg — a national-scale simulation of 151 million U.S. workers interacting with 13,000 AI tools (you can find the hyperlink in the “What am I reading” section below. The core idea is simple and powerful: the AI disruption everyone talks about is only the visible tip of the iceberg. According to the authors, what we see in headlines today — tech layoffs, software automation, copilots writing code — represents just 2.2% of total wage value exposed to AI. But beneath the surface lies a much larger transformation: AI systems already have the technical ability to perform 11.7% of all tasks across administrative, financial, and professional services, representing roughly US$1.2 trillion of wage value. As the paper puts it, traditional indicators like GDP, income, or unemployment “explain less than 5% of this variation,” meaning policymakers and firms essentially have no instruments today to detect where AI exposure is actually building up.

The paper is also refreshingly explicit about what the Index measures — and what it doesn’t. It’s not a forecast of job losses; it’s a capability map. MIT describes it as “a skills-centered KPI for the AI economy,” focusing strictly on where AI has demonstrated the ability to perform human tasks across more than 32,000 skills. And because the simulation uses actual deployed tools — not academic benchmarks — it captures what’s reshaping work now, not hypothetical future models. This distinction becomes even more relevant when you look at what happened this week with DeepSeek’s new math-specialized model. At first glance, a high-performance math model sounds like a narrow technical breakthrough. But the MIT paper shows why these domain-specialized jumps matter far beyond their original use cases. The authors explicitly argue that AI capabilities rarely stay confined to one task: “tools developed for coding demonstrate capability in document processing, financial analysis, and routine administrative tasks” (p. 10). In other words, once a model becomes exceptionally good at one structured reasoning domain (like code or math), those same underlying capabilities often spill over into adjacent cognitive work. DeepSeek’s performance is therefore a real-time example of the dynamic MIT describes — specialized reasoning today becomes generalized cognitive automation tomorrow.

What really stood out to me this week was how the findings of the MIT paper resonate with recent real-world missteps — not just theoretical concerns. While the paper warns that many AI-exposed jobs will shift long before we see it in unemployment stats (Pointing to a 13% drop in entry-level roles in exposed occupations, plus a tilt toward senior talent), the recent scandal around Deloitte underscores the human risk when organizations rush to adopt AI. In Canada, Deloitte delivered a 526-page government report filled with fake academic citations and fabricated references — mistakes reportedly caused by over-reliance on AI-generated content, then insufficient human validation. The episode was the second controversy this year after a similar case in Australia, a sobering example of what the MIT authors call “automation surprise” and “capability creep”: tasks that look like low-stakes document-processing or reporting, but which quickly become critical when scaled across public services. It’s a sharp reminder that exposure to AI doesn’t just mean efficiency gains — if unchecked, it can lead to serious errors and reputational damage.

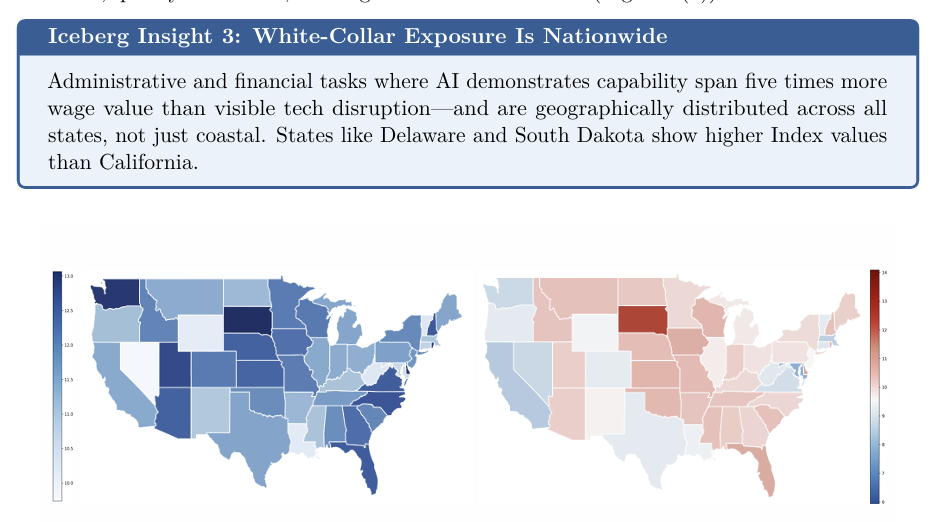

Perhaps the most striking insight in the MIT paper comes from its geography analysis, which shows that AI exposure is not confined to coastal tech hubs. On the contrary, regions traditionally perceived as “low tech” — such as Tennessee and Ohio — show Surface Index values of just 1–2% but Iceberg Index values above 11% (p. 10–11). In plain terms: while these states don’t look like AI adopters today, their administrative, financial, coordination, and logistics-heavy roles are far more exposed than anyone realizes. MIT calls this pattern “automation surprise”: the risks are highest where people aren’t looking for them.

This matters because the AI news from this week — including OpenAI’s new group-workflow features and DeepSeek’s domain-specialized reasoning model — makes one thing clear: AI adoption is no longer limited to companies with large engineering teams or deep technical sophistication. OpenAI’s enterprise paper argues that AI is shifting from a tool used by specialists to an “organizational collaborator” that embeds into everyday workflows. DeepSeek’s model shows that high-precision AI capabilities are spreading into narrow cognitive domains (like math) that underpin many back-office tasks.

And that’s exactly the point MIT is making with the geography maps: the next wave of AI impact won’t follow the geography of the tech sector — it will follow the geography of cognitive, administrative, and coordination work, which exists everywhere. Middle America’s supply chain hubs, healthcare systems, insurance clusters, and government agencies are full of the kinds of tasks the Iceberg Index classifies as high-exposure. So when OpenAI and DeepSeek release tools that make it easier and cheaper to automate structured reasoning or document-heavy workflows, the shockwaves will not remain in San Francisco or New York — they will land exactly in the regions that currently underestimate their exposure.

Taken together, MIT’s message is clear: the AI transition will be neither slow nor geographically narrow — it will be structural, skills-driven, and widely distributed. And it’s already underway. In the authors’ words, “AI-human collaboration creates new forms of labor that existing metrics don’t capture” (p. 3). For policymakers, investors, and ecosystem builders in LatAm (and everywhere), the takeaway is obvious: if you’re only watching the layoffs in tech, you’re watching the wrong part of the iceberg.

Follow me on LinkedIn , Instagram or X for daily updates!

Opinions expressed here are solely my own and does not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

General news:

Brazil’s foodtech sector is gaining renewed momentum with R$877M raised across 24 deals in 2024 and more than 500 active startups shaping new trends. Nearly a quarter were founded after 2020, driven by digitalization and shifting macro conditions. Leading segments include new foods, logistics, order management, waste reduction and foodservice tech. São Paulo dominates activity, and AI adoption is accelerating across supply, inventory, personalization and sustainability. 🇧🇷

SoulCode was selected for HolonIQ’s Latin America EdTech 100, recognized as a “Trending Organization” and the only company in the ranking with fully integrated AI across its programs. The list highlights Brazil’s rising leadership in AI-driven education and continuous digital upskilling. The recognition validates SoulCode’s mission to expand inclusion and prepare talent for fast-evolving tech markets. 🇧🇷

Stone introduced a new wave of financial and management tools as it accelerates its evolution beyond card machines toward a full operating platform for SMBs. New features include facial-recognition time tracking on terminals, salary payments in-app, subscription sales management, Pix on credit and delivery-order analytics. AI-powered products are planned for 2026 to further boost productivity. 🇧🇷

Deals:

Revolut reached a US$75B valuation after a major secondary sale backed by Coatue, Greenoaks, Dragoneer, Fidelity and NVentures, solidifying its position as one of Europe’s most valuable private tech companies. Revenue jumped 72% to US$4B in 2024, with crypto exchange Revolut X driving a 298% surge in Wealth division revenue. The company is targeting 100M users by 2027 as it scales across LatAm, India, Mexico and the UAE. 🇬🇧🇪🇺

DIVA, part of Grupo Ginga, raised R$2.5M to shift its focus toward foresight and futures design through its FutureKind methodology. The funding will support immersive programs, global partnerships and international expansion as futurist Ryan James Kemp joins as partner. 🇧🇷

EduSense was acquired by DOT Digital Group, strengthening DOT’s position in next-gen corporate learning. The São Paulo–based platform integrates LXP, LMS, AI and analytics to deliver personalized, gamified and omnichannel training for organizations seeking scalable skill development. 🇧🇷

General news:

Itaú expanded its generative-AI investment agent to 100k clients as part of the broader “Inteligência Itaú” strategy. Accuracy has reached 97%, and the tool will soon scale to the entire customer base. More than 140 GenAI initiatives are now live across the bank, from Pix via WhatsApp to solutions for entrepreneurs, supported by modernized data, tech and responsible-AI guardrails. 🇧🇷

Google Cloud expanded its Startup Hub program to Salvador, hosting AI demos and training to support founders outside Brazil’s Rio–São Paulo axis. With 4,661 startups now in the Northeast, Google is ramping up cloud credits (US$2K–US$350K), mentorship and technical support as multimodal AI, autonomous agents and cybersecurity reshape SaaS innovation. 🇧🇷🇺🇸

Belo, the Argentine fintech known for its Pix-enabled wallet, entered Brazil after processing over US$150M in 2024, largely from Pix payments by Brazilian tourists. The company now aims for 1M Brazilian users by 2026, targeting tourism hubs, local merchants and regional expansion across LatAm. 🇦🇷🇧🇷

Klarna beat expectations with US$903M in Q2 revenue and plans to launch KlarnaUSD, a dollar-backed stablecoin for everyday spending and cross-border payments. While losses reflect U.S. accounting rules, Klarna projects Q3 revenue near US$1.07B and is betting on AI to accelerate product speed and efficiency as global stablecoin rules mature. 🇸🇪🇺🇸

Texas made a US$5M bitcoin investment through BlackRock’s ETF, establishing the first state-level crypto reserve in the U.S. An additional US$10M is earmarked as Texas positions itself as a crypto-forward jurisdiction under new legislation. 🇺🇸

PayPal is launching agent-commerce in Brazil by integrating its wallet with ChatGPT, allowing an AI agent to search, compare and complete purchases end-to-end. The move aligns with its global strategy, including PayPal World, which connects wallets worldwide for automated cross-border transactions. Locally, the company gained an acquiring license and launched Complete Payments for SMEs. 🇧🇷🇺🇸

Qurate expanded from Chile into Peru and Argentina, self-funded through revenues. Its platform turns any video into a shoppable experience and has early traction with clients like Super Pet and integrations with Tienda Nube. The company aims to lead LatAm’s accelerating wave of video-commerce. 🇨🇱🇵🇪🇦🇷

Stark Infra officially spun off from Stark Bank, emerging with 50 clients, 170 employees and R$500B in annual TPV. Led by former PayPal executive Felipe Facchini, the company supports 60M monthly transactions and offers a full suite of banking infrastructure solutions, backed by a previous US$45M raise. 🇧🇷

Just Climate expanded its nature-focused investment strategy to US$375M, backed by new anchors including Achmea, the UK’s Environment Agency Pension Fund and RBC. Its latest investment supports India’s AgroStar, which uses AI and 5G to help small farmers adopt biological inputs and boost productivity. 🇺🇸🇮🇳

Deals:

Clara secured a US$70M structured debt round from BBVA Spark, Covalto and the IFC to scale corporate cards and bill-pay products in Mexico and Colombia. With 20k+ organizations on the platform, Clara is evolving into a full payments infrastructure provider as it moves toward profitability. 🇲🇽🇨🇴

Grupo Werthein acquired Proxxima, adding 240k customers and R$225M in revenue to its broadband footprint. The deal strengthens its move toward national fiber scale and complements recent purchases including Zaaz. The group plans US$450M in regional investments by 2031. 🇧🇷🇦🇷

Sharpi raised US$1M from MAYA Capital and founders of Stone, Vtex and iFood to automate WhatsApp commerce. Its AI copiloto structures informal chats, audios and images into ready-to-process sales data, built after 200+ days shadowing sellers. The startup targets Brazil’s massive SME base on WhatsApp. 🇧🇷

Lugui raised R$1.5M in angel funding to automate rental processes with AI agents via WhatsApp. Its system delivers instant credit and legal checks using CPF/CNPJ data and is already used by major real estate groups managing 20k+ units. 🇧🇷

General news:

Keeta is expanding across Greater São Paulo on December 1 with more than 27,000 restaurants and 98,000 couriers already onboard. Backed by Meituan, the delivery app is betting on a courier-first strategy with smart helmets, safety sensors and a new São Paulo support center. Keeta rejects exclusivity contracts and aims for courier earnings high enough to make the platform a primary income source. Early data from Santos shows rising engagement and fast delivery times. 🇧🇷

OpenAI and Perplexity launched new AI shopping assistants ahead of Black Friday, enabling richer product discovery through detailed prompts, image-based searches and personalized recommendations. Analysts say the move pressures niche shopping-AI startups, though specialized players argue they still outperform generalist models. With integrations like Shopify and PayPal, both platforms signal a push toward in-chat commerce and future ad-driven search revenue. 🇺🇸

Ideen launched Revvo, a new credit-infrastructure platform that centralizes data from registrars, ERPs and financiers to automate receivables financing. With digital duplicatas becoming standard, Revvo offers end-to-end tools for liquidity, credit decisions, cash-flow management and predictive scoring via Revvo Insight. Targeting mid-to-large companies, it aims for 100 clients and R$50M ARR by 2026. 🇧🇷

Deals:

Omni raised R$500M in financial bills from institutional investors and the IDB to grow its credit portfolio from R$6B to R$20B by 2031. The oversubscribed issuance marks its first since a major restructuring. With improving delinquency and rising vehicle financing demand, Omni is preparing a new growth cycle with more agents, deeper digitalization and future bond/CDB raises. 🇧🇷

AB Card raised R$1M in a round led by DOMO.VC’s FIP Anjo to scale its flexible-benefits platform for SMBs. Employees can customize perks across 40+ categories using the company’s Visa multisaldo card. After 410% CAGR and 60+ clients in one year, the new capital will fund AI-driven personalization, product upgrades and nationwide expansion. 🇧🇷

Robinhood and Susquehanna are acquiring MIAXdx, a CFTC-licensed derivatives exchange, enabling Robinhood to list and settle its own prediction-market contracts. The acquisition comes as event trading becomes its fastest-growing business, with 2.3B contracts traded last quarter. Legal uncertainty persists, but the deal positions Robinhood at the center of one of the hottest new U.S. financial markets. 🇺🇸

Carozzi Ventures made its first corporate investment by backing Frankles, part of the Chilean biotech’s US$1M round led by Südlich Capital and Veterquímica. Frankles develops high-value ingredients from agro-food byproducts, advancing circular-economy innovation. It is emerging as a standout in Chile’s food-biotech ecosystem. 🇨🇱

Examedi raised US$750K led by Platanus and existing board members, valuing the company at US$17M and marking General Catalyst’s exit. After a restructuring and leadership change, Examedi now expects US$4M in revenue this year, driven by its Mexico unit reaching breakeven and 80%+ growth. The round supports a shift toward lean, sustainable expansion. 🇨🇱🇲🇽

Guia da Alma raised R$2.4M from Bossa Invest, Anjos do Brasil, PoliAngels and others to scale its corporate mental-health platform. With revenue and clients doubling in 2025 and demand rising amid regulatory pressure, the startup aims to reach 1,000 B2B clients by 2027 through product development, marketing and Media for Equity partnerships. 🇧🇷

Victor Lazarte raised ~US$200M for his new VL Fund, surpassing its US$180M target. The vehicle will back about 10 companies with checks up to US$40M, mirroring Benchmark’s concentrated model. Investors include Brex’s Henrique Dubugras, who said it was one of his largest commitments. The raise stands out amid the slowest U.S. VC fundraising environment in a decade. 🇧🇷🇺🇸

General news:

The US AI market is heading for another record year, with 2025 already matching 2024’s tally of 49 startups raising more than US$100M. TechCrunch data shows capital remains abundant as companies hit billion-dollar valuations at unprecedented speed, driven by mega-rounds from OpenAI (US$40B), Anthropic (US$13B) and Thinking Machines (US$2B seed). In total, US AI startups have raised ~US$193B so far, accounting for over half of global VC this year. 🇺🇸

PicPay is entering the high-income segment with Epic, a premium offering featuring a Black card with up to 4% international cashback, zero-spread global accounts in USD/EUR and investment options yielding up to 200% of CDI. Over 2 million users already fit the target profile, transacting nearly seven times more than the average customer. 🇧🇷

Brazil’s crypto market is entering a new phase as the Central Bank and tax authority introduce regulatory frameworks to close long-standing gaps. A new category for virtual-asset providers and tightened reporting rules for cross-border operations begin in 2026, while the DeCripto mandate aligns Brazil with OECD CARF standards. The changes are expected to accelerate tokenization, blockchain adoption and market confidence. 🇧🇷

OpenAI alerted API users to a third-party Mixpanel incident that exposed limited analytics metadata tied to platform.openai.com, including browser, OS, location and organization IDs. No API keys, passwords, billing data or ChatGPT content were leaked, but the data may enable social-engineering attempts. OpenAI removed Mixpanel from production and strengthened supplier-security requirements. 🇺🇸

Vector360, a spin-off from Chicago Advisory Partners, launched a platform to benchmark digital UX performance across 100+ Brazilian financial institutions. The tool analyzes metrics such as clicks to complete a payment, screen load time and Pix-via-WhatsApp availability. Subscriptions start at R$15k per month, with revenue expected to reach R$3M in the first year. 🇧🇷

Deals:

Totvs acquired Suri for R$28M, strengthening its position in conversational commerce and enhancing RD Station’s automation and personalization stack. Suri serves 2,300 clients and offers tools like Suri Shop, enabling full shopping journeys inside WhatsApp, Instagram and web channels. 🇧🇷

BHub raised a US$10M extension round, bringing total funding to US$55M from investors including Next Billion, IFC, Valor Capital, Monashees and Hedosophia. Now profitable, BHub continues scaling its full-stack backoffice-as-a-service model and has acquired 20 companies since 2021, most recently Agrocontar. 🇧🇷

Cenit raised a US$1.8M seed round led by Hi Ventures to scale its AI-powered tax-automation app for freelancers and SMBs across Latin America. The platform integrates directly with tax authorities, auto-downloads invoices and transactions and enables one-click filing and payments. 🇨🇴🇲🇽🇨🇱

TIM acquired 100% of V8.Tech for R$140M plus up to R$140M in contingent earn-outs. The cloud and AI integrator posted R$235M in revenue over the last 12 months and brings 380 specialists and 100+ enterprise clients, strengthening TIM’s B2B digital-transformation strategy. 🇧🇷

Sororitê Ventures joined a R$5M follow-on round in Sanii, which provides an end-to-end platform for home-based senior care. The capital will support geographic expansion, hospital partnerships and the rollout of Care IA, its Gemini-powered matching and quality-monitoring engine. 🇧🇷

DigAÍ raised R$10M in a round led by Alerce with GVAngels, Harvard Angels and high-profile angels to evolve from HR tech into a broader human-intelligence platform using WhatsApp-based conversational AI for recruiting and predictive insights. 🇧🇷

Doji raised R$3M in a pre-Series A led by Indicator Capital to expand its AI-based Trade-In as a Service platform. With 50,000+ devices already processed, the startup enables real-time pricing, reduces fraud and supports retailers and telcos participating in a market projected to reach US$130B by 2030. 🇧🇷

ColmeIA raised a R$18M follow-on from Crescera Capital, bringing total investment from the firm to R$43M and pushing the startup toward a R$500M valuation. The company tripled revenue, doubled headcount and secured major enterprise clients, with plans to double again by 2026. 🇧🇷

General news:

The Brazilian Central Bank issued new rules banning the use of “bank” or “banco” by institutions not licensed as banks. The measure targets fintechs and payment institutions whose branding implied services they were not authorized to provide. Companies now must align all names and communications with their actual license category, with 120 days to submit an adaptation plan and up to one year for full compliance. 🇧🇷

Visa highlighted AI agents as a major force for 2026, predicting a profound shift in how consumers buy, spend and pay as autonomous systems execute transactions securely. The company now offers 230+ tech solutions and is preparing Visa Intelligent Commerce to let GenAI platforms search, compare and pay directly. Visa is also investing in fraud prevention, Pix innovation, Open Finance and stablecoins as programmable finance accelerates globally. 🇺🇸

Deals:

Malga projected R$15B in processed volume for 2025 — triple last year — as it expands its modular payment infrastructure for B2B platforms like SaaS providers, ERPs, fintechs and digital banks. Backed by a R$32M Series A led by CV iDEXO and Costanoa, Malga is growing its team, building Pix innovations and increasing monetization of payment flows. 🇧🇷

Mercado de Recebíveis raised a R$150M FIDC structured by Oriz Partners, after a year in which TPV hit R$1B — 10x higher than 2024. The fund gives the fintech its own recurring credit engine after previously relying on bank partners. With breakeven reached in May and a blockchain-based corporate card gaining traction, the company targets another 10x expansion in 2026 as escritural invoices come into effect. 🇧🇷

TecnoSpeed acquired Assinadoc, merging digital signatures with AI-driven contract analysis under a new entity, Assinadoc S/A. The integration combines Assinadoc’s tech with PlugSign and TecnoSpeed’s API ecosystem, offering ERP providers faster onboarding, scalable infrastructure and automated clause detection. 🇧🇷

Turbi secured R$30M in new debt from Santander to accelerate expansion and push toward nearly R$400M in revenue by 2025. The company recently added 1,400 cars through a R$156M debenture, bringing its fleet to 7,000. With EBITDA margins above 50% for ten straight months, Turbi continues doubling annually through scale, proprietary tech and operational discipline. 🇧🇷

Atlantikos raised R$1M from Acrux Capital to fuel its next growth phase. The vegan, sustainable marketplace has grown 300% in three years, now aggregating 400+ brands and 20,000 products with its own logistics. The new capital strengthens operations, tech and product development as Atlantikos prepares proprietary SKUs, expanded logistics and subscription offerings. 🇧🇷

Brazil Tech Summit 2025

Date: December 9, 2025

Location: São Paulo, SP

Description: Part of the Global Startup Ecosystem Series, Brazil Tech Summit brings together entrepreneurs, government leaders, and investors to foster tech-driven innovation across Latin America.

More info

MIT - The Iceberg Index: Measuring Workforce Exposure in the

Bloomberg Technology: Harvard Database hacked in the Latest Ivy League Cyberattacks

“What people see in the economy is the tip of the iceberg, but what matters for workforce transformation is everything beneath the surface.”

(MIT, Project Iceberg Report – p. 2)